Gold Price Forecast: XAU/USD bounces off multi-day low, holds steady above $1,920 level

- Gold is under pressure on US dollar strength.

- The US dollar is firm as investors price in the Fed and US yields rise.

Update: Gold edged lower during the early part of the trading on Monday, though the downtick lacked any follow-through selling. The XAU/USD quickly reversed an intraday dip to the four-day low and was last seen trading just above the $1,920 level, or nearly unchanged for the day heading into the European session. The US monthly jobs report released on Friday reinforced market bets that the Fed would adopt a more aggressive policy stance to combat stubbornly high inflation. In fact, the markets have been pricing in a 100 bps rate hike move over the next two policy meetings. This, in turn, pushed the yield on the two-year US government bond, which is highly sensitive to rate hike expectations, to a three-year top and acted as a headwind for the non-yielding yellow metal.

That said, fading hopes of diplomacy in Ukraine, along with talk of additional sanctions against Russia weighed on investors' sentiment and extended some support to the safe-haven XAU/USD. In the latest developments, Ukraine accused Russian forces of carrying out a massacre in the town of Bucha. British Prime Minister Boris Johnson said that his government would step up sanctions, as well as military and humanitarian support for Ukraine. Adding to this, German defense minister Christine Lambrecht said on Sunday that the European Union must discuss banning imports of Russian gas. The uncertainty over Ukraine kept a lid on any optimistic move in the markets and continued lending some support to traditional safe-haven assets, including gold.

Apart from this, subdued US dollar price action was seen as another factor that benefitted the dollar-denominated commodity. The mixed fundamental backdrop warrants some caution before placing any aggressive directional bets around the XAU/USD. Investors might also prefer to move on the sidelines ahead of the FOMC monetary policy meeting minutes, scheduled for release on Wednesday. In the meantime, the incoming geopolitical headlines, along with the US bond yields and the USD price dynamics, might provide some impetus to gold prices.

Previous update: Gold, XAU/USD, has been pressured at the start of the week while mixed sentiment prevails surrounding the Ukraine crisis vs expectations of rapid-fire from the Federal reserve following last week's Nonfarm Payrolls outcome.

At the time of writing, XAU/USD, is down 0.26%, falling from a high of $1,926.86 and sliding to below Friday's low printing of $1,918.32. The greenback got off to a solid start o Monday, buoyed by a rise in US Treasury yields on the expectations of a series of interest rate rises from the Fed. Following the NFP report, US 2-year bond yields closed at a high for the year in the North American session and the US 10-year yields also rose, weakening investor demand.

Non-farm payrolls increased 431k in March, following a strong upward revision to the February data to 750k. The Unemployment Rate also fell slightly to 3.6% while the average hourly earnings increased 0.4% MoM to bring annual growth to 5.6%. The data was a mixed bag, with hourly earnings for February revised back to 0.1%, which along with the March figure, indicates the heat may be coming off the US labour market. Overall, however, the report has strengthened the Fed’s case to use aggressive rate hikes to tame inflation. Fed funds futures have priced a near 4/5 chance of a 50 basis point hike next month.

Nevertheless, the ongoing war in Ukraine is likely to see demand for safe have assets remain strong, analysts at ANZ Bank argued. ''Our gold valuation model of the spread between fair value and spot gold prices has shot from zero to USD300/oz since Russia invaded Ukraine, suggesting a hefty risk premium. In addition, the secondary impacts of the Russia-Ukraine crisis will provide a strong level of support. The broader isolation of Russia will see a structural shift in the energy sector, which will be inflationary.''

Elsewhere, talk of new sanctions kept the broad mood cautious in early trade, but this too supports the US dollar. Germany's defence minister said on Sunday that the European Union must discuss banning imports of Russian gas after Ukrainian and European officials accused Russian forces of atrocities. Ukraine accused Russian forces of carrying out a "massacre" in the town of Bucha, which was denied by Russia's defence ministry.

''So long as material progress on ceasefire talks and de-escalation remains elusive, haven flows are likely to keep the yellow metal supported,'' analysts at TD Securities said. ''At the same time, the 2-year and 10-year curve flirting with inversion has further fueled talk of a recession on the horizon, offering another positive dynamic for the gold market.''

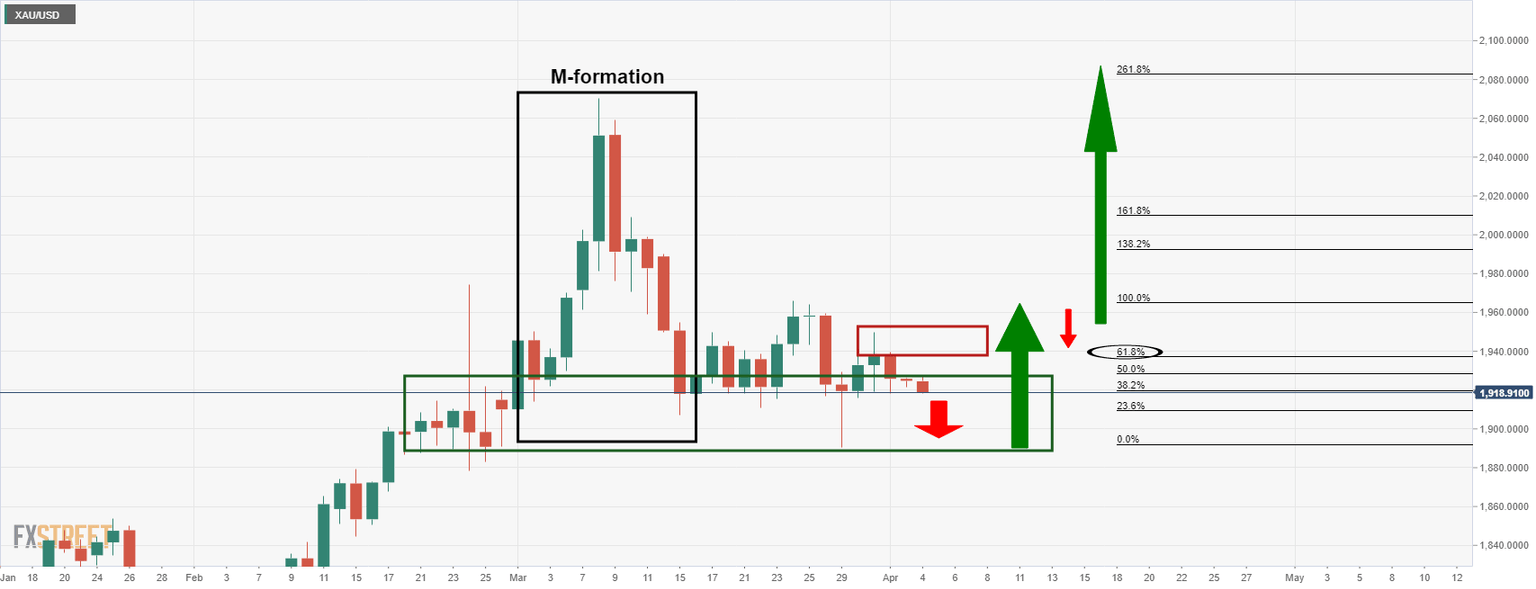

Gold technical analysis

The price is heading deeper into the demand and supporting area following a 61.8% Fibonacci correction of the prior bearish impulse. However, should bulls commit, then there will be prospects of a move beyond the current resistance near $1,950 for the days ahead and the potential for an onward continuation.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.