Gold Price Forecast: XAU/USD bears eye the cycle lows for end of week

- Gold bears could come under pressure into the closing sessions of the week.

- The US dollar has lagged behind the rise in yields but is making a comeback from a confluence of key daily support.

The gold price has moved back to a flat position on the day to print around $1,629.25 at the time of writing having travelled between a low of $1,622.54 and $1,628.93 thus far, reversing two losing sessions as the US dollar eased.

There has been a disparity in the price of the US dollar and US yields which may come back to bite the gold bugs before the week is out, however. Federal Reserve Bank of Philadelphia President Patrick Harker said Thursday the central bank is not done with raising its short-term rate target amid very high levels of inflation. His most hawkish of comments sent yields to fresh cycle highs, the strongest in a decade. He said the Fed has made disappointing progress at lower inflation and added that inflation in 2023 would fall to around 4% and 2.5% in 2024, which is still well above the 2%. as such risk sold off, yield and the greenback rallied weighing on the price of gold.

Bond yields rose, with the US 2-year note last seen paying 4.593%, up 0.75%, after reaching to the highest since 2008 at 4.614%:

Meanwhile, the US dollar weakened, with the DXY index last seen down 0.15 points to 112.85 having moved between a low of 112.16 and 113.09.

The index, however, remains in a bullish trend, near term and long term. The confluence of the bullish flag pattern and W-formation, with the correction, supported the neckline meeting a 50% mean reversion and trendline likely give fuel for the bulls to play catch up with US yields, weighing on gold's outlook for the remaining session of the week.

It's been a particularly troubling time in markets this week, with UK politics a major driver of volatility, feeding into the doom loop for gold prices at times of risk-off. However, the bearish themes could well intensify for the yellow metal as jumbo rate hikes are around the corner. As analysts at ANZ Bank explained, ''with the Truss soap opera over, global investors can now refocus on upcoming central bank meetings.'' The war on inflation will be firmly on the minds of investors as we head into these meetings, and in this context, gold will likely continue to struggle given inflation's increasing persistence.

''For the time being, we have found that US wage growth trends are validating near-term household inflation expectations, but appear to have settled at levels that would sustain a CPI inflation rate of 5-6% going forward, far removed from the 2.5% rate consistent with the Fed's inflation target,'' analysts at TD Securities said.

''In turn, don't count on investors to grow their appetite in the yellow metal. Physical demand for bullion has remained elevated, but seasonal considerations suggest that this tailwind could soon fade following India's festive season.''

Gold technical analysis

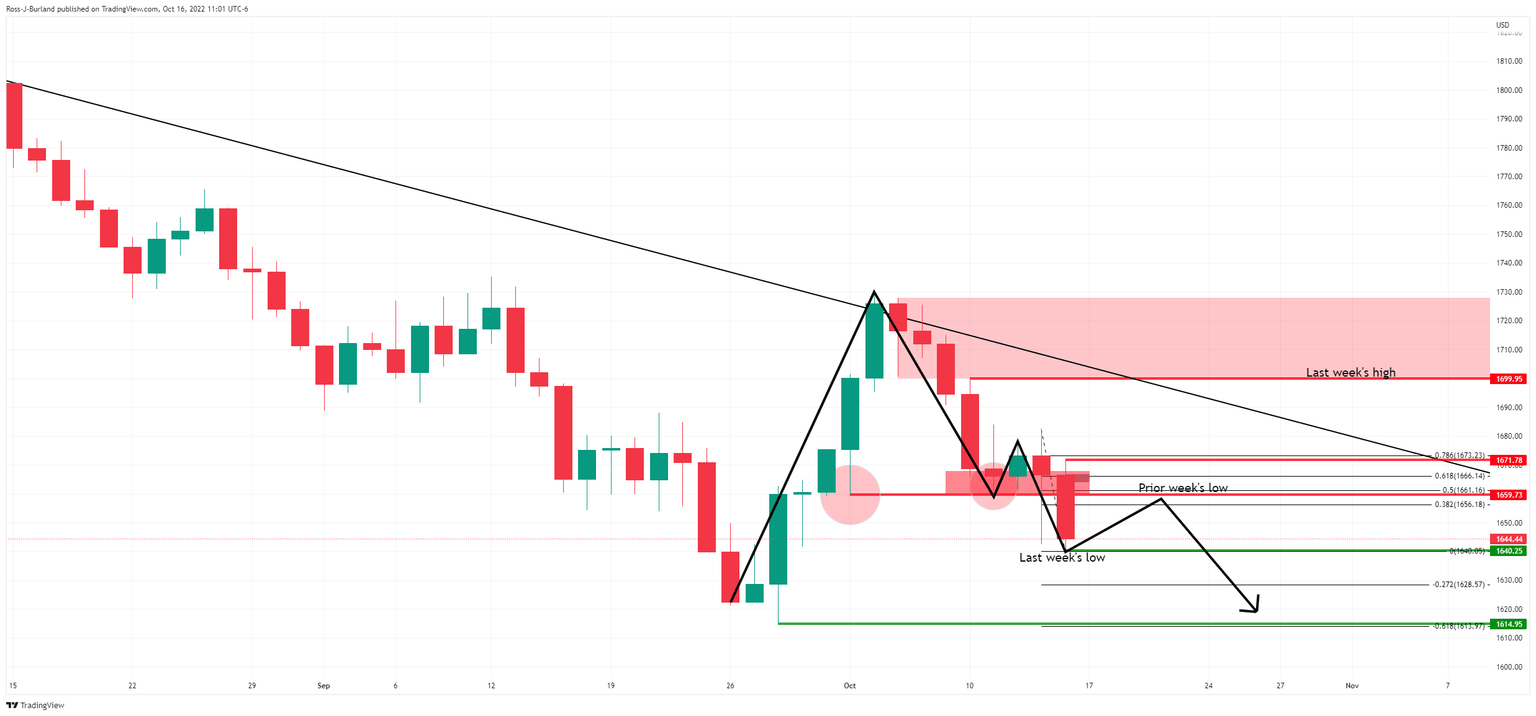

At the start of the week, within the pre-open market analysis on gold, Chart of the Week, Gold Price: Halloween comes early, XAU/USD back below critical bearish structure $,1670, the downside was marked as the path of least resistance as follows:

Gold, pre-open analysis October 16

Gold update, daily chart

As illustrated, that path continues to play out with the $1,614 lows potentially just a session or two, or three, away. Beyond there, we have the year 2020 $1,570s clocked as the midpoint of the March 2020 range:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.