Gold Price Forecast: XAU/USD aims for stability above $1,930 as risk-on solidifies, US PMI eyed

- Gold price is looking for establishing the auction above $1,930.00 as the risk-on profile has strengthened.

- US yields have scaled above 3.52% as the Fed policymakers have not toned down interest rate projections.

- The release of the US S&P PMI data will result in a power-pack action in the Gold price.

Gold price (XAU/USD) is looking to sustain above the immediate resistance of $1,930.00 in the early Tokyo session. The precious metal has extended its responsive buying action move from $1,912.50 to near $1,930.00 and is aiming to stretch further as the risk appetite of the market participants is firmer.

S&P500 ended Monday’s session with significant gains amid a decent quarterly result season. The US Dollar Index (DXY) dropped after failing to surpass the critical resistance of 101.80 despite multiple attempts. The 10-year US Treasury yields scaled above 3.52% as the Federal Reserve (Fed) policymakers have not trimmed their interest rate peak projections despite the presence of indicators that claim further decline in inflation projections.

Gold price is likely to display a power-pack action after the release of the preliminary United States S&P PMI data (Jan), which is scheduled for Tuesday. The Manufacturing PMI is seen lower at 46.1 while the Services PMI might contract to 44.5. Weaker demand projections and the unavailability of cheap money from the Fed due to higher interest rates might impact the US Dollar as fears of recession will soar further. This could also impact the strength of the S&P500.

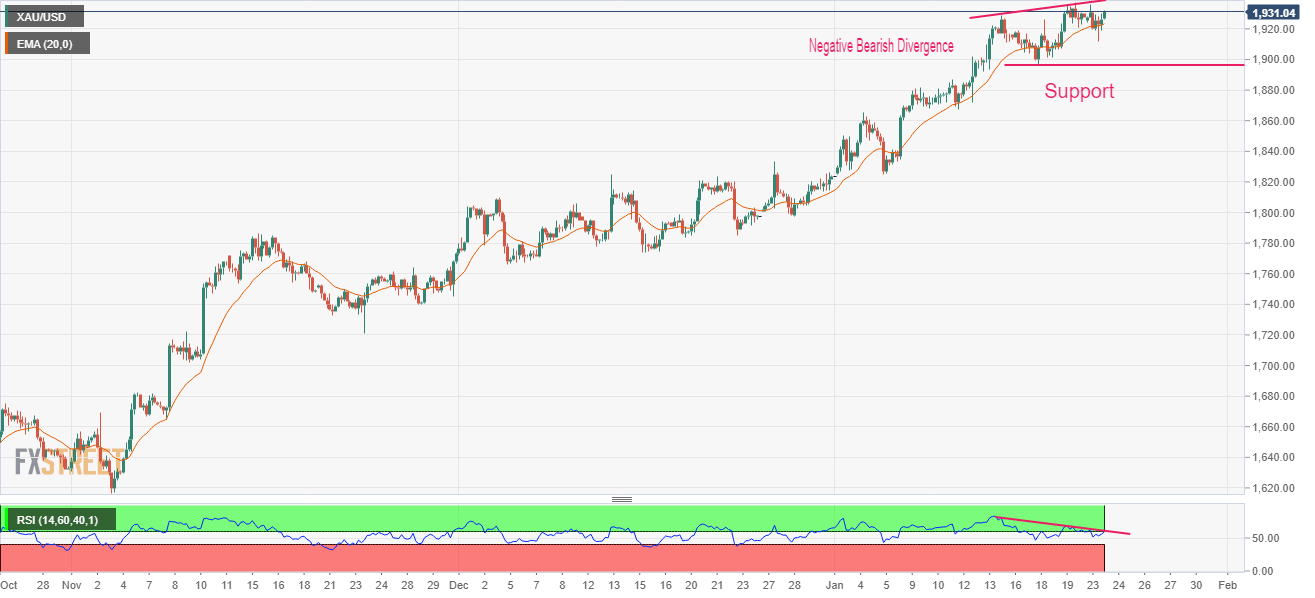

Gold technical analysis

Gold price is demonstrating signs of a loss in the upside momentum as the Relative Strength Index (RSI) is showing a negative bearish divergence formation. The Gold price is forming higher highs and higher lows while the momentum oscillator RSI (14) had formed a lower high when the asset formed a high of $1,937.57 on Friday, which indicates exhaustion in the bullish momentum.

The downside bias is not completely developed as the asset has not formed a lower low, which might be established on a breakdown of horizontal support plotted from January 18 low at $1,896.63.

The 20-period Exponential Moving Average (EMA) at $1,923.02 is still providing support to the Gold bulls.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.