- Gold price is tinkering on the edge of a collapse to $1,825.

- United States of America Consumer Price Index next week will be key for the Gold price.

Gold price was falling on Thursday in a US session sell-off that followed a spike leading into the cash open on Wall Street where heightened volatility led to the collapse of the Gold price. The US Dollar, despite the dovish take on the Federal Reserve, rallied which sank all ships on the day.

US Dollar rises despite dovish Federal Reserve comments

The US Dollar was lit up from the lows of 102.50 in the DXY index that measures the US Dollar vs. a basket of currencies. The Gold price tends to weaken in risk-off scenarios that have carried the US Dollar oy of the Federal Reserve sentiment-induced doldrums of late.

Markets are neither here nor there when it comes to a definitive notion around the Federal Reserve's outlook. The jury is still out as to whether there will indeed be a pivot in the second half of the year that has otherwise been borne out of some dovish rhetoric from the Federal Reserve's chairman, Jerome Powell of late.

In view of the strength of the US January Nonfarm Payrolls data, markets were expecting Federal Reserve's Jerome Powell to double down on his hawkish rhetoric. So, when he used the word ‘disinflation’ early on, this was a trigger for a relief rally in stocks and a dip in treasury yields.

However, the US Dollar and Gold price have been volatile on both sides of the sentiment and Powell described ‘disinflation’ as being in the very early stages. He also emphasised that “the base case for me is that…we’ll have to do more rate increases, and then we’ll have to look around and see whether we’ve done enough”. So, there is still the prospect of a higher terminal rate and that is weighing on the Gold price when it rallies.

''The discussions I’ve been having with clients definitely turned towards the possibility and implications of the Fed going well beyond the 5-5.25 peak everyone has been forecasting,'' Kit Juckes, an economist at Societe Generale said in a note.

''Glancing at the Bloomberg economists’ survey there are quite a few banks that think we’ll be at 5 ¼ well into 2024, but no-one has yet put down a 5 1/2 % peak, let alone something higher,'' he explained. ''The obvious answer is that a 5 ½% peak, instead of 5 ¼%, means little, but 6% increases the risk of the cycle ending messily. And that would support for the US Dollar and be bad for risk-sensitive currencies everywhere,'' he added.

Gold price, a case for lower

The Gold price would also be pressured in such a scenario. In fact, analysts at TD Securities are already calling for lower and argue that Gold price may well still be overbought.

Key notes

''Our tracking of positioning for the top traders in Shanghai gold has pointed to notable liquidations over the past weeks, but this cohort's gold length is now at sub-average levels relative to the last year,'' the analysts explained.

''This suggests the pace of Chinese selling could slow, leaving investors as the marginal buyer or seller. At the same time, however, we don't expect any downside flow from CTAs until prices break the $1,840/oz range. And, we argue that notable selling activity from CTAs will likely be elusive above the $1,800/oz mark,'' the analysts added.

''In contrast, the margin of safety against a marginal buying program is razor thin above $1900/oz. Discretionary money manager positioning also appears flat. Overall, this suggests that the slump in precious metals prices could be limited without data corroborating a more hawkish path ahead.''

Gold price, what's in store on the Economic Calendar?

It could be a turbulent week ahead with US Consumer Price Index, CPI, and Retail Sales.

US Consumer Price Index key for Gold price

CPI is expected to show headline inflation for January at 0.5% MoM and core inflation running at 0.3% MoM. ''If these numbers are achieved this would result in an easing of core inflation from 5.7% to 5.4% YoY and headline inflation from 6.6% to 6.2%,'' the analysts at ANZ Bank explained, noting also Retail Sales and manufacturing data er due.

''If we continue to see strength in these data, then it will be very difficult for Federal Reserve policymakers to signal anything other than a further tightening of monetary policy.''

