- Gold is under pressure on the daily chart, flat in Asia ahead of the FOMC minutes.

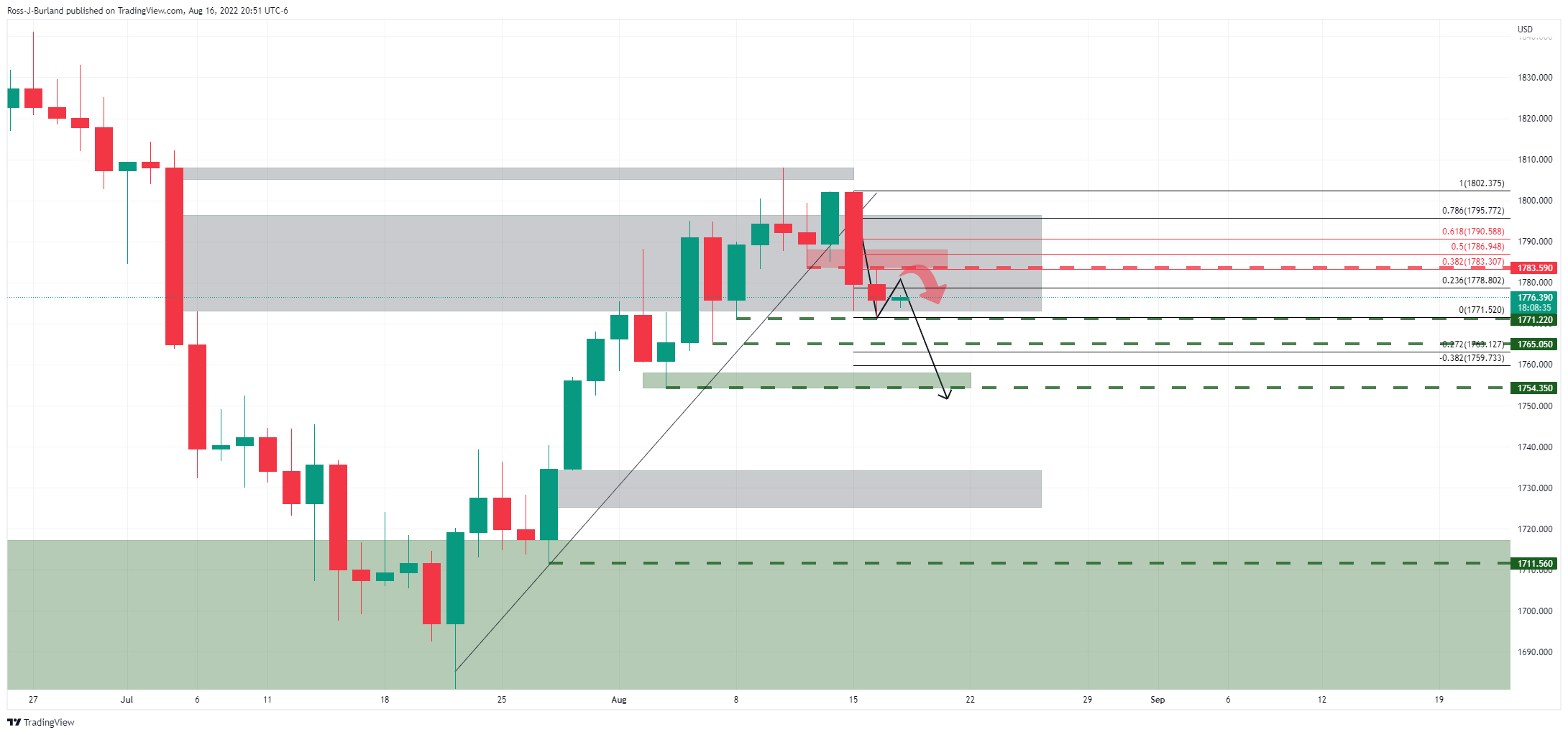

- The price would be expected to move below daily support so long as the resistance holds near the 50% mean reversion around $1,785.

Gold is flat on the day trading at around $1,776.50 and sticking to a tight range of between $1,773.91 to a high of $1,776.85. The yellow metal fell due to rising Treasury yields weighed on investor appetite. A slightly stronger US dollar was also a headwind for investor demand. The greenback is currently steady as investors await the release of the minutes of the Federal Open Market Committee issues minutes from its meeting of July 26-27.

The US central bank raised its benchmark overnight interest rate by 225 basis points to tame high inflation. The minutes could offer clues on further interest rate hikes. The Fed is expected to raise its policy rate by another 50 or 75 basis points at its next meeting on Sept. 20-21. US Treasury yields have been firm as a consequence and also due to the recession worries and despite nascent signs of a slowdown in inflation.

Several Fed policymakers have spoken of the need for continued rate hikes despite the lower-than-expected outcome of last week's Consumer Price Index. "Fed officials have no choice but to sound tough in the face of a very, very tight labour market and far too high inflation," Kit Juckes, the head of FX strategy at Societe Generale argued. "It's hard to build a compelling case to sell the dollar in that world."

Meanwhile, ''odds of a short squeeze in gold are notably declining,'' the analysts at TD Securities argued. ''However, our CTA positioning estimates suggest that a trend followers buying program contributed to lower rates over the past month, as algos were forced to cover shorts. While this supported higher prices in gold, the bar is razor thin for algorithmic trend followers to add to selling pressures in US10y Treasuries once more,'' the analysts said.

''This should further sap appetite to buy the yellow metal, while the bar for additional short covering rises further. Meanwhile, Shanghai traders are also likely to appear on the offer, particularly amid a weakening CNY. Gold prices are vulnerable, considering we see signs that gold sellers are lurking. Ultimately, prop traders are still holding a massive amount of complacent length, suggesting we have yet to see capitulation in gold, which argues that the pain trade remains to the downside.''

Gold technical analysis

Gold is carving out a bearish case below the counter trendline on the daily chart as follows:

The price has stalled at a prior support level but would be expected to move below it so long as the resistance holds near the 50% mean reversion around $1,785.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD tumbles to 2024 lows near 1.0460

The US Dollar gathers extra pace and weigh on the risk complex, sending EUR/USD to new YTD lows near the 1.0460 region as the NA draws to a close on Thursday.

GBP/USD dips to multi-month lows around 1.2570

Further losses now motivate GBP/USD to revisit the vicinty of the 1.2570 zone for the first time since early May, always on the back of the strong move higher in the Greenback.

Gold faces extra upside near term

Gold extends its bullish momentum further above $2,660 on Thursday. XAU/USD rises for the fourth straight day, sponsored by geopolitical risks stemming from the worsening Russia-Ukraine war. Markets await comments from Fed policymakers.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.