Gold Price Forecast: XAU/EUR pierces €1,600 to refresh monthly top on softer yields

- Gold prices grind higher around multi-day peak, up for fourth consecutive day.

- US 10-year Treasury yields drop to three-week low as Omicron fears escalate.

- Fed rate-hike concern, US stimulus chatters add to risk-off mood amid quiet session.

Gold (XAU/EUR) refreshes monthly high near €1,603 heading into Monday’s European session. In doing so, the yellow metal cheers downbeat US Treasury yields to renew multi-day top.

That said, the US 10-year Treasury yields drop four basis points (bps) to 1.36%, down for the third consecutive day to poke the monthly low marked on December 03 at the latest as market sentiment sours.

The risk-off mood could be linked to the market’s rush towards the traditional safe-havens, like the US Treasury bonds and gold. The sour sentiment takes clues from the escalating concerns over the covid variant linked to South Africa, namely Omicron, as well as fresh fears of a Fed rate hike in early 2022. Adding to the bearish catalysts is the indecision over President Joe Biden’s Build Back Better (BBB) stimulus.

Covid woes escalate in the West and challenge the holiday mood. A 52% jump in the UK’s weekly covid cases and a virus-led death of a New Zealand resident who took Pfizer vaccine were the main catalysts favoring the virus-led risk-aversion. Additionally, New York Times said, “Dr. Anthony S. Fauci, the nation’s top infectious disease expert, warned on Sunday that the extraordinarily contagious Omicron variant of the coronavirus was raging worldwide and that it was likely to cause another major surge in the United States, especially among the unvaccinated.”

On a different page, US Senator Joe Manchin refused to vote in favor of President Biden’s Build Back Better (BBB) plan during the weekend. The news pushed back previous hopes of getting the stimulus through the house in 2021. However, US House Speaker Pelosi stays hopeful of reaching an agreement over BBB in 2022.

It’s worth noting that the hopes of a Fed’s rate-hike in early 2022 also weigh on the risk appetite. The sentiment grew after Fed Board of Governors member Christopher Waller said, per Reuters, “The ‘whole point’ of the Fed's decision to accelerate the pace of its QE taper was to make the March Fed meeting ‘live’ for a first rate hike.”

It’s worth noting that a surprise rate cut from the People’s Bank of China (PBOC) and chatters over Kaisa, the troubled firm based in Beijing, fail to challenge the market’s pessimism amid a light calendar.

Moving on, risk catalysts remain in the driver’s seat as an absence of major data/events and already announced monetary policy meetings dim the importance of the economic calendar.

Technical analysis

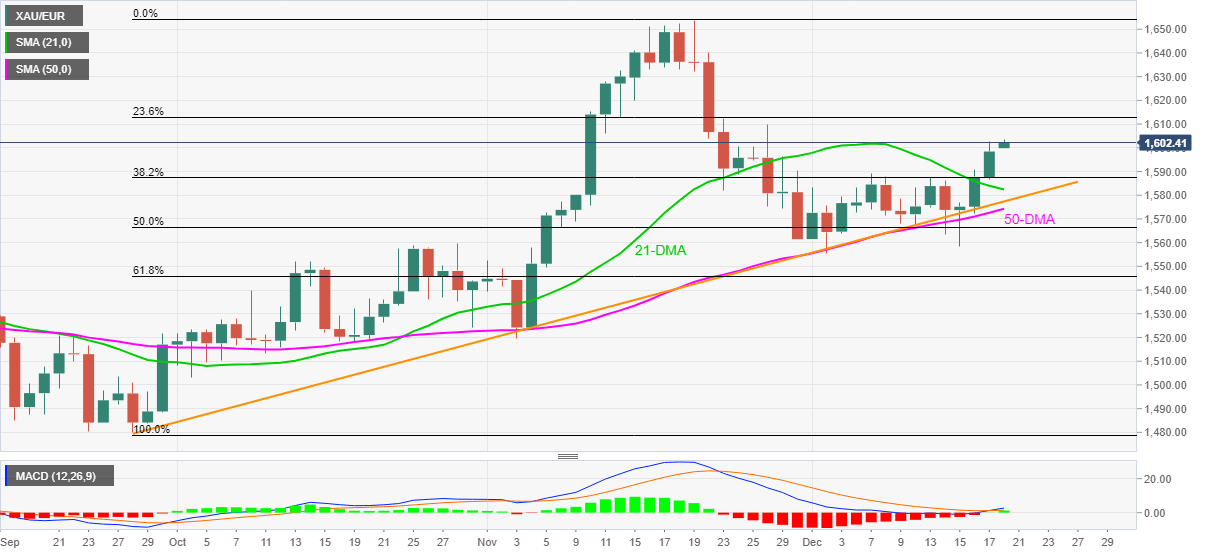

A clear upside break of the 21-DMA joins the first bullish MACD signal in a month to favor Gold (XAU/EUR) buyers.

The latest upside momentum eyes the 23.6% Fibonacci retracement (Fibo.) level of September-November advances, near €1,613, a break of which will need validation from €1,635 before challenging the yearly peak of €1,654.

In a case where XAU/EUR bulls keep reins past €1,654, the September 2020 peak of €1,664 will act as an additional upside filter before the €1,700 round figure.

Alternatively, 21-DMA restricts the commodity’s immediate downside to around €1,582.

Also acting as the key downside filters is an ascending support line from late September and 50-DMA, respectively around $1,577 and $1,574.

To sum up, XAU/EUR has further upside room before hitting the short-term cap.

Gold: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.