- Gold Price attempts a bounce on Tuesday but not out of the woods yet.

- The pullback in the US Treasury yields, dollar offer reprieve to gold bulls.

- Focus shifts towards the US inflation data, as growth and inflation fears loom.

Gold Price is attempting a minor bounce in Tuesday’s trading so far, although bulls appear less convinced as global economic growth and inflation concerns continue to haunt markets. The cautious market tone will keep the safe-haven dollar underpinned even as the Treasury yields embark upon a corrective decline. Gold Price tumbled to multi-day lows of $1,852 on Monday, as ‘sell everything’ mode engulfed markets on growth fears, triggered by the Fed’s interest rates hike, China’s covid curbs and the Ukraine crisis-led surging inflation.

Also read: Gold Price Forecast: Unbeatable dollar set to keep appreciating

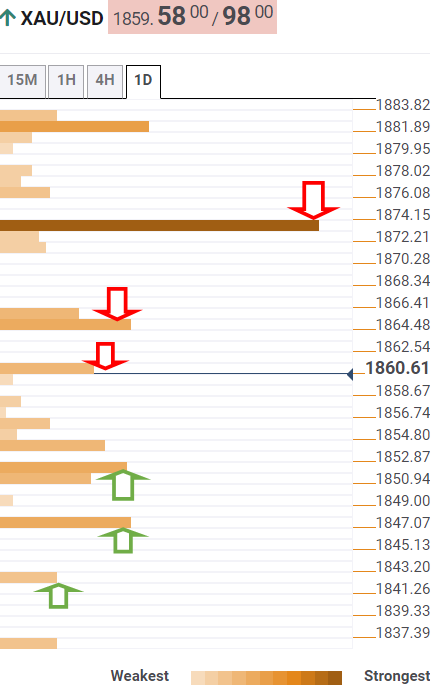

Gold Price: Key levels to watch

The Technical Confluences Detector shows that the Gold Price rebound is on its way to challenging a bunch of healthy resistance levels around $1,865, which is the convergence of the Fibonacci 38.2% one-day and Fibonacci 23.6% one-week.

Up next, gold bulls will have to find a strong foothold above the $1,974 powerful resistance to extend the recovery momentum. That level is the confluence of the SMA5 one-day, Fibonacci 61.8% one-day and Fibonacci 38.2% one-week.

The next relevant upside barrier is seen at the pivot point one-day R1 at $1,877, above which the SMA10 one-day at $1,882 will be the level to beat for XAUUSD buyers.

Alternatively, strong support awaits around the $1,855 region, the pivot point one-week S1.

If the selling pressure intensifies, then the confluence of the previous week’s low and the previous day’s low of $1,852 will come into play.

Further down, the psychological $1,850 level will get tested, below which gold bulls will look out for the immediate support at the pivot point one-month S1 of $1,847.

The last line of defense for gold buyers is pegged at $1,842, the pivot point one-day S1.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD strengthens as Trump confirms talks with China

The Australian Dollar extends its rally, with the AUD/USD gaining ground as the US Dollar weakens amid growing concerns over the economic impact of tariffs on the United States. Market participants are closely monitoring developments in US trade negotiations, although trading activity is expected to be subdued due to the Good Friday holiday.

USD/JPY weakens below 142.50 as Japanese CPI came in at 3.6% YoY in March

The USD/JPY pair softens to near 142.25 in a thin trading volume session on Friday. The US Dollar edges lower against the Japanese Yen amid concerns over the economic impact of tariffs.

Gold price loses momentum on profit-taking

Gold price holds steady on Friday after retreating from an all-time high of $3,358 as investors book profits during a long Easter weekend. Significant uncertainty over US President Donald Trump's tariffs on imports into the US and ongoing geopolitical tensions could underpin the Gold price.

Ethereum ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs. Meanwhile, Tron founder Justin Sun said that he won't sell his ETH holdings despite the sustained downtrend in the top altcoin’s price.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.