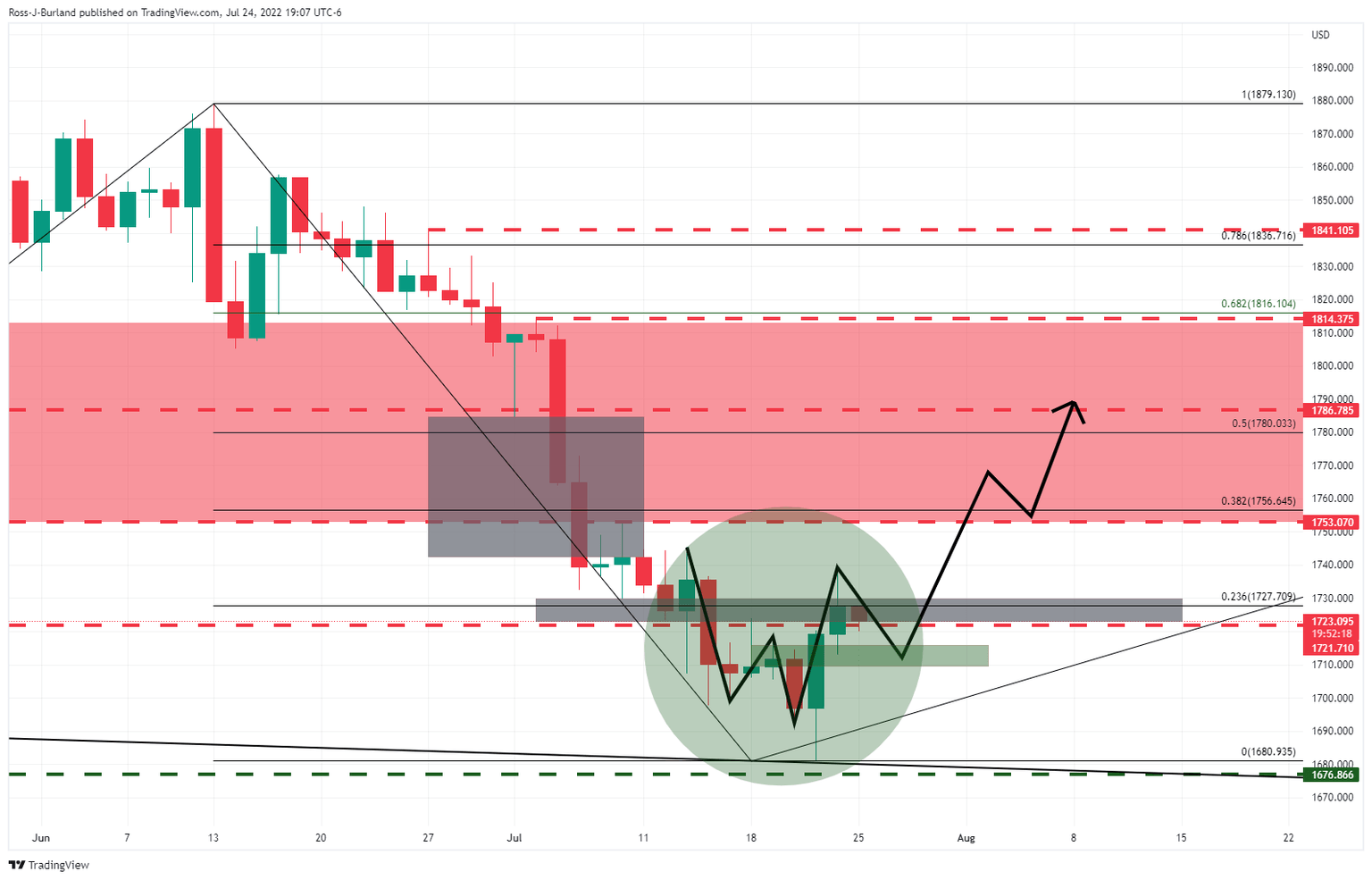

Gold Price Forecast: XAU/USD bears move in but higher levels are calling

- Gold is under pressure in the open as the US dollar continues to catch a bid.

- The Federal Reserve is coming up this week which will be critical for gold.

Gold is trading offered at the start of the week as the US dollar firms despite data that showed on Friday US business activity shrunk for the first time in nearly two years in July as a services slowdown outweighed manufacturing growth. At the time of writing, XAU/USD is trading at $1,722.30 within a range of between $1,719.98 and $1,727.66

On Friday, the US Composite PMI Output Index tumbled far more than expected to 47.5 this month from a final reading of 52.3 in June indicating the US could be headed for a recession. However, the greenback found some support from safe-haven flows late on Friday while investors' stepped aside from stocks on the back of some weak earnings reports.

Nevertheless, as per the prior analysis, Gold price could be on the verge of a significant correction, Fed meeting will be decisive, the gold price has mitigated a significant price imbalance on the weekly chart ahead of a critical event in this week's Federal Open Market Committee meeting.

All about the Fed

The Fed is expected to follow up June's large 75bp rate increase with a similar move in July, lifting the target range for the Fed Funds rate to 2.25%-2.50%. ''In doing so, the Committee would bring the policy stance to its estimate of the longer-run neutral level. We also look for Chair Powell to retain optionality by leaving the door open to additional 75bp rate increases,'' analysts at TD Securities said.

While there is potential for some upside in the price of gold, the analysts at TD Securities argue that from a positioning lens, the behemoth position held by the average prop-trader is still nearly twice its typical size, suggesting a substantial amount of pain will reverberate across gold markets as prices revert lower. ''We have yet to see capitulation in gold, suggesting the recent rally will ultimately fade faced with a wall of offers.''

Gold daily chart

Meanwhile, the daily chart's W-formation is pulling the gold price towards the neckline for a restest of the bull's commitments near $1,700 prior to a full-on drive higher in the coming days.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.