Gold Price Forecast: XAU/USD bears comply with symmetrical triangle

- Gold price bulls eye the 50% mean reversion as a resistance area that could hold.

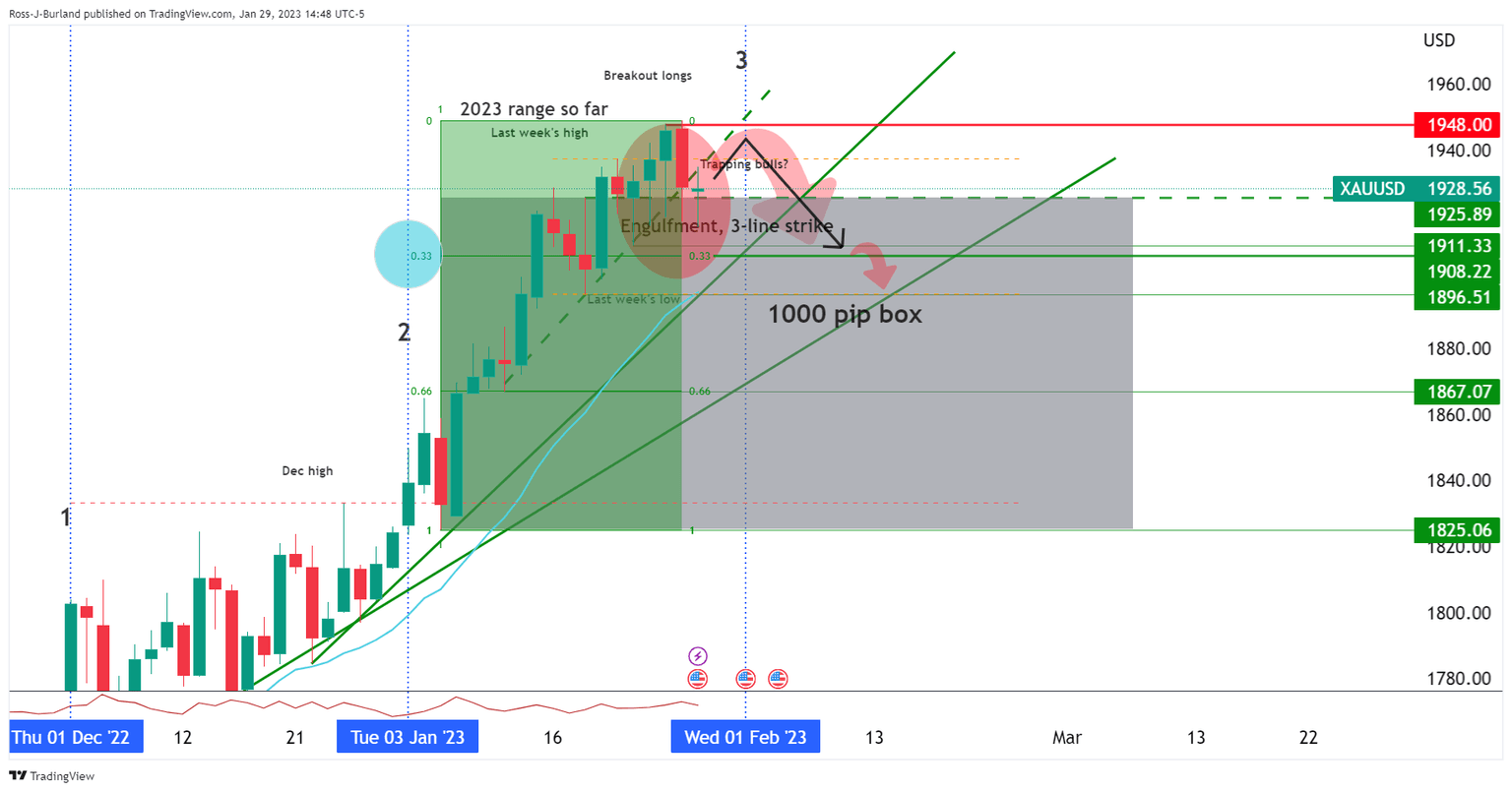

- Gold price bears seek a break of $1,850 for the continuation to the $1,825 1000 pip target.

