Gold Price Forecast: XAU/USD bears eye a breakout

- Gold price is under pressure at key levels.

- Markets were focussed on the Fed's Chairman Powell.

The Gold price was offered on Wednesday even as the US Dollar fell and bond yields climbed. XAU/USD fell from a high of $1,939.57 to a low of $1,919.24.

Markets were reacting to the congressional testimony from Federal Reserve chair Jerome Powell on Wednesday ahead of the Senate on Thursday. Treasury yields were mixed after Powell's appearance before the House Financial Services Committee, bearish for gold which offers no interest.

The Fed had left interest rates unchanged at its June meeting, so there was an emphasis on that as to why in the face of inflation. Powell told lawmakers the fight against inflation still "has a long way to go" and that despite a recent pause in interest rate hikes officials agreed borrowing costs would likely need to move higher. Powell said it may make sense to still raise rates at a more moderate pace. As a consequence, investors broadly expect rate hikes to resume at the Fed's July meeting.

''Whilst he said that it makes sense to slow the frequency of rate hikes, there is a difference between the speed at which rates rise and the level to which rates ultimately need to get,'' analysts at ANZ Bank said.

''The FOMC wants to observe the effects of the very rapid hiking cycle on the real economy and retain optionality whilst maintaining its commitment to low and stable inflation. There is merit in that strategy – albeit it has caused some volatility in markets, which tend to prefer clarity to nuance,'' the analysts argued. ''Powell’s testimony did not deviate from the strategy that interest rate decision will be made on a meeting-by-meeting basis. Data momentum will be key in coming months.''

Meanwhile, analysts at TD Securities explained that ''while the yellow metal has remained locked in a tight range over the last weeks, the lackluster price action is revealing some implicit weakness as the metal fails to rally despite a slumping USD.''

''Given our gauge of CTA positioning continues to suggest extremely limited outflows, it is possible that discretionary traders are growing their net short position following the latest FOMC meeting, suggesting traders aren't skeptical about the Fed's hawkish communication,'' the analysts argued.

