Gold Price Forecast: XAU/USD licks wounds at three-week low near $1,800 amid firmer USD

- Gold slid to trendline support as US equities lost ground late in the session.

- US Q4 GDP rose 6.9% saar in December, versus 5.5% expected.

- US dollar remains in bullish territory despite the slump in US yields.

Update: Gold (XAU/USD) bears take a breather around $1,797 as Friday’s Asian session begins, following a $50 slump in the last two consecutive days to a three-week low.

In doing so, the yellow metal awaits fresh clues after piercing the $1,800 threshold the previous day.

That said, the global rush towards the US dollar after the Federal Reserve (Fed) indirectly confirmed the March rate hike, also cited room for more lift-offs, seemed to have underpinned the latest declines even as the US Treasury yields eased afterward. Additionally, escalating geopolitical fears concerning the Russia-Ukraine issue also drown the gold prices.

Moving on, major attention will be given to the US Core PCE Price Index figures for December as they’re considered the Fed’s preferred version of inflation. Markets expect a 4.8% YoY figure versus 4.7% prior.

End of update.

Gold, (XAU/USD), was lower in midday markets on Wall Street, losing some 1.4% at $1,795. The price of gold fell from a high of $1,822.18 and had reached a low of $1,791.86. Equity markets initially bounced in the aftermath of the FOMC driven sell-off yesterday. However, they started to slide again and the US dollar edged higher, hitting a one-and-a-half-year high, weighing on the yellow metal.

''The market ran short of optimists as it weighed up the pros and cons of a Fed belatedly determined to tame rampant inflation,'' analysts at ANZ Bank explained.

At the time of writing, the Dow Jones Industrial Average is down 0.25% and has marked a low of 34,034.08 so far, giving up earlier gains of as much as 1.4%. The Nasdaq Composite fell 0.5% to 14,002.58 after trading in the green at market open. The S&P 500 is down 0.37% and hit a low of 4,315.20 after trading up 1.2% earlier in the session. The yield on the US 10-yr note fell to 1.783% and is down 4%.

Powered by bets the US Federal Reserve could deliver faster and larger interest rate hikes in the months ahead, the greenback holds near the highest levels since July 2020 against other major currencies on Thursday, as measured by the DXY index. At the time of writing, it is trading 0.7% up near 97.20 as money markets move in to price in as many as five quarter-point increases by year-end.

The greenback was also supported on the fourth-quarter Gross Domestic Product that rose 6.9% saar vs expectations of a 5.5% rise. The GDP price index also beat expectations, rising 6.9% saar, while Q4 core inflation rose to 4.9% vs 4.6%. Personal consumption expenditures rose 3.3% vs 2.0% in Q3.

Is the Fed jawboning?

Analysts at TD Securities tackle the questions as to whether the Fed is jawboning, or whether they are on a quest to pummel inflation?

''The answer to this question is key to recognizing the regime that lies ahead. By not pushing back against the notion of hikes at consecutive meetings or even against a potential 50bp rate hike, Chair Powell's tone was undeniably hawkish at yesterday's FOMC,'' the analysts argued.

Key points

''The market has already priced-in a 25bp hike in March but the possibility of a 50bp hike is also seeping into market pricing. Given global macro's elevated sensitivity to liquidity, evidence that quantitative tightening might be more impactful for asset prices suggests that this axis could be particularly relevant.''

''We expect that the precious metals complex will struggle to attract capital in the face of a hawkish Fed.''

''We should not discount the possibility that the Fed's tone is also being used as a policy tool — jawboning might also help crush the momentum in inflation expectations that ultimately threatens the Fed's control on inflation itself.''

''In this scenario, the Fed could potentially use the pace of quantitative tightening as a tool to manage the strike on its put, without necessarily causing undue harm to its primary objective of keeping inflation expectations bounded.''

''We have initiated a short gold position and expect a low threshold for CTA trend follower liquidations to support our position.''

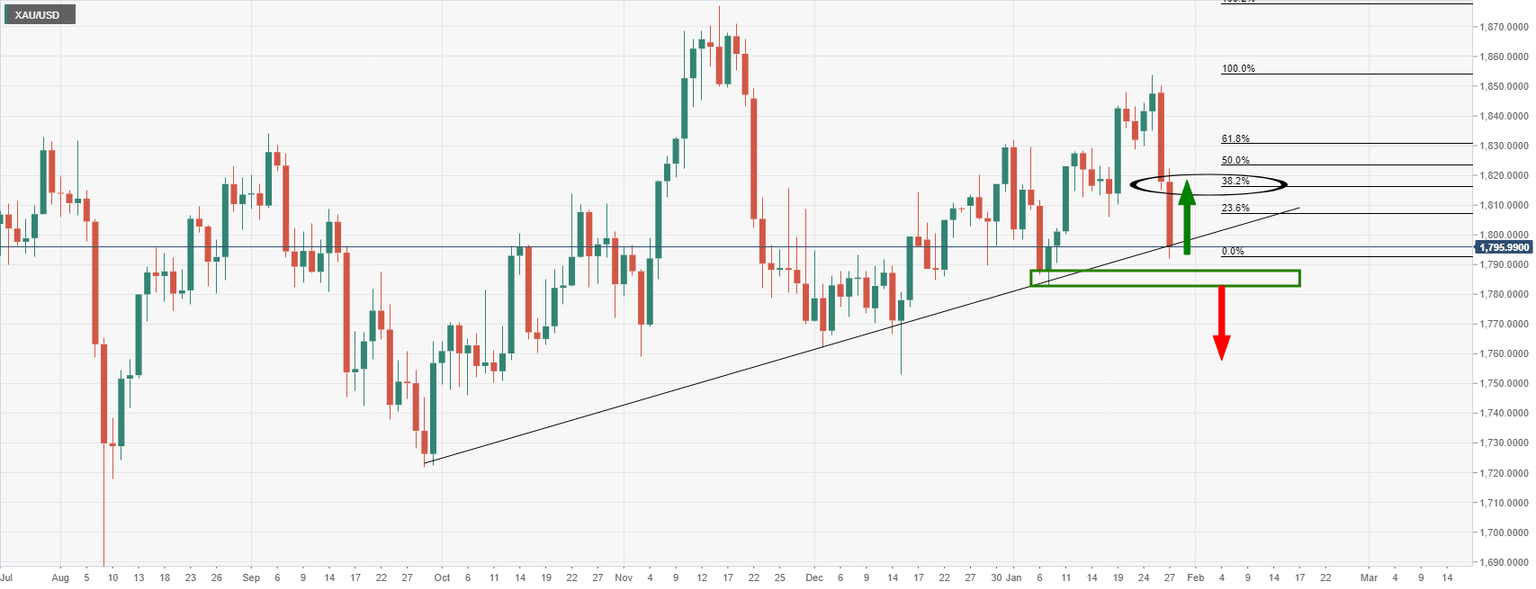

Gold technical analysis

The price, however, is meeting dynamic trendline support. While the momentum is with the bears, profit-taking into month-end could see the bulls move in for the kill. This could be expected to see the price revert back towards liquidity where the 38.2% ratio is currently aligned, towards $1,820. With that being said, a break below the trendline and then $1,780 horizontal support would open the doors to lower levels for the foreseeable future.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.