Gold Price Forecast: XAU/USD bounces off $1,860 support amid Fed, China concerns

- Gold price snaps two-day downtrend at the lowest levels in a month.

- US Dollar bulls struggle ahead of Fed Chair Powell’s speech.

- Sino-American tussles renew as Washington shot down Chinese balloon.

Gold price (XAU/USD) consolidates the recent losses as it prints mild gains around $1,875 during early Monday, printing the first positive day in three around the one-month low. In doing so, the precious metal cheers the US Dollar’s inability to stay firmer, as well as takes clues from the US-China tussles, ahead of this week’s key events.

That said, the US Dollar Index (DXY) remains sidelined around 103.00, after posting a two-day rebound from the lowest levels since April 2022. In doing so, the greenback’s gauge versus the six major currencies struggles to justify the strong US jobs report and geopolitical fears surrounding China.

The weekend headlines suggesting the US military fighter jet shot down a suspected Chinese spy balloon off the coast of South Carolina weighed on the sentiment as US Secretary of State Antony Blinked called off his previously planned visit to Beijing following the event. In a reaction to the event, China President Xi Jinping termed this as an ‘obvious overreaction’.

The same joins strong US jobs report and ISM Services PMI data, published on Friday, to challenge the XAU/USD bulls ahead of Fed Chair Jerome Powell’s speech, up for publishing on Tuesday.

Amid these plays, S&P 500 Futures extend the previous day’s pullback from the highest levels since August, down 0.30% intraday near 4,140 by the press time. On the same line, the US 10-year Treasury bond yields remain firmer for the third consecutive day, to 3.56% by the press time, following the biggest weekly jump since late September 2022.

It’s worth noting that a lack of major data seemed to have triggered the XAU/USD rebound from the short-term support but the Gold buyers should remain cautious amid recently hawkish Fed concerns and the US-China tension. Also important to watch will be Friday’s US UoM Consumer Sentiment Index for February, as well as the University of Michigan's 5-year Consumer Inflation expectations.

Gold price technical analysis

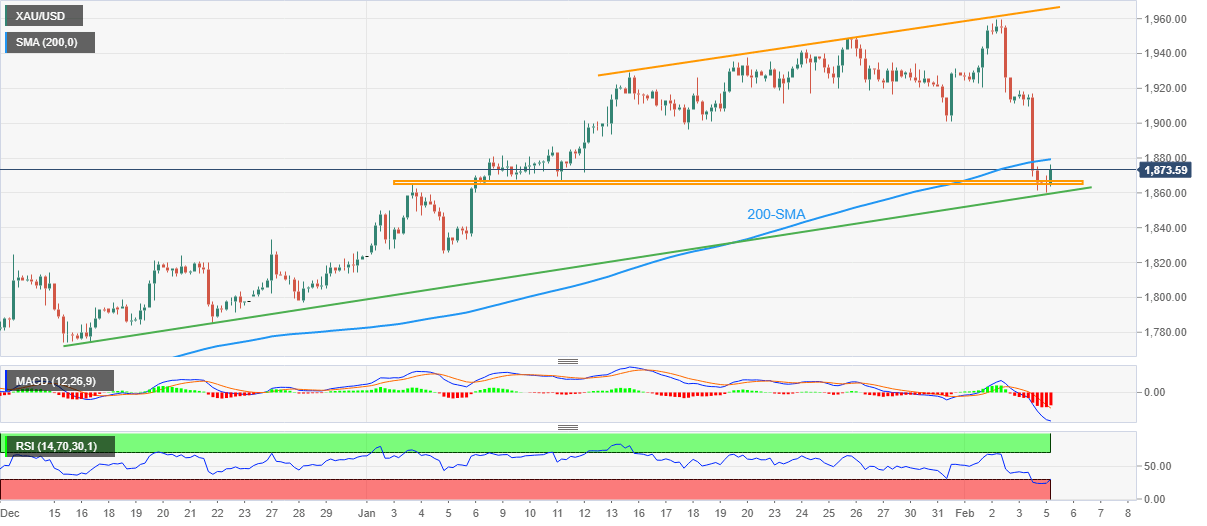

Gold price bounces off a seven-week-old ascending trend line, as well as crossing the monthly horizontal hurdle, as XAU/USD bulls approach the 200-Simple Moving Average (SMA) level surrounding $1,880.

The corrective pullback also takes clues from the oversold RSI (14). However, bearish MACD signals and the inability to cross the 200-SMA hurdle keep Gold sellers hopeful.

Even so, the metal’s fresh downside needs validation from the aforementioned support line, close to $1,860 by the press time.

On the contrary, an upside break of the 200-SMA hurdle surrounding $1,880 could direct Gold buyers toward the $1,900 threshold.

Following that, an upward-sloping resistance line from January 16, close to $1,965, as well as the March 2022 peak of around $1,966, will be crucial to watch for Gold buyers to tackle to keep the reins.

Gold price: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.