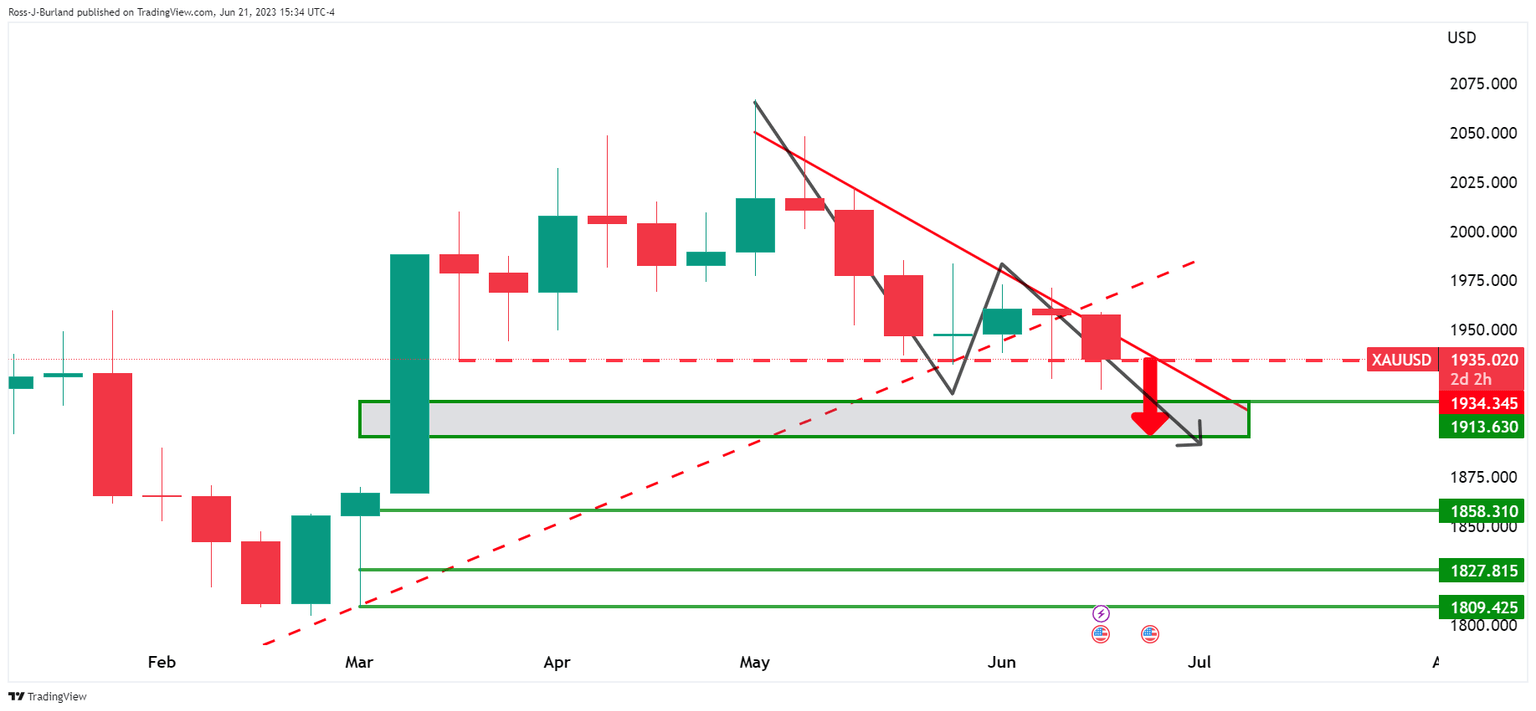

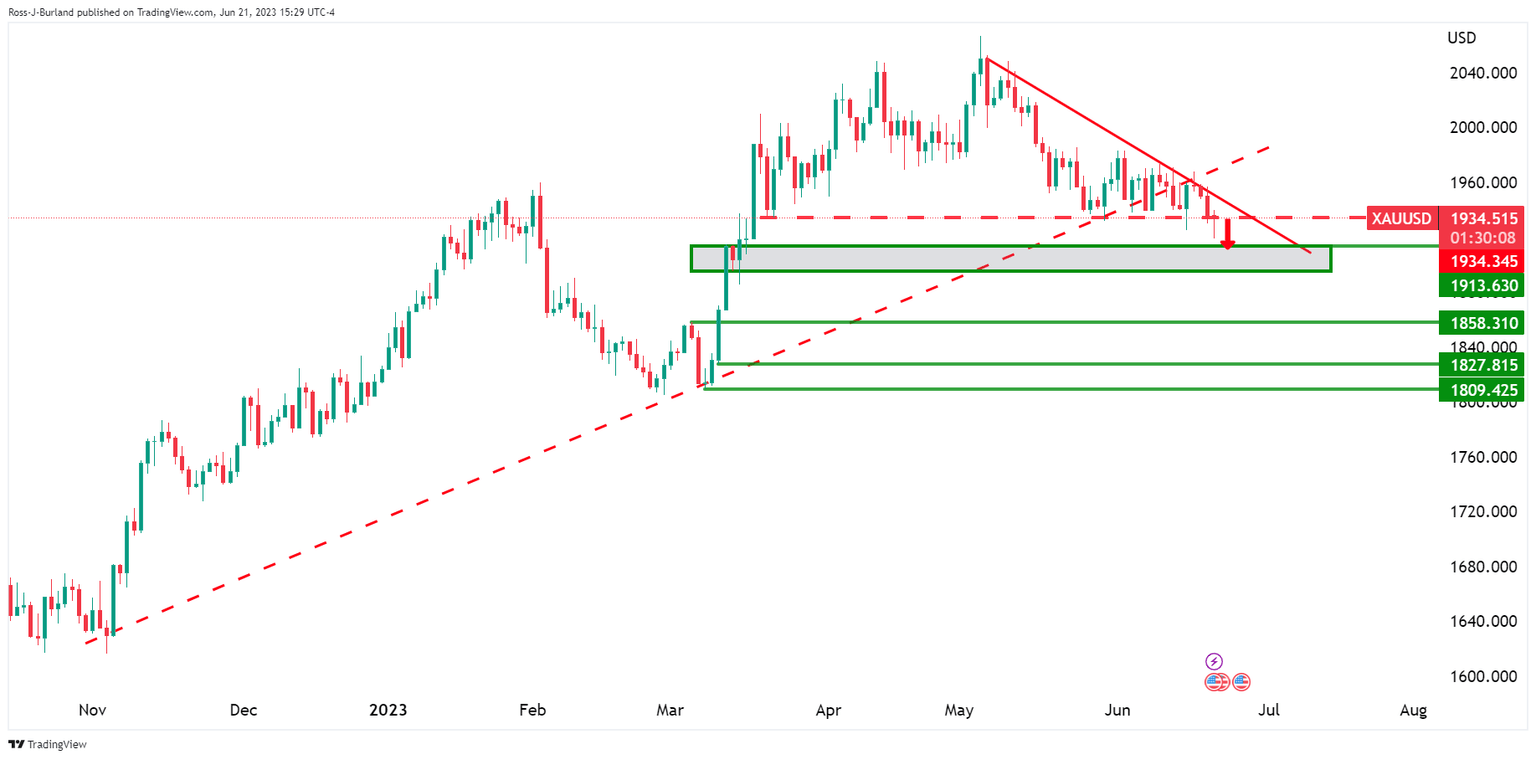

Gold weekly chart

We have prospects of a downside continuation on the weekly chart.

