- Gold Price drops for the fourth consecutive day as bears cheer downside break of key support confluence.

- China-inflicted risk aversion joins hawkish Fed talks and upbeat US data to weigh on XAU/USD price.

- Fed Chair Jerome Powell’s ability to defend the hawkish halt will be eyed by the Gold sellers to keep the reins.

Gold Price (XAU/USD) remains on the back foot as bears prod $1,930 support confluence with eyes on Fed Chair Jerome Powell’s bi-annual testimony. In doing so, the XAU/USD drops for the fourth consecutive day amid a firmer US Dollar and sour sentiment, mainly led by China.

That said, the US Dollar Index (DXY) stays defensive around 102.60 while keeping the four-day uptrend without marking keen interest to move toward the north. Even so, the geopolitical fears surrounding the US and China weigh on the sentiment and put a floor under the US Dollar’s haven demand. Also underpinning the US Dollar’s run-up, as well as weighing on the Gold price are the upbeat US housing numbers and hawkish Fed signals published the previous day.

Apart from that fears that China’s inability to mark upbeat growth can endanger the Gold demand from one of the world’s biggest XAU/USD consumers also weigh on the precious metal prices. Late on Tuesday, The Straits Times marked the second consecutive monthly easing on China’s Gold demand.

Looking forward, a light calendar ahead of Fed Chair Jerome Powell’s bi-annual testimony may test the Gold sellers but the buyers are less likely to return to the table.

Also read: Gold Price Forecast: XAU/USD keeps sight on $1,918 and Fed Chair Powell’s testimony

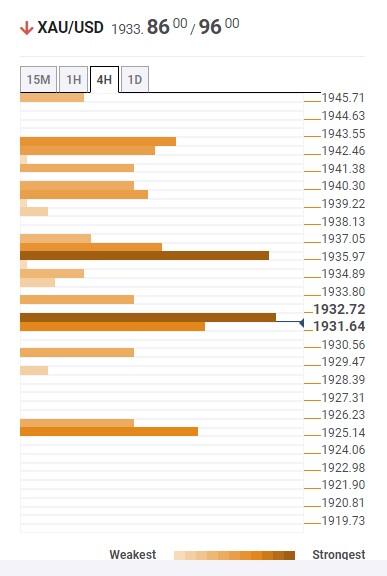

Gold Price: Key levels to watch

As per our Technical Confluence Indicator, the Gold Price has already breached the two short-term key supports around $1,936 and $1,931 respectively. However, the $1,930 round figure and the previous bottom of around $1,925 prods the XAU/USD bears on an important day.

That said, the Gold Price presently seesaws around $1,930 support confluence comprising Pivot Point one-week S1.

Following that, the Pivot Point one-day S1 will act as the final defense of the XAU/USD bulls around $1,925, a break of which could drag the Gold bears toward the $1,900 round figure.

Meanwhile, the previous monthly low of around $1,931 prods the Gold buyers ahead of the Fibonacci 23.6% on the daily and weekly chart, around $1,936.

It’s worth noting that the Gold Price run-up beyond $1,936 will need to stay firmer past the $1,945 hurdle comprising the Fibonacci 38.2% on the weekly chart to push back the bearish bias.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD resumes slide below 1.0500

EUR/USD gained modest upward traction ahead of Wall Street's opening but resumed its slide afterwards. The pair is under pressure in the American session and poised to close the week with losses near its weekly low at 1.0452.

GBP/USD nears 1.2600 as the US Dollar regains its poise

Disappointing macroeconomic data releases from the UK put pressure on the British Pound, yet financial markets are all about the US Dollar ahead of the weekly close. Demand for the Greenback increased in the American session, pushing GBP/USD towards 1.2600.

Gold pierces $2,660, upside remains capped

Gold (XAU/USD) puts pressure on daily lows and trades below $2,660 on Friday’s early American session. The US Dollar (USD) reclaims its leadership ahead of the weekly close, helped by rising US Treasury yields.

Broadcom is the newest trillion-dollar company Premium

Broadcom (AVGO) stock surged more than 21% on Friday morning after management estimated on Thursday’s earnings call that the market for customized AI accelerators might reach $90 billion in fiscal year 2027.

Can markets keep conquering record highs?

Equity markets are charging to new record highs, with the S&P 500 up 28% year-to-date and the NASDAQ Composite crossing the key 20,000 mark, up 34% this year. The rally is underpinned by a potent mix of drivers.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.