Gold Price Forecast: XAU/USD consolidates near $1,840, downside seems limited amid risk-off

- Gold stays firmer around intraday high as bulls brace for yearly resistance break.

- Risk assets remain on the back foot as pre-Fed anxiety joins Russia-led geopolitical risks.

- Firmer inflation expectations add to the fears of hawkish Fed, US CB Consumer Confidence eyed.

Update: Gold struggled to capitalize on the previous day's positive move and oscillated a narrow trading band, around the $1,840 level through the early European session on Tuesday. The US dollar drew some support from a goodish rebound in the US Treasury bond yields and held steady near a two-week high touched on Monday amid expectations for an eventual Fed lift-off in March. This, in turn, was seen as a key factor that acted as a headwind for the dollar-denominated commodity.

That said, concerns about escalating geopolitical tensions over Ukraine and the dominant risk-off theme in the markets should continue to lend some support to the safe-haven gold. Investors might also refrain from placing aggressive directional bets and prefer to wait for the outcome of a two-day FOMC meeting on Wednesday. This should further contribute to limit the downside for the precious metal, at least for the time being. Hence, it will be prudent to wait for a strong follow-through selling before positioning for any meaningful depreciating move.

Previous update: Gold (XAU/USD) holds on to the week-start rebound towards the yearly resistance line, dribbles around $1,842 during early Tuesday morning in Europe.

Mixed clues ahead of Wednesday’s Federal Open Market Committee (FOMC) meeting join grim concerns over Russia-Ukraine to underpin the yellow metal’s safe-haven demand.

However, a lack of major catalysts and pre-Fed anxiety seems to probe the gold buyers. On the same line are the downbeat prints of US Markit PMIs for January. Additionally, chatters concerning China’s Evergrande and trade/political ties with the US also offer distant support to the gold buyers.

Though, firmer US Treasury yields and downbeat equities keep gold buyers cautious after the metal failed to cross the key hurdle the previous week. Further, upbeat prints of US inflation expectations, per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, seem to bolster the Fed’s rate hike concerns and probe gold’s immediate upside.

While portraying the market mood, the US 10-year Treasury yields stay firmer around 1.78%, rising for the first time in the last five days, whereas the US stock futures and Asia-Pacific shares remain on the back foot.

That said, grim concerns may keep gold buyers hopeful but the recent recovery in the US Treasury yields may test the upside momentum. On the data calendar, US CB Consumer Confidence for January, prior 115.8, will offer intermediate inflation-related clues to traders, making it important ahead of tomorrow’s Fed drama.

Read: Conference Board Consumer Confidence January Preview: Inflation is a shock to the system

Technical analysis

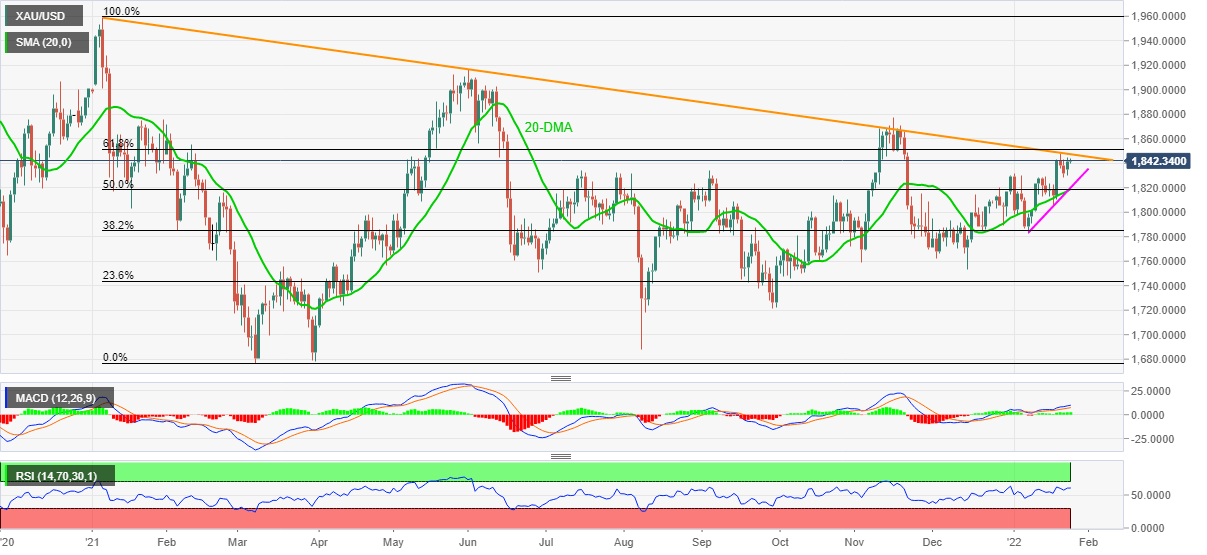

Gold stays directed towards the yearly resistance line amid bullish MACD signals and steady RSI, which in turn suggests the bull's dominance over prices.

That said, gold buyers remain hopeful until the precious metal drops below $1,818 support confluence, including 20-DMA, a 12-day-old ascending trend line and 50% Fibonacci retracement (Fibo.) of January-March downside.

That said, gold’s declines past $1,818 will quickly challenge the $,800 threshold but the 38.2% Fibo. level near $1,784 could trigger the bullion’s rebound.

Alternatively, a yearly resistance line near $1,848 precedes the 61.8% Fibonacci retracement level around $1,851 to limit the short-term upside of gold.

It should be noted, however, that a clear upside past $1,851 will enable the gold buyers to challenge November 2021 peak surrounding $1,877 before aiming for the $1,900 round figure.

Overall, gold prices witness pullback as buyers lacked the strength to cross the key hurdle. However, the bears have a long way to go before retaking controls.

Gold: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.