Gold Price Forecast: XAU/USD bears are pushing back ahead of Nonfarm Payrolls

- Gold price is stalling on the bid and the focus is on a meanwhile correction.

- The US Dollar is firming up ahead of the US Nonfarm Payrolls report this Friday.

Gold price is tracking the ebbs and flows in the US Dollar on Wednesday but holding its own in the $2,020s in midday trade having traveled between a low of $2010.09 and $2032.11 so far on the day. The US Dollar initially fell to mark a fresh bear cycle low on Wednesday but has since recovered the best part of the losses made on Tuesday´s sell-off and is now reaching back towards 102.00 DXY, making the Gold price a touch less affordable for international buyers.

Nevertheless, the Gold price rose to a fresh 13-month high early on Wednesday as investors move to safe havens after a second-straight report showed slowing employment growth for the United States as interest rates rise. A combination of this week´s data and a report today that showed US private sector employers added 145,000 jobs in March, well under expectations for a rise of 210,000, sent the greenback to a low of 101.415 DXY. The data came in well below the 242,000 positions gained in February. The data follows the weak result for US new job openings released Tuesday and gives rise to sentiment that the Federal Reserve is about to pivot due to the evidence that the US economy is slowing.

US Treasury yields dropping

Consequently, investors are fearful of recession and are pricing in Federal Reserve rate cuts later in the year and the Gold price is finding support from a fall in US Treasury yields. The US two-year note was paying as little as 3.646% on the day while the yield on the 10-year note was down to a low of 3.268%. Both notes were poised to close at lows last seen in September as safe-haven buying pushed bond prices, which move opposite to their yields, higher.

Reuters reported that ´´futures priced in a 39.1% likelihood that the Fed raises its target rate by 25 basis points on May 3 when policymakers conclude a two-day meeting, down from 59.7% on Monday, CME's FedWatch Tool showed. Chances the Fed cuts rates by year's end also rose, with the outlook for the US central bank's target rate falling below 4.0% in December.´´

US Nonfarm Payrolls could see outsize movements

Looking ahead, the market now is waiting for the US Nonfarm Payrolls report on Friday and Gold price bulls will be keen to see if there will be any confirmation that the labor market is cooling, a major requisite in the Federal Reserve's fight to curb inflation. Particular attention will be paid to the Unemployment Rate in this regard.

Analysts at Brown Brothers Harriman said the following with regard to the forthcoming jobs data:

´´The consensus for Nonfarm Payrolls this Friday stands at 240k vs. 311k in February, while the unemployment rate is seen steady at 3.6%. Average hourly earnings are expected to slow to 4.3% y/y vs. 4.6% in February. It's worth noting that the data will come on Good Friday. With markets likely to be very thin, we could get some outsize movements from the numbers, whether good or bad. ´´

Gold technical analysis

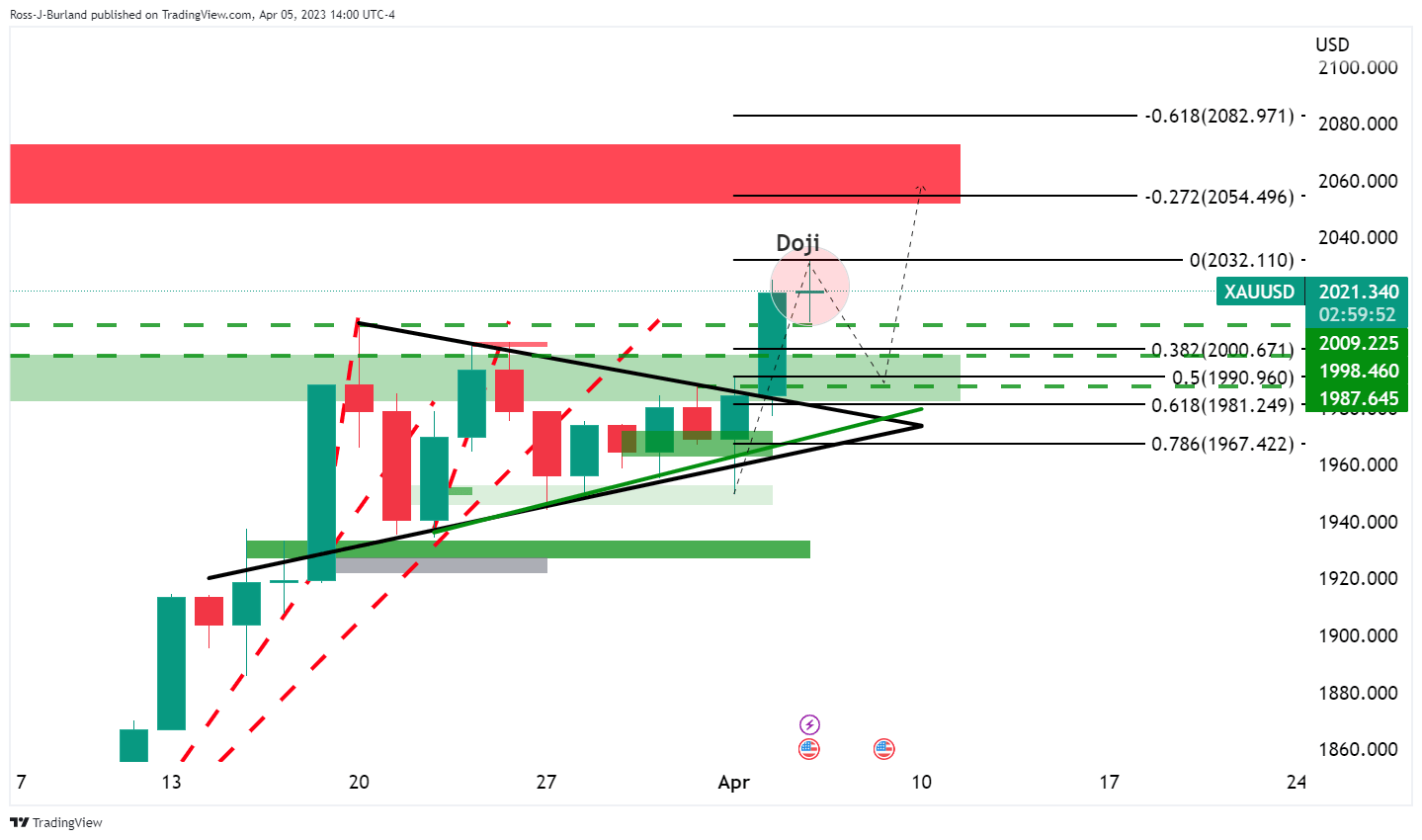

As per the pre-market open weekly Gold price analysis, Gold, Chart of the Week: XAU/USD bulls remain in control, the Gold price indeed rallied:

Prior Gold price analysis

We had a bullish Gold price pennant on the daily and 4-hour charts:

Gold price updates

The Gold price bulls were back in the market after an anticipated drive from around the supporting area. The Gold price bulls needed to commit at this juncture to get and stay above $2,010.

The Gold price bullish pennant thesis played out as illustrated in Tuesday´s chart above.

It was shown that the Gold price Fibonacci scale comes into play.

We have the 38.2% Fibonacci retracement of the Gold price aligned with the $2,000 area that could come back under pressure for a retest, if not lower, prior to the next bullish impulse and an eventual upside continuation:

Gold price update, live chart

The Gold price doji is a stalling candle and it could be followed by a bearish engulfment on Thursday that could give way to the prospects of a move lower in the Gold price as the bias. However, so long as the Gold price bulls stay committed, this bullish cycle will have further to run for the Gold price.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.