Gold Price Forecast: Hawkish Fed and soaring yields weigh on XAU/USD

- XAU/USD drops 0.56% to $1919.74 as the Fed’s decision to maintain and revise rates upward pressures gold prices.

- US real yields hit a YTD high at 2.115%, which continues to be a significant headwind for Gold.

- Mixed US economic data and hawkish stances from other central banks globally add to the bearish outlook for the precious metal.

Gold price slides for the third straight day against the US Dollar (USD), following the Federal Reserve’s hawkish hold that bolstered the Greenback. Hence, higher US Treasury bond yields rose, while the XAU/USD traded at $1919.74, losing 0.56% after reaching a daily high of $1931.57.

Gold price continues to slide, trades below $1920 as high US Treasury yields and strong US Dollar weighs on precious metals

The aftermath of the US central bank decision keeps market participants averse to risk. US equities are dropping, US Treasury bond yields skyrocket, and the Greenback stays firm above the 105.00 threshold.

Jerome Powell and his colleagues’ decision to hold rates while upward revising the Federal Funds Rate (FFR) for 2024 from 44.6% to 5.1% was the reason behind the market’s reaction. Even though policymakers see another 25 bps rate hike toward the end of the year, market participants remain skeptical about a hike in November, but not so much in December. The odds of a 25 bps hike in the former are 26.3%, while the latter stands at 38.4%.

That spurred Gold’s fall, as US Treasury bond yields skyrocketed, while US real yields reached a year-to-date (YTD) high at 2.115%, as shown by US 10-year TIPS (Treasury Inflation-Protected Securities).

Additionally, more central banks kept rates unchanged but stressed the need to add to the Fed’s mantra of holding rates “higher for longer.” The Bank of England (BoE) kept rates at 5.25% but maintained the door open for additional rate increases. Also, the Swiss National Bank (SNB) held its policy rates unchanged at 1.75% and warned about future tightening.

On the data front, US unemployment claims for the week ending on September 16 rose below estimates of 225K at 201K. The Philadelphia Fed Manufacturing Index, a gauge for business activity, plummeted to -13.5, below forecasts of -0.7, while Existing Home Sales for August improved to -0.7% MoM, compared to July -2.2% plunge.

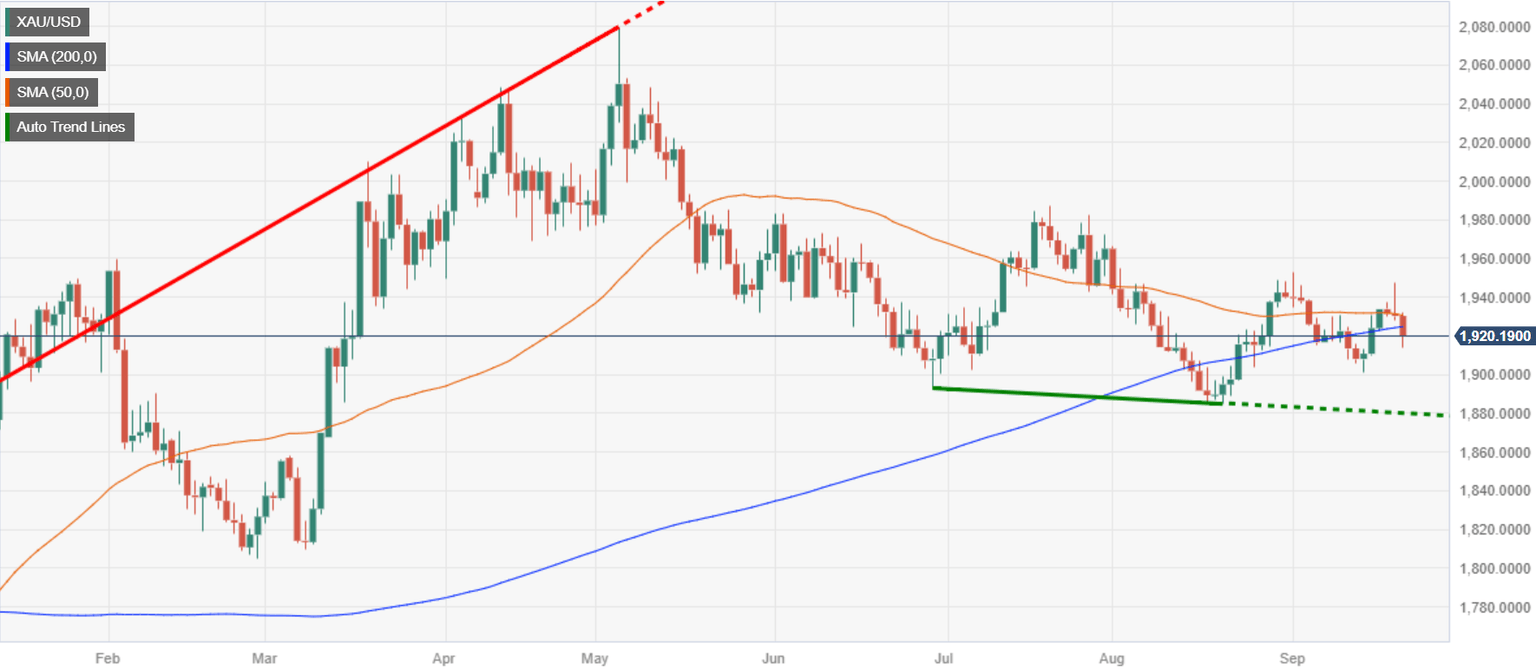

XAU/USD Price Analysis: Technical outlook

After spiking due to the Fed’s decision day, the XAU/USD retraced and printed a daily close below the 50-day moving average (DMA) at $1930.40, with the yellow metal extending its losses past the Asian session. As price action continued to drop, the XAU/USD broke crucial technical support levels, like the confluence of the 20 and 200-DMA at around $1925.00/58, exposing the non-yielding metal to additional selling pressure. Next, support emerges at the September 14 swing low of $1901.11, followed by the August 21 swing low of $1884.89.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.