Gold Price Forecast: XAU/USD bears eye Fed Chair Powell’s Testimony, PMIs to retake control

- Gold Price struggles to keep bears on board after snapping two-week uptrend, retreating of late.

- XAU/USD fails to cheer US Dollar weakness amid economic fears surrounding China, US.

- ECB out-hawks Fed and weighs on USD amid mixed United States data, putting a floor under the Gold Price.

- Fed Chair Powell’s Testimony, preliminary PMI readings for June will be crucial for clear directions.

Gold Price (XAU/USD) remains depressed after posting the first weekly loss in three, bouncing off short-term key support confluence to around $1,950. That said, the XAU/USD begins the trading week on a dicey floor amid the US holiday on Monday, as well as a light calendar elsewhere. However, hopes of the Federal Reserve’s (Fed) July rate hike join mixed concerns about China and the US weighing on the Gold Price, despite the downbeat US Dollar. That said, Fed Chair Jerome Powell’s bi-annual Testimony and the preliminary readings of the US, UK and Japan PMIs for July will be the key to watch for clear directions during the week.

Gold Price holds lower ground despite downbeat US Dollar

Gold Price fails to cheer the downbeat US Dollar performance in the last week as mixed US data joined blurry concerns about the US and China economics.

US Dollar Index (DXY) dropped for the third consecutive week to the lowest level since early May, pressured near 102.30 at the latest.

That said, the US central bank kept the benchmark interest rate unchanged at 5.0-5.25%, matching market expectations of pausing the multi-month-old hawkish cycle after 10 consecutive rate increases. However, the upbeat FOMC Economic Projections and Federal Reserve (Fed) Chairman Jerome Powell’s speech backed the hawkish Fed bias surrounding the July meeting. Even so, mixed US data and comparatively more hawkish moves of the European Central Bank (ECB) weighed on the US Dollar.

On Friday, the preliminary readings of the University of Michigan (UoM) Consumer Sentiment Index (CSI) for June improved to 63.9 from 59.2 prior and market expectations of 60.0. However, the year-ahead inflation expectations receded for the second consecutive month to the lowest since March 2021, falling to 3.3% in June from 4.2% in May, per the UoM report, while the five-year forecasts appear little changed to 3.0% versus 3.1% anticipated and prior.

Previously, US Retail Sales and inflation data weren’t too impressive, which in turn flagged fears of the US economic performance and weighed on the Gold Price.

Additioally, Fed policymakers have been hawkish of late and exerted downside pressure on the XAU/USD. “Inflation in the US is well above target and the labor market remains very tight,” as per the latest US Federal Reserve (Fed) Monetary Policy Report to the US Congress, published Friday. The report also mentioned, per Reuters, “Outlook for funds rate is subject to considerable uncertainty.” On the same line, “Raising rates further could create the risk of a more significant slowdown in the economy,” signaled Thomas Barkin, President of the Federal Reserve Bank of Richmond on Friday that, per Reuters. The policymaker, however, also added that the Fed can do comfortable more to slow resilient US economy, which in turn triggered a jump in the 2-year Treasury bond yields to 4.75% and helped the US Dollar to get off the lows.

Furthermore, “US economy is still ‘ripping along’,”said Federal Reserve Governor Christopher Waller on Friday while adding that everything seems to be calm in the US banking system, as reported by Reuters.

China, Russia flash mixed signals to defend the Gold Price

As per the South China Morning Post (SCMP), the Council considered a batch of macroeconomic policies designed to expand “effective demand”, strengthen the real economy and defuse risks in key areas. However, the markets appear to have lost interest in announcements from China as the last week’s rate cuts have already signaled such measures but mostly failed to inspire the markets much. On the same line, the US Secretary of State and the Chinese foreign minister on Sunday held what both called candid and constructive talks on their differences from Taiwan to trade but seemed to agree on little beyond keeping the conversation going with an eventual meeting in Washington, per Reuters.

