Gold Price Forecast: Where is XAUUSD headed next?

- Gold Price is under pressure, despite a souring market mood amid continued tensions in Eastern Europe.

- The Federal Reserve decision had a limited lasting impact on financial markets.

- XAUUSD trades at the lower end of the daily range, neutral in the near term.

Gold Price seems unable to find a clear direction in the last trading session of the week, hovering around $1,935.00 a troy ounce. Wall Street trades mixed, following the poor performance of their European counterparts, which fell on the back of turmoil in the Eastern Europe front. US indexes were further affected by a couple of US Federal Reserve speakers, as Governor Christopher Waller and St. Louis Fed President James Bullard hinted at 50 bps rake hikes coming in the next central bank’s meetings.

Risk sentiment has taken a hit ever since US Secretary of State Antony Blinken said that Russia may be contemplating a chemical-weapons attack in the US last session. Further, the lack of substantial progress on the Russia-Ukraine peace talks has left markets in limbo, triggering fresh risk-off flows into the US dollar at gold’s expense. Investors also remain cautious ahead of US President Joe Biden and China’s President Xi Jinping meeting due later this Friday. Both leaders will likely discuss the Russian invasion of Ukraine among other diplomatic and trade issues.

Also read: Gold Price Forecast: XAU/USD bears have the upper hand below $1,960, or 38.2% Fibo.

Earlier in the week, the US Federal Reserve surprised market players with a hawkish stance. The central bank rose its main rate by 25 basis points and the dot-plot included six more probable hikes for the year. Even further, Chair Jerome Powell said that plans to reduce the $9 trillion balance sheet will probably be complete by their next meeting in May.

The American currency, in the meantime, sees subdued demand, despite the risk-averse environment, amid easing government bond yields. The yield on the 10-year US Treasury note has peaked for the day at 2.191% and currently stands around 2.14%.

Gold Price Technical Analysis

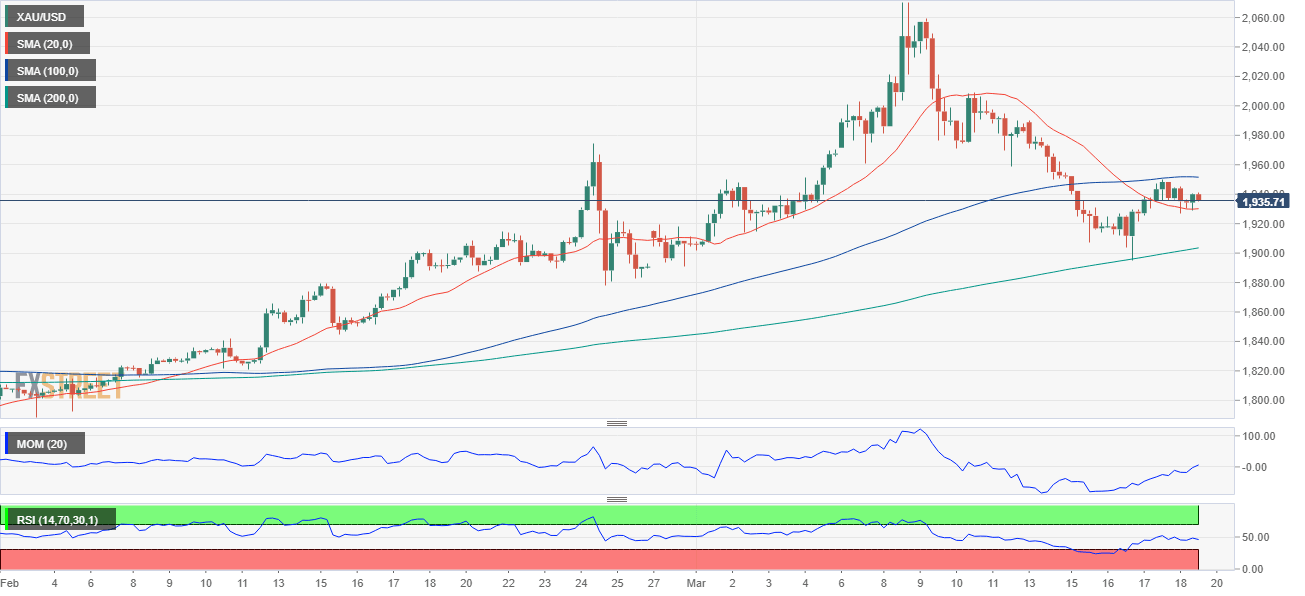

From a technical perspective, the bright metal is down for the week, albeit off its low of $1,895 a troy ounce. XAUUSD bounced sharply after nearing the 61.8% retracement of this year's rally at around $1,890 and currently trades between the 38.2% and the 50% retracement of the same rally.

On a daily basis, the bright metal has met sellers around a flat 20 SMA, while technical indicators have lost their previous momentum, hinting at decreased buying interest.

The near-term picture is a bit more encouraging for bulls, as Gold Price is finding buyers around a mildly bullish 20 SMA, while technical indicators turned marginally higher within positive levels. Still, XAUUSD will maintain a limited bullish potential as long as it holds below the strong static resistance area around the $1,960 level.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.