- Gold bears move in on a critical area of support following a massive decline at the start of the week.

- The US dollar and yields have been relentless due to market sentiment surrounding the Fed narrative.

The gold price, as per the start of the week's pre-open analysis, Gold, the Chart of the Week: XAU/USD bears eye a run to key support near $1,675, US CPI eyed, has dropped significantly lower on Monday. Not only did the price take out $1,675, but it has also made a low of $1,665.77, taking on a key support area as the markets stay on the theme of a hawkish Federal Reserve.

The gold price dropped from a high of $1699.91 from the get-go this week, sliding in Asia and not looking back, pausing for only a brief hourly candle in European markets and at the open of New York forex trade at around $1,677. However, with an elevated US dollar and US yields reaching for blue skies, gold bulls had no choice but to capitulate, making way for a strong second wind from the bears during Wall Streets' first few hours of trade.

The yield on the 10-year US Treasury bond has made a high of 3.992%, surging in the last hour in what might be the last-ditch effort to breach the psychological 4.00% level having already cleared the prior week's highs. The next target beyond there is last month's high of 4.019%. In turn, the US dollar has reached a high of 113.333 after climbing from a low of 112.621 as per the DXY index which is now holding above both Friday's and last week's highs. It is worth noting that, speculators’ net long USD index positions recovered ground for the second consecutive week following a string of hawkish Fed speak. That said, net longs remained below recent averages which leaves room for further upside in the greenback.

The Fed is driving gold

As for the driver, the Fed sentiment, analysts at TD Securities, who have been advocating an imminent drop in the gold price for many weeks explain again that ''inflation's rising persistence suggests the Fed is unlikely to stop hiking preemptively.''

''A prolonged period of restrictive rates suggests traders should ignore gold's siren calls, as a sustained downtrend will likely prevail, while quantitative tightening continues to drive real rates higher. Indeed, a constant flow of hawkish Fedspeak has seen the upside momentum in gold ease in recent days.'' The analysts also cite important inflation data this week and remind their readers that ''there are plenty of catalysts which could see the focus shift back toward hawkish interest rate policy.''

In terms of Fed speakers, we have heard from both Chicago Fed President Charles Evans and, in more recent trade, Federal Reserve Vice Chair Lael Brainard. Evans said that the Fed needs to "carefully and judiciously" navigate to a "reasonably restrictive" policy rate, as reported by Reuters, while Brainard argued that US monetary policy has begun to be felt in an economy that may be slowing faster than expected. Both officals however, explained that "monetary policy will be restrictive for some time to ensure that inflation moves back to target over time," Brainard said. "Target rate needs to rise a bit above 4.5% by early next year and remain there as Fed takes stock," Evans argued.

Fed fund futures are now pricing in a 92% chance of a 75-basis-point hike at the next Fed meeting. Higher interest rates increase the opportunity cost of holding zero-yield bullion.

As for the rest of the week, we have the Fed minutes, US Consumer Price Index and Retail Sales. With regards to the two key events, firstly, the minutes, the analysts at TD Securities explained that '' the September dot plot revealed a higher-than-expected Fed Funds terminal rate of 4.625%, with a fairly even dot distribution around this level. The question is how much of this was reflected in the deliberations at the Sep meeting. The tone of these deliberations likely was more hawkish given core CPI inflation trends, upsetting the current dovish pivot markets narrative.''

Secondly, for CPI, the analysts said, ''core prices likely stayed strong in September, with the series registering another large 0.5% MoM gain. Shelter inflation likely remained strong, though we look for used vehicle prices to retreat sharply. Importantly, gas prices likely brought additional relief for the headline series again, declining by about 5% MoM. Our m/m forecasts imply 8.2%/6.6% YoY for total/core prices.''