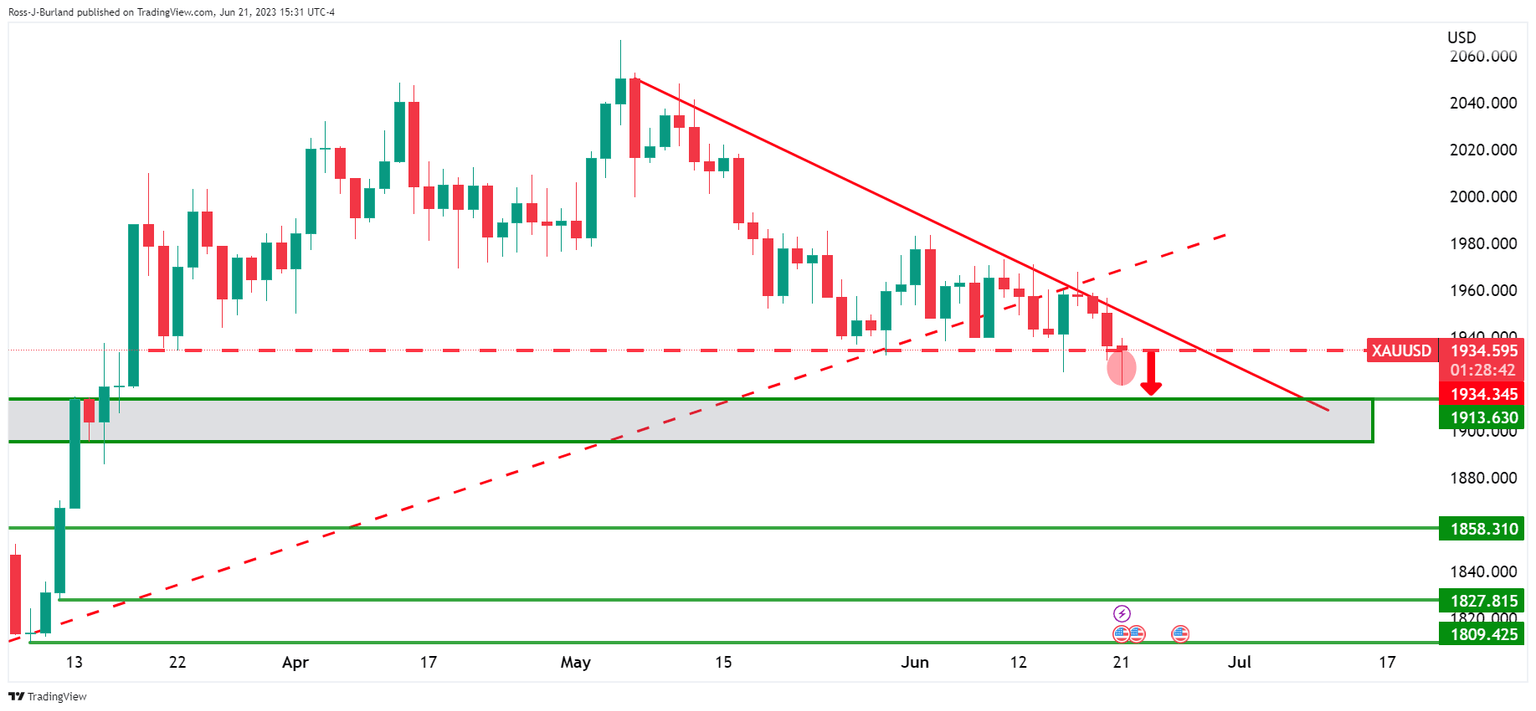

Gold daily charts

From a daily perspective, we are moving into testing the lows while on the front side of the bearish trend. The wick on the chart could've filled in the coming session and this could be the catalyst for a selling programme into support in and around $1,913.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.