Gold technical analysis

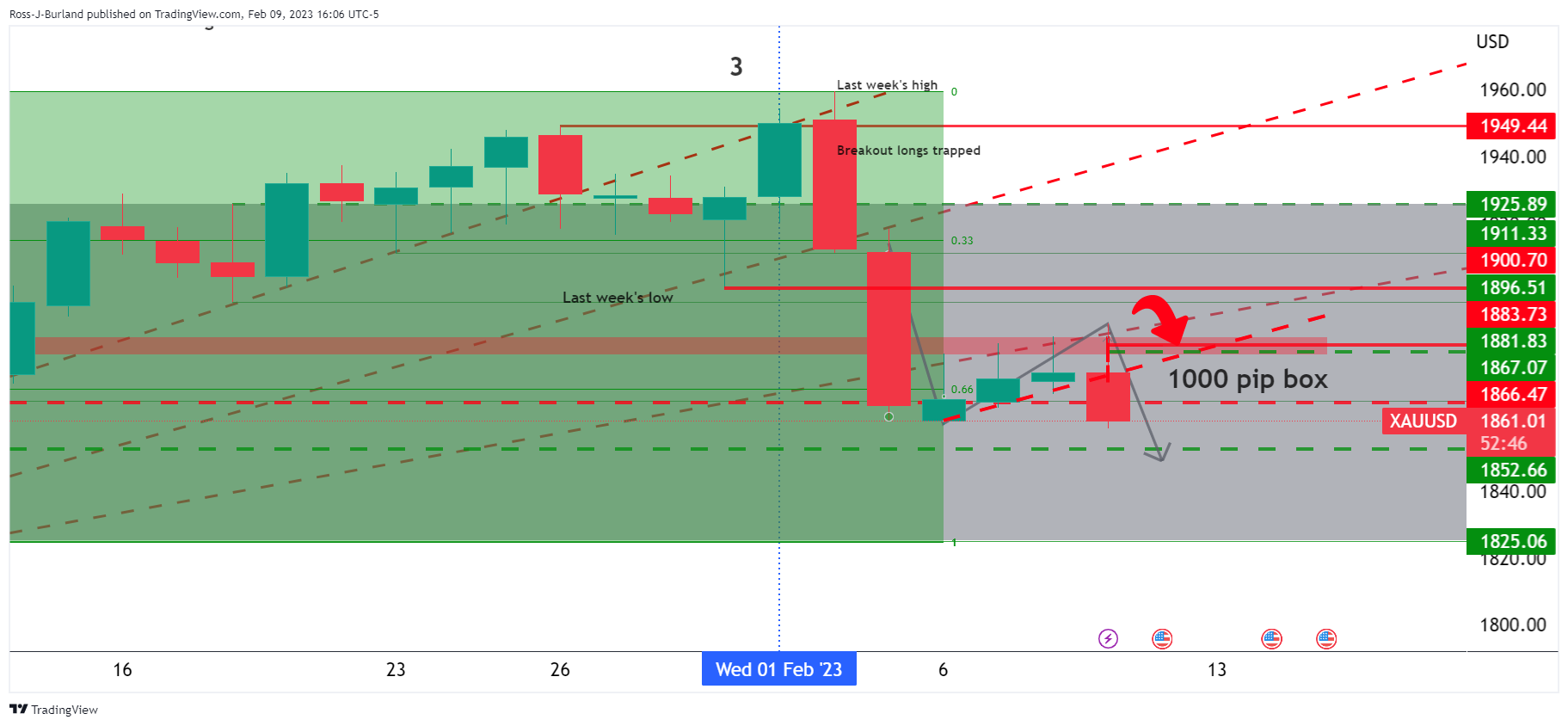

As per the prior Gold price analysis, where it was stated that The Gold price was correcting to a 38.2% Fibonacci retracement level within a 1000 pip box, the downside played out as follows:

(Before)

After:

The move this week in Gold price was forecasted at the start of the week's per-open analysis, an article that is produced each Sunday for the week ahead: Gold, the Chart of the Week: XAU/USD breakout traders triggered in, bear traps being laid down

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold moves to record highs past $3,340

Gold now gathers extra steam and advances beyond the $3,340 mark per troy ounce on Wednesday, hitting all-time highs amid ongoing worries over escalating US-China trade tensions, a weaker US Dollar and lack of news from Powell's speech.

AUD/USD: Upside now refocuses the 200-day SMA

AUD/USD advanced for the sixth consecutive daily advance, picking up extra upside impulse on the back of the continuation of the sell-off in the US Dollar. Next on tap for the Aussie now emerges the yearly peak above 0.6400 prior to the key 200-day SMA.

EUR/USD looks to retest its 2025 highs

EUR/USD reversed two consecutive daily retracements and revisited the key 1.1400 neighbourhood as the selling bias in the Greenback gathered extra pace, always against the backdrop of rising uncertainty surrounding US yields. Chief Powell, in the meantime, delivered a neutral message in his discussion over the economic outlook.

Bitcoin held steady as US reveals China faces up to 245% tariffs

Bitcoin (BTC) witnessed little pressure on Wednesday despite the Chinese government selling off parts of its confiscated cryptocurrency holdings.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.