Gold Price Forecast: XAU/USD bears approach $1,650 on hawkish Fed bets, China news

- Gold price fades Friday’s corrective bounce off the lowest levels since April 2020.

- Sour sentiment joins hawkish expectations from the Fed to weigh on XAU/USD prices.

- Biden announced support for Taiwan in case of China’s attack, PBOC cuts RRR.

- Risk appetite remains sluggish amid off in Japan and the UK, central banks in focus.

Gold price (XAU/USD) holds lower ground near the intraday bottom surrounding $1,670 during early Monday morning in Europe. In doing so, the metal prices bear the burden of the firmer US dollar amid a sluggish session due to the holidays in Japan and the UK. The reason could be linked to the hawkish Fed bets and headlines surrounding China.

US Dollar Index (DXY) snaps a two-day downtrend while printing 0.18% intraday gains around 109.85 by the press time. The greenback’s gauge versus the six major currencies recently cheered upbeat consumer sentiment data from the University of Michigan for September, as well as the market’s optimistic bets on the Fed’s next move. That said, the odds of the Fed’s 75 basis points rate hike (bps) rose to 80% while the market’s expectations of a full one percentage increase in the Fed rate lift up to 20% at the latest.

Elsewhere, US President Biden said, “I'm more optimistic than I have been in a long time.” The national leader also stated that they are going to get control of inflation. On the same line are the covid updates from China as it unlocks Dalian and Chengdu cities while witnessing zero coronavirus cases in Beijing and one, versus zero the previous day, outside Shanghai’s quarantine zone. However, US President Biden’s readiness to back Taiwan in case China attacks Taipei and the hawkish hopes for the Fed seem to weigh on the metal price ahead of the key monetary policy announcements.

Also, the People’s Bank of China (PBOC) cuts the 14-day reverse repo rate by 10 basis points (bps) to 2.15%. “With no reverse repos maturing on Monday, China central bank injects 12 billion yuan on the day,” per Reuters. The same might have signalled that the dragon nation isn’t on the recovery mode and needs more rate cuts than the rate hikes, which in turn could have drowned the gold price. The reason is China’s status as one of the biggest gold consumers in the world.

Against this backdrop, the S&P 500 Futures print mild losses while tracking Wall Street’s Friday close. It should be noted that the off in Japan restricts the bond moves in Asia but the yields are sturdy near the multi-day high amid recession fears and hawkish Fed expectations.

Moving on, a light calendar and holidays in the key markets could restrict intraday moves of the XAU/USD. However, bears are likely to keep reins amid hawkish hopes from the Fed, which in turned down could defy the bearish chart pattern and trigger the much-awaited rebound.

Also read: Gold Weekly Forecast: Can XAU/USD gain traction on a 75 bps Fed hike?

Technical analysis

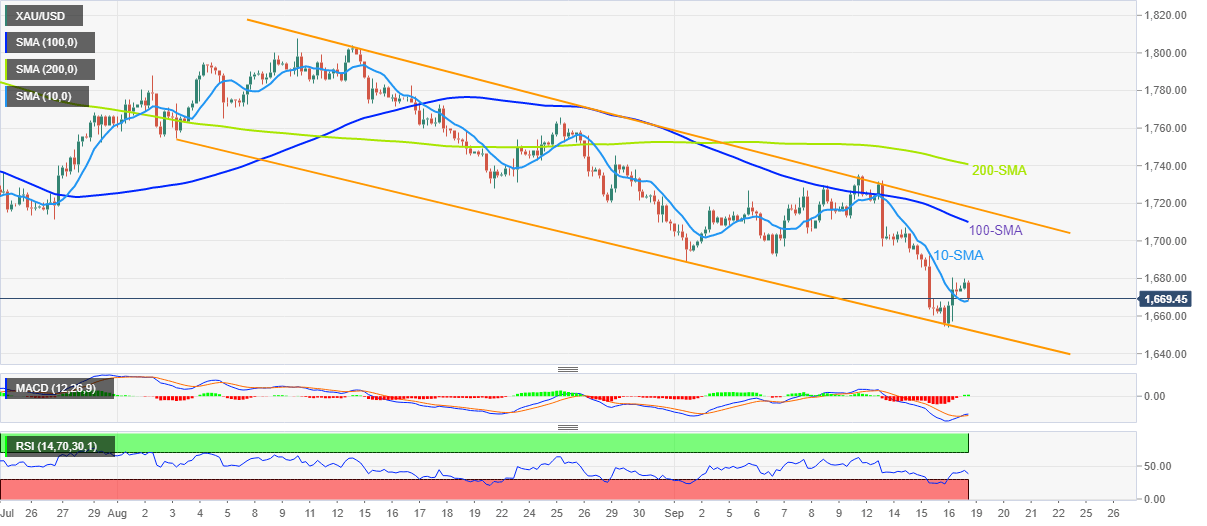

Gold price remains inside a six-week-old bearish channel, holding lower grounds of late. In doing so, the XAU/USD also reverse the previous day’s upside break of the 10-SMA, around $1,668 by the press time.

Given the metal’s failure to defend the upside break of a short-term SMA inside a bearish chart formation, the gold bears are likely to keep the reins. However, the recently bullish MACD signals and nearly oversold RSI seems to restrict the short-term downside of the metal around the stated channel’s support line, close to $1,650 by the press time.

Meanwhile, the $1,700 threshold and the 100-SMA guard the quote’s immediate upside around $1,710 before challenging the bearish chart pattern’s upper line, near $1,720 by the press time.

It should be noted that the metal’s upside past $1,720 will need validation from the 200-SMA level surrounding $1,740 to recall the gold buyers.

Gold: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.