Gold Price Forecast: XAU/USD appears bearish past $1,900, focus on PMI, Jackson Hole

- Gold Price remains sluggish at five-month low after declining for four consecutive weeks.

- Firmer US Dollar, Treasury bond yields weigh on XAU/USD as key central bankers prepare for annual Jackson Hole event.

- China-inflicted markets woes, trade war fears also keep Gold sellers hopeful as August PMI figures loom.

- Falling wedge formation, oversold RSI make XAU/USD technical analysis interesting and challenge the bulls ahead of top-tier catalysts.

Gold Price (XAU/USD) marks an unimpressive start of the trading week around $1,890, after declining in the last four consecutive weeks. In doing so, the Gold Price licks its wounds at the lowest level since March while struggling to gain traction amid the market’s cautious mood ahead of this week’s top-tier data/events. That said, the firmer US Dollar, however, exerts downside pressure on the XAU/USD even if the technical analysis signals a corrective bounce in the prices. It’s worth noting that Wednesday’s preliminary readings of the August month Purchasing Managers Indexes (PMIs) for major economies will decorate the calendar ahead of the Kansas Fed’s annual event for central bankers, namely the Jackson Hole Symposium.

Gold Price drops on firmer US Dollar

Gold price marked a four-week downtrend in the last as the firmer US Dollar joined fears surrounding one of the world’s biggest XAU/USD customers, namely China. Additionally, concerns that the global central banks still have some room for the rate tightening spell and trade wars also contributed to the Gold Price weakness.

US Dollar Index (DXY) grew in the last five consecutive weeks and weighed on the Gold Prices.

The upbeat US activity numbers, Retail Sales and wage growth allowed the US Dollar to remain firmer for the fifth consecutive week, especially backed by the hawkish Fed Minutes. Also keeping the Greenback firmer was the risk-off mood and the upbeat Treasury bond yields.

That said, the latest Fed Minutes showed that most policymakers preferred supporting the battle again the ‘sticky’ inflation, despite being divided on the imminent rate hike.

It’s worth noting that the market players started reassessing previous biases about the major central banks and added strength to the risk aversion, primarily fuelled by the China-linked woes. That said, investors anticipated that the end of the rate hike cycle is still unclear, which means more bearish pressure on riskier assets and a rush for the US Dollar.

Talking about China catalysts, the nation’s second-large realtor, as well as the world's most heavily indebted property developer, Evergrande filed for protection from creditors in a US bankruptcy court on Thursday. The shockwave renewed market fears of 2021 pessimism when the same realtor defaulted on bond payments and shock equities. However, the concerns about Chinese policymakers’ readiness for more stimulus to defend the economy from debt woes, as well as revive the activity numbers, seems to have challenged the pessimists of late.

Elsewhere, the US imposed tariffs on Tin Mil Steel coming from China, Germany and Canada in a surprise move on Thursday.

Furthermore, the global rating agency Fitch Ratings lowered medium-term Gross Domestic Product (GDP) projections for 10 developed economies in its quarterly Global Economic Outlook. Among those nations are the US, the UK, Japan and Germany. It’s worth noting that the rating giant kept growth forecasts for Australia, Canada and Switzerland unchanged among others.

Alternatively, the People's Bank of China (PBOC) announced on Sunday, per Reuters, “China will coordinate financial support to resolve local government debt problems.” It’s worth noting that the PBoC met with the Chinese financial regulator and the securities regulator late last week amid concerns about the spillover effects from the nation’s reality sector debt crisis, as well as doubts about the local government bonds.

Against this background, Wall Street closed mixed and the US Treasury bond yields retreat after a strongly negative week for the equities and the upbeat bound coupons.

PMIs will entertain XAU/USD traders before Jackson Hole

Moving on, August month Purchasing Managers Indexes (PMIs) for major economies will decorate the calendar on Wednesday amid the market’s cautious optimism of late, which in turn may allow the Gold Price to consolidate recent losses. On the other hand, the Kansas Fed’s annual event for central bankers, namely the Jackson Hole Symposium, will be important to watch for the XAU/USD traders as major central bankers will speak between August 24 and 26 to suggest the optimum path for future monetary policies, which in turn can entertain the market players.

Also read: Gold Price Weekly Forecast: XAU/USD looks fragile heading into Jackson Hole week

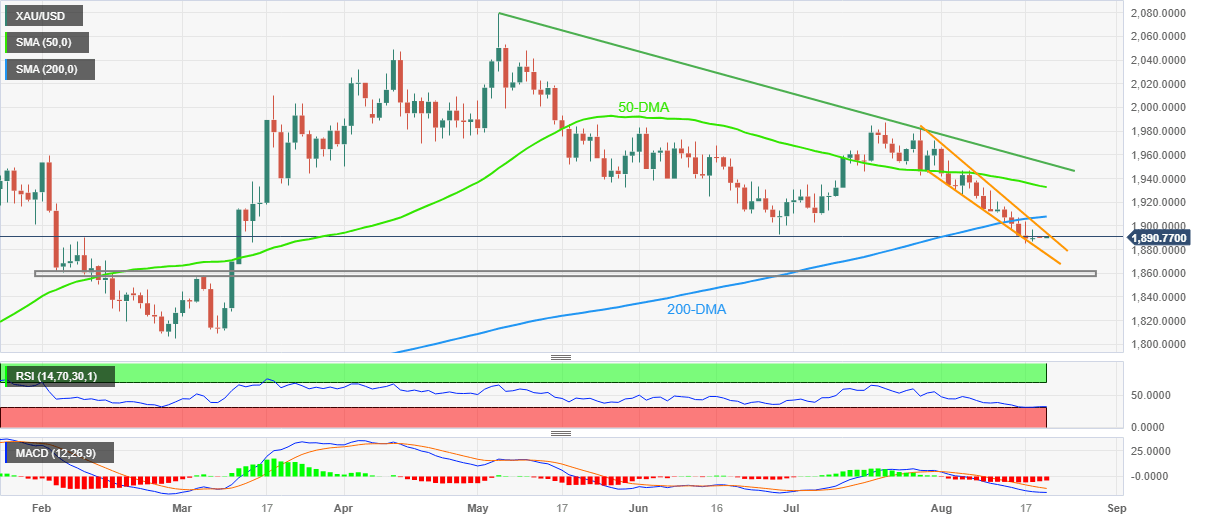

Gold Price Technical Analysis

Gold Price remains on the back foot at the lowest level since mid-March.

However, the falling wedge bullish chart formation joins oversold conditions of the Relative Strength Index (RSI) line, placed at 14, to suggest bottom-picking of the XAU/USD, which in turn suggests a corrective bounce in prices.

As a result, the stated wedge’s bottom line surrounding $1,880 appears an immediate challenge for the Gold bears to tackle before approaching the 6.5-month-old horizontal support zone surrounding $1,860.

On the contrary, a daily closing beyond the $1,900 threshold will confirm the bullish chart formation suggesting a theoretical target of $1,990.

That said, the 200-DMA and 50-DMA, surrounding $1,907 and $1,935 in that order, will act as the additional upside filters for the Gold buyers to cross before approaching the $1,990 mark.

It’s worth noting that a downward-sloping resistance line from early May, close to $1,955, appears the last defense of the XAU/USD.

Overall, Gold Price is likely to portray a bearish consolidation but the buyers have a long and bumpy road to travel before taking control.

Gold Price: Daily Chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.