Gold Price Forecast: XAU/USD bulls move in on Federal Reserve pivot sentiment

- Gold price jumps on dovish Federal Reserve tilt.

- The US Dollar drops as markets price in a pivot at the Federal Reserve.

Gold price shot higher to a fresh bull cycle high on the back of the Federal Reserve's dovish tilt that markets have priced in, smelling a 'Fed-pivot' around the corner, bullish for the Gold price.

At the time of writing, the Gold price is trading at $1,950 and has rallied from a low of $1,920.58 reaching as high as $1,954.64. The Fed terminal rate has fallen to under 4.9% amid Federal Reserve's chair Powell's comments that followed the eighth rate hike in a year. However, the Federal Reserve slowed its pace to a quarter of a point in a nod to an improved inflation outlook, underpinned by Federal Reserve's chairman, Jerome Powell, when he took questions from the press.

Federal Reserve Jerome Powell's key comments

"We can now say for the first time that the disinflationary process has started".

-

Powell speech: Very difficult to manage the risk of doing too little on rates

-

Powell speech: Disinflationary process is in early stages

-

Powell speech: History cautions against prematurely loosening policy

-

Powell speech: Well-anchored longer-term inflation expectations not grounds for complacency

-

Powell speech: Will likely have to maintain restrictive stance for some time

-

Powell speech: Very difficult to manage the risk of doing too little on rates

-

Powell speech: Policymakers did not see this as a time to pause

-

Powell speech: Will not be appropriate to cut rates this year according to our current outlook

Meanwhile, the Federal Reserve was retaining its prior language in the statement and Fed fund futures are still pricing in rate cuts this year, with the Fed funds rate seen at 4.486% by end of December, unchanged prior to the Fed decision. The March Federal Reserve meeting is priced in at 85% for 25 bps with the remainder at no change.

United States data supports higher Gold price

In data from the United States, The January ADP jobs report undershot expectations, with private sector jobs up 106k in January, versus 253k previously (and 180k expected) and this data will still cast some doubt over forecasts for a firm January Nonfarm Payrolls print. The US ISM Manufacturing index fell further in January, dropping to 47.4 (48.4 previously). That’s the third month in a row of contraction (below 50).

Gold price technical analysis

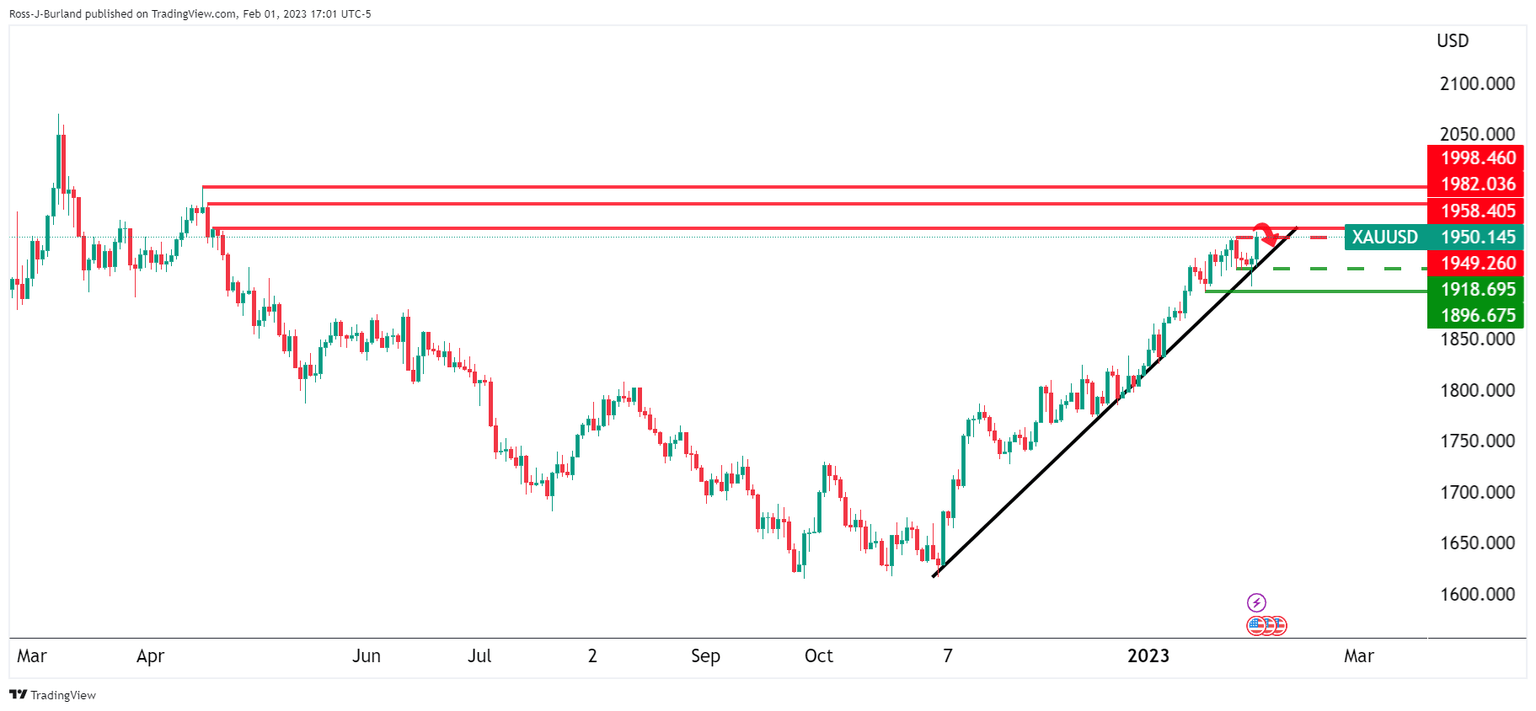

The Gold price is now carving out a fresh high on the front side of the dominant trendline. To the downside, bears need to get below $1,920 again to cement a bearish bias for the foreseeable future while bulls need to stay above $1,950 and then get over $1,980:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.