Gold Price Forecast: XAU/USD sees a spike towards $1800 amid notable USD weakness

- Gols prices are steady in the open as markets look to the end of the week's events.

- Friday will bring a key note speech from Fed's chair following PCE data.

- The US dollar has marked a critical milestone in its 2021 resurgence.

- XAU/USD to stay in consolidation ahead of Jackson Hole.

Update: Gold price is marching towards $1800 after seeing a quick $7 spike in the last hour, courtesy of the fresh leg down in the US dollar across the board, as the risk sentiment improves. The Asian stocks trade firmer, taking a positive lead from its US counterparts while shrugging off the Delta covid strain worries. However, the risk-on mood-driven advance in the Treasury yields could check the downside in the dollar, in turn, capping gold’s uptick. US Treasury Secretary Janet Yellen’s endorsement of Jerome Powell for a second term as Fed chair could likely help reduce the market uncertainty, collaborating with the better mood.

Meanwhile, investors remain hopeful ahead of the virtual three-day Fed Symposium, starting this Thursday. Ahead of the Fed event, the Eurozone and the US Preliminary Markit PMIs could throw fresh light on the strength of the global economic recovery amidst the Delta crisis. Therefore, the risk trends and the dynamics in the dollar will continue to drive gold price going forward.

Read: All Eyes On Jackson Hole

The price of gold has started out the week where it left off, huddled between the daily 10 and 20 EMAs near $1,780.

XAU/USD has stuck in a tight range so far between $1,779.95 and $1,782.43.

However, the week ahead will potentially mark a milestone in the Federal Reserve's guidance on its monetary policy for markets.

The event, for which is highly anticipated, will start on Aug 26 in a three-day gathering of global central bank leaders where the Fed's chairman, Jerome Powell will take centre stage.

Powell’s opening remarks will be at 9 am CT/10 am ET/1400 GMT on August 27 not long following the release of the Fed's preferred measure of inflation, Core Personal Consumption Expenditure.

A stronger-than-expected reading could help the USD outperform its rivals, capping gold, as it would hint at a possible hawkish shift in the Fed’s forward guidance.

Any surprise to the upside will likely see Powell rewriting his script on the day.

''Some are looking for Fed Chair Powell to make an explicit tapering announcement at Jackson Hole,'' analysts at Brown Brothers Harriman said.

''While it is certainly possible, we think the September 21-22 FOMC meeting is a more likely venue.''

Moreover, Fed officials will likely seek to avoid a taper tantrum considering the recent stock market reaction to the latest minutes that showed officials largely expect to reduce their monthly bond-buying later this year.

Dovish rhetoric from officials reminding markets that tapering should not be regarded as the basis for a rate hike in the near future should do it.

Additionally, Powell may not wish to front-run the Fed’s September meeting because new macro forecasts will be released before then.

Instead, there should be a message to the markets that the Fed is keeping an eye on how the economy, specifically the jobs market, is responding to the spread of the Covid delta variant.

''The Fed will have gotten another jobs report on September 3 that will hopefully be strong enough to trigger tapering,' the