Gold technical analysis

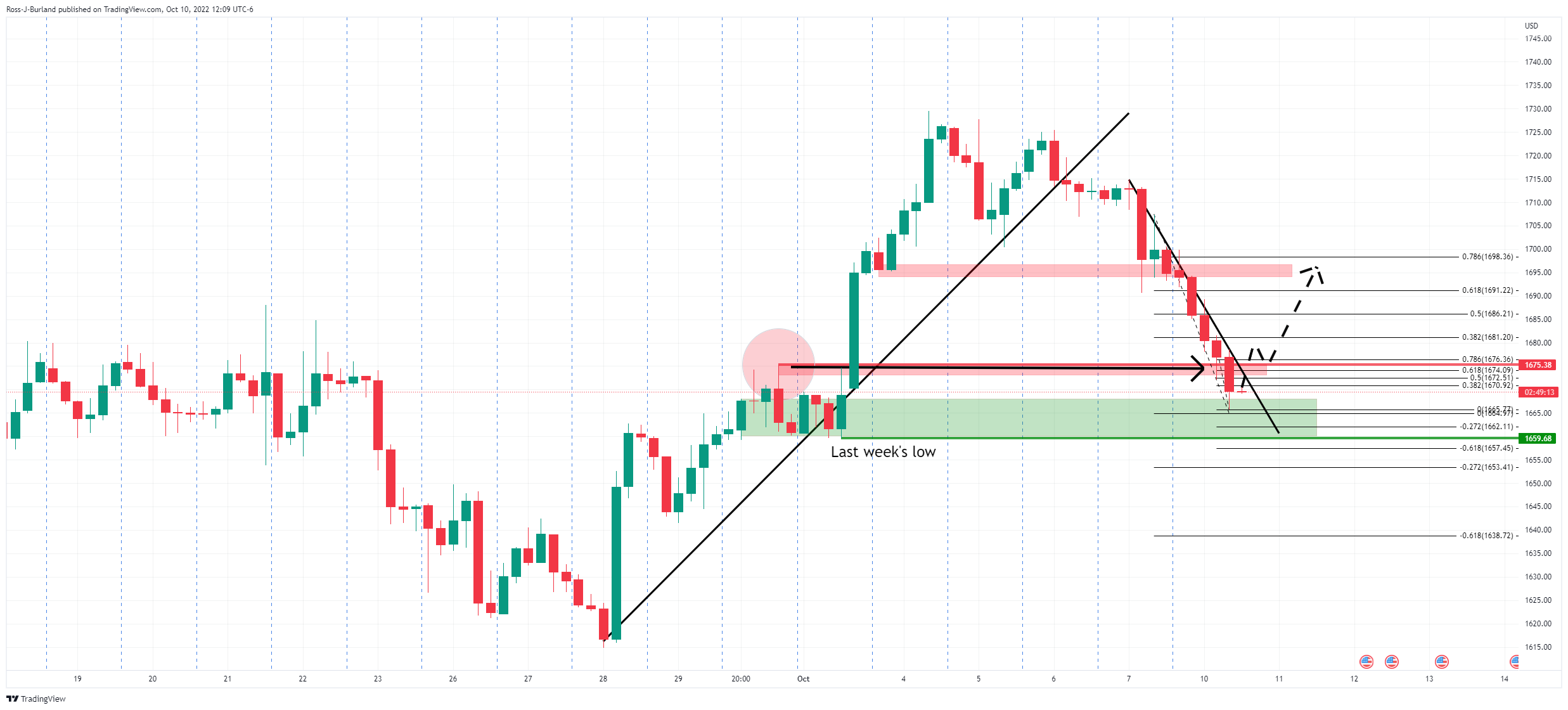

As per the pre-open analysis, the price dropped significantly at the start of the week:

Gold H1 chart

The price has reached the start of the prior rally as follows:

As illustrated, the price has made its way into the forecasted support area but still has some way to go until reaching last week's low. A correction into the key Fibonaccis that has a confluence with the prior structure could result in an onward move in the yellow metal to test the weekly lows:

A move beyond that resistance structure, however, could have implications for a move deeper correction, as per the following 4-hour analysis:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.