Elsewhere, Russia rules out the scope of extending the Ukraine grain deal and flags more risk-off moves, which in turn can weigh on the XAU/USD.

Amid these plays, Wall Street closed on the positive side, yields eased but the commodities traded mixed while the US Dollar dropped.

Moving on, Monday’s inaction, due to the US holiday, may allow traders to reassess the previous week’s mixed moves ahead of Federal Reserve (Fed) Chair Powell’s Testimony, which will be crucial for confirming the July rate hike and may weigh on the Gold Price. Following that, Friday’s US Purchasing Manager Indexes (PMIs) for June will be eyed for clear directions.

Also read: Gold, the Chart of the Week: XAU/USD is coiled and breakout eyed

Gold Price Technical analysis

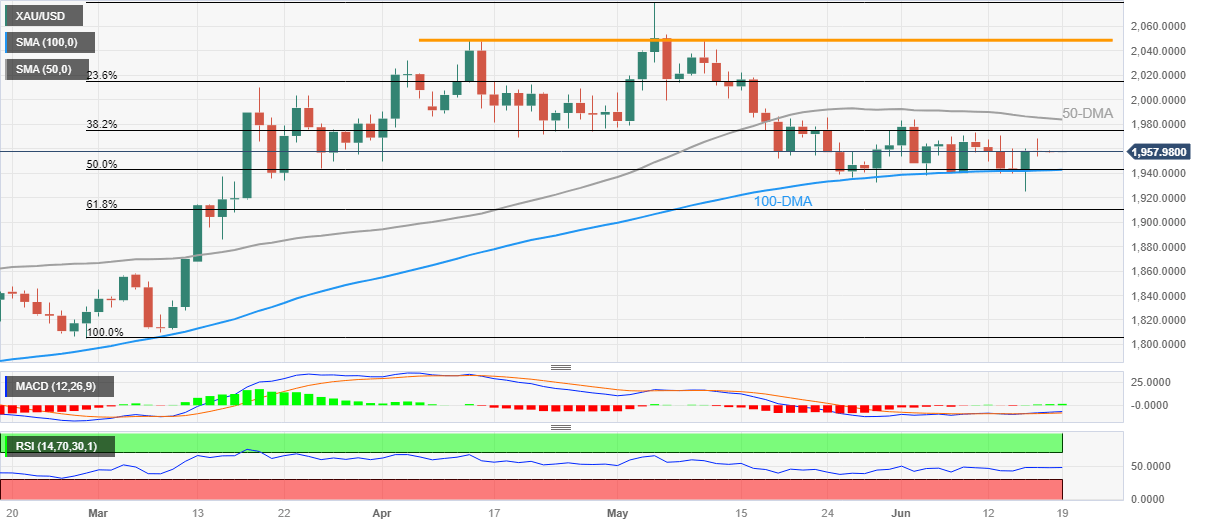

Gold Price portrays bearish consolidation above a convergence of the 100-DMA and 50% Fibonacci retracement of late February to early May upside, around $1,940 by the press time.

That said, the Moving Average Convergence and Divergence (MACD) indicator regains bullish momentum but the Relative Strength Index (RSI) line, placed at 14, steadies near the 50.0 level, suggesting a continuation of the bearish grind.

With this, the XAU/USD is likely to remain sidelined unless breaking the $1,940 support confluence.

Following that, a quick fall towards the 61.8% Fibonacci retracement, also known as the golden ratio, around $1,910, can’t be ruled out. However, the $1,900 round figure may offer breathing space to the XAU/USD bears afterward.

Meanwhile, the Gold Price recovery needs validation from the 50-DMA hurdle of around $1,985 by the press time.

Even if the XAU/USD crosses the $1,985 resistance, the $2,000 psychological magnet may check the further upside before directing the Gold Price toward a two-month-old horizontal resistance area of around $2,050 and then to the record high marked in May near $2,080.

Gold Price: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.