- US CPI is a critical event for the Gold price this week.

Gold price was choppy in New York but decisively bearish as per the technicals and failures to rally even on US Dollar weakness as the session got going around the London fix and Wall Street's cash open. Gold price is currently trading at $1,850 and at the bottom of a new box that was formed in Friday's sell-off. The yellow metal dropped on Monday in a continuation of that move and from the day's high set in Asia at $1,866.59.

US Consumer Price Index key for Gold Price

Gold price is pressured as investors get set for a very heavy week of data in the United States where we start on Tuesday, with what could be a robust 6.2% annualized Consumer Price Index, CPI, outcome for the prior month. When combined with the unexpectedly strong January jobs report released earlier this month, in the Nonfarm Payrolls, NFP, this data could really kick off a storm in markets that are otherwise front-running the Federal Reserve and are pricing in a picot for later in the year.

Analysts at TD Securities explained that ''core prices likely stayed strong in January with the index rising 0.4% MoM (matching Dec's upward-revised gain), as we look for the recent relief from goods deflation to come to an end.''

''Shelter inflation likely remained the key wildcard, while a rebound in gasoline prices will be the main driver of non-core CPI prices. Our MoM forecasts imply 6.2%/5.5% YoY for total/core prices.''

However, there are mixed outlooks for the Consumer Price Index, CPI, data with some analysts anticipating a hawkish outcome while others a dovish one.

For instance, while some analysts anticipate a more benign outcome from the data, analysts at Brown Brothers Harriman argued that a move higher in US Treasury yields of late, (10-year US Treasury note rose from Thursday's low of 3.334% to a recent high of 3.755%), coincides with renewed inflation concerns and a reprising of Fed tightening expectations.

''WIRP suggests 25 bp hikes March 22 and May 3 are nearly priced in, while the odds of a third hike in June or July top out near 45%,'' the analysts said. ''Strangely enough, an easing cycle is still expected to begin in Q4 but we believe that will be corrected in the next stage of Federal Reserve repricing, which may come after Consumer Price Index, CPI, and Producer Price Index, PPI, data this week,'' they argued.

On the other side of the narrative, analysts at TD Securities said that they anticipated a dovish outcome that will be underscoring the prospects that the recent pain trade starts to reverse.''

''The latest USD correction was inspired mostly by extreme positioning and short-term risk premium, which has also started to correct,'' they noted. ''Plus, the strong employment numbers did little to rattle the Federal Reserve, which has helped reinforce the soft-landing narrative.''

''The upshot is that if CPI complies with our forecasts this week, that should kick-start a new round of broad US selling,'' the analysts at TD argued, paving the way for bullish prospects of the euro that is negatively correlated to US selling.

Meanwhile, the Federal Reserve speaker Governor Michelle Bowman said the following at the start of the week:

"I expect we'll continue to increase the federal funds rate because we have to bring inflation back down to our 2% goal and in order to do that we need to bring demand and supply into better balance," Bowman said during an American Bankers Association conference in Florida.

Once at a sufficiently restrictive level, interest rates will then need to be held for "some time" to restore price stability, she added.

Bowman rounded off by saying that a very strong labour market alongside moderating inflation meant a so-called economic 'soft landing' remains possible.

Gold technical analysis

The breaks of the Gold price structures have occurred over the past couple of days and shorts are building, penetrating deeper territories. However, a correction could be on the cards as follows:

The Gold price 50% mean reversion is a resistance area that could hold and result in a downward continuation with $1,850 eyed. This guards a move to the 1000 pip box target of $1,825 made in the prior Gold price analysis:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.