- Gold price is probing the $2,000 near a 61.8% Fibonacci retracement.

- Gold price bears are on the prowl at key resistance.

Gold price remains in the key support area in Asia with the bulls probing the bearish commitments at the psychological $2,000/oz level. XAU/USD has moved up from a low of $1,993.41 to score a high of $1,999.41 so far.

The theme driving the markets on a low calendar week stays with the sentiment surrounding the Federal Reserve and questions over whether the central bank is on the brink of pausing or not. On Friday, the US Dollar was boosted by hawkish rhetoric from Federal Reserve´s Governor Christopher Waller. The top central banker said that despite a year of aggressive rate increases, the Fed "hasn't made much progress" in returning inflation to their 2% target and argued that rates still need to go up.

There were some bullish components in the latest US Retail Sales and Consumer spending for the past quarter was solid also. The April survey of business activity in New York State was rising for the first time in five months also. ´´New orders jumped by a record 46.8pts in the month to 25.1, a one-year high. The shipments gauge also surged more than 37pts. Prices received rose 0.8 to 23.7pts indicating mild inflationary pressure. Delivery times and the average workweek both increased,´´ analysts at ANZ Bank explained.

The combination of hawkish rhetoric and the recent data is making greenback-bullion less attractive for overseas buyers, while benchmark Treasury yields climbed to a more than two-week high. Fed funds futures are showing that the expectations that the Fed will start cutting rates later this year have been pushed back to November from September, with a smaller cut now anticipated also.

Looking ahead, investors will focus on US flash PMIs for April and any further comments from Fed officials before they enter into a blackout period from April 22 ahead of the Fed's May 2-3 meeting. In this regard, analysts at TD Securities said the S&P PMIs for early April will offer a first comprehensive look at the state of the US economy post-banking turmoil. ´´Note that the March data was not clearly impacted by banking jitters, but perhaps it was too soon to be reflected: both the mfg and services PMIs registered their third consecutive increase then, with the latter advancing further into expansion territory.´´

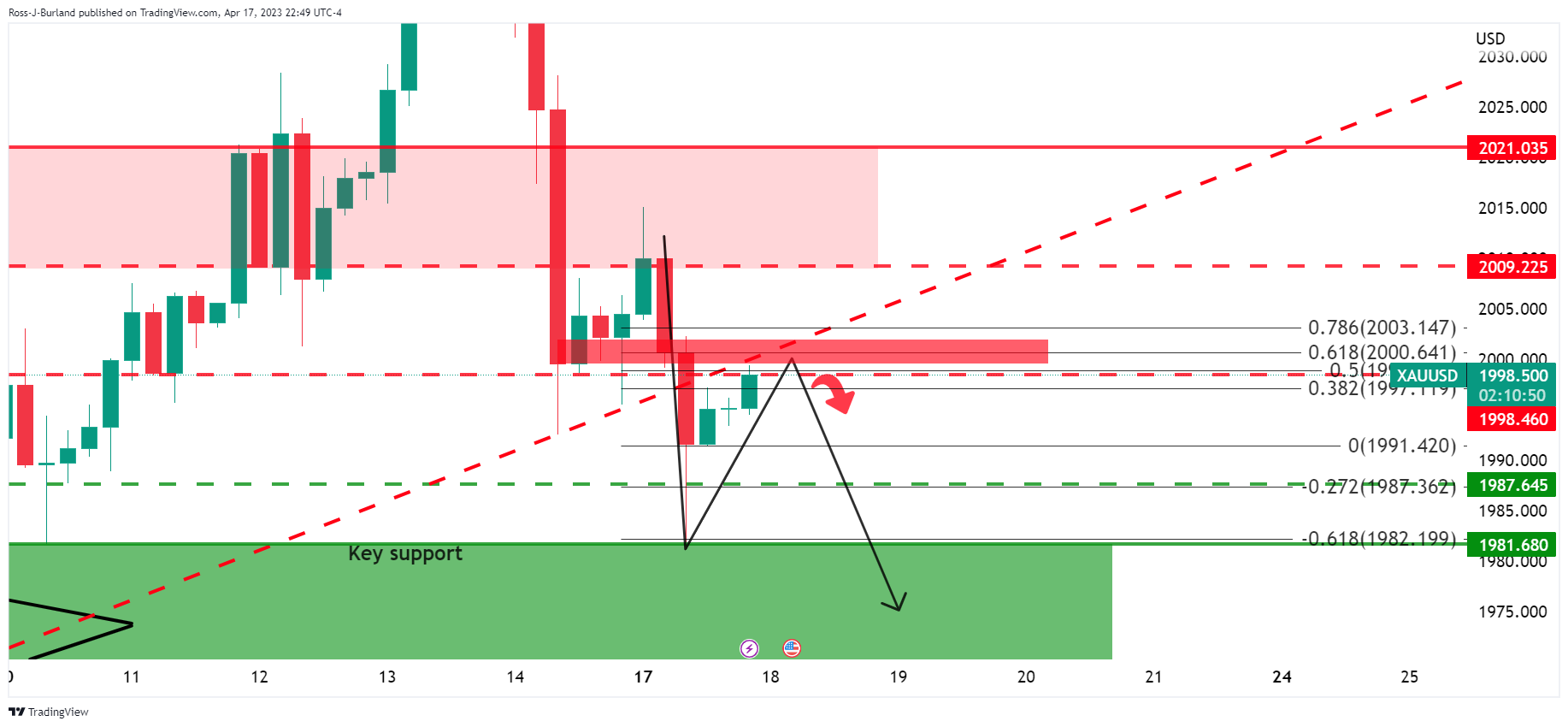

Gold technical analysis

Despite the bid, technically, the bears are in the market while below the trendline support that is currently acting as a counter-trendline:

There is a bullish correction in the making but bears are lurking at this juncture, guarding $2,000 near a 61.8% Fibonacci retracement of the prior 4-hour bearish sell-off.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold gives away some gains, slips back to $2,980

Gold retraced from its earlier all-time highs above the key $3,000 mark on Friday, finding a footing around $2,980 per troy ounce. Profit-taking, rising US yields, and a shift to a risk-on environment seem to be putting the brakes on further gains for the metal.

EUR/USD remains firm and near the 1.0900 barrier

EUR/USD is finding its footing and trading comfortably in positive territory as the week wraps up, shaking off two consecutive daily pullbacks and setting its sights back on the pivotal 1.0900 mark—and beyond.

GBP/USD remains depressed, treads water in the low-1.2900s

GBP/USD is holding steady in consolidation territory after Friday’s opening bell on Wall Street, hovering in the low-1.2900 range. This resilience comes despite disappointing UK data and persistent selling pressure on the USD.

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

Week ahead – Central banks in focus amid trade war turmoil

Fed decides on policy amid recession fears. Yen traders lock gaze on BoJ for hike signals. SNB seen cutting interest rates by another 25bps. BoE to stand pat after February’s dovish cut.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.