- Gold retreats after two-day uptrend sidelined of late.

- Hopes that China will save Evergrande, US debt limit expiry will be extended favor buyers.

- Fed tapering concerns, geopolitical fears keep sellers hopeful ahead of multiple resistances.

- Gold Price Forecast: Further advances depend on the Fed

Update: Gold (XAU/USD) regains upside momentum after a sluggish start to the key day. That said, the yellow metal rises for the fourth consecutive day, up 0.10% around $1,776 during early Wednesday.

Although the pre-Fed cautious challenged gold buyers earlier in Asia, China’s heavy liquidity injection and Evergrande news suggesting the ability to pay coupons on expiry recently favored the risk-on mood, also the metal prices.

Earlier in the day, the International Monetary Fund’s (IMF) Chief Economist Gita Gopinath also sounded optimistic over China’s ability to tame the fears emanating from the real-estate firm. On the same line were hopes of the extension to the US debt limit expiry the House votes 217-207 to favor temporary government funding and debt limit increase debate.

While headlines concerning China and Evergrande may entertain gold traders, markets may witness sluggish moves ahead of the Fed decision.

End of update.

Gold (XAU/USD) bulls take a breather around $1,775, following a three-day uptrend during the key Wednesday’s Asian session. In doing so, the metal fades bounce off the mid-August levels while trading sideways of late.

Markets turn cautious, mostly inactive, as the Federal Reserve (Fed) prepares for the Federal Open Market Committee (FOMC) monetary policy meeting announcement. Recently mixed data contrasts the Fed policymakers’ hawkish bias to confuse traders. Goldman Sachs recently backed the Fed tapering announcement and challenged the gold buyers. On the same line could be firmer US housing market data, namely Housing Starts and Building Permits for August, which backed hopes of hearing the word taper from the US Fed in Wednesday’s meeting.

Also important is the return of China after a long weekend amid chatters that the dragon nation will save its biggest real-estate player. Evergrande Chairman and the International Monetary Fund’s (IMF) Chief Economist Gita Gopinath also sound optimistic in his latest speech and supported the brighter concerns.

It’s worth noting that the UK, Australia and US securities pact, followed by Bloomberg’s news stating that the European Union (EU) and the US aim to pledge more enforcement to curb China risk, add to the market’s fears and weigh on gold prices.

Also previously adding to the risk-on mood were the hopes of stimulus, as hinted by House Speaker Nancy Pelosi, as well as the US Democratic Party’s push to suspend the debt ceiling. Recently, the US House votes 217-207 to favor temporary government funding and debt limit increase debate.

While portraying the mood, US equities closed mixed while the 10-year Treasury yields rose 1.9 basis points (bps) to 1.328% by the end of Tuesday’s North American session. That said, S&P 500 Futures drop 0.25% by the press time whereas US Dollar Index (DXY) also portrayed the sluggish mood while keeping the previous day’s pullback from the monthly top on Tuesday.

Moving on, monetary policy decisions from the People’s Bank of China (PBOC) and the Bank of Japan (BOJ) may entertain gold traders, as well as chatters relating to Evergrande. However, the Fed decision will be crucial for gold traders. Should the US central bank hint at tapering, gold prices may have to bear the burden of the likely US dollar upside.

Read: Fed Preview: Three ways in which Powell could down the dollar, and none is the dot-plot

Technical analysis

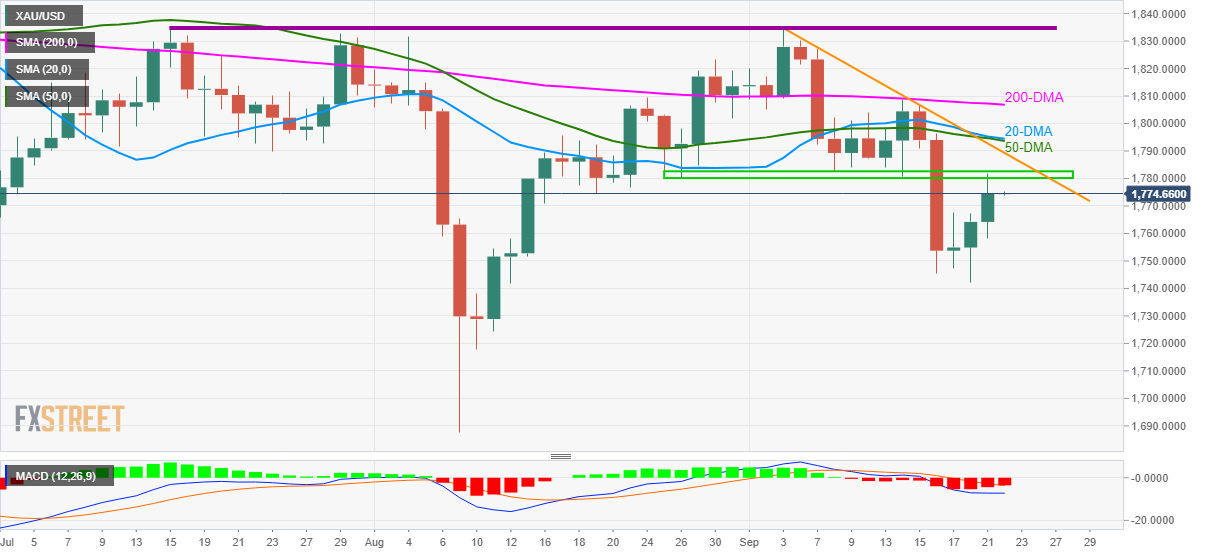

Gold retreats from the monthly horizontal hurdle, following a three-day rebound from the lowest levels in six weeks.

Not only a failure to cross the horizontal area from late August, around $1,780-82, but bearish MACD signals also keep gold sellers hopeful.

Even if the metal crosses the $1,782 hurdle, a downward sloping trend line from September 03, near $1,789, precedes a convergence of 20 and 50 DMAs close to $1,795 to challenge the gold bulls.

Additionally, 200-DMA and the famous double tops, respectively around $1,807 and $1,834, act as extra hurdles to the north.

On the contrary, the latest swing lows around $1,742 and August 10 bottom close to $1,717 may lure the gold sellers during fresh downside.

However, the $1,700 threshold and the yearly low of $1,687 may restrict the metal’s weakness afterward.

Overall, gold had many challenges to sustain before convincing the bulls.

Gold: Daily chart

Trend: Pullback expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds above mid-0.6300s amid mixed fundamental cues

AUD/USD consolidates near the weekly low touched on Wednesday amid fading optimism over a quick resolution to the US-China trade dispute. Moreover, easing concerns about the Fed's independence assists the USD to preserve its recovery gains registered over the past two days and acts as a headwind for the currency pair.

USD/JPY snaps a two-day winning streak to over one-week high

USD/JPY eases from over a one-week top set on Wednesday and stalls this week's recovery move from a multi-month, though it lacks follow-through selling. Concerns about the US-China trade standoff and the divergent BoJ-Fed policy expectations continue to underpin the JPY, which weighs on the currency pair.

Gold price rallies back to $3,340 area on fading US-China trade deal optimism

Gold price regains positive traction during the Asian session on Thursday and snaps a two-day losing streak to the $3,260 area, or the weekly low touched the previous day. The optimism over a possible US-China trade deal fades quickly and revives demand for the safe-haven bullion.

Russia Central Bank to launch crypto exchange for “qualified investors” - Official report

Russia is launching a government-backed crypto exchange for high-networth investors, marking a major step towards legalizing cryptocurrencies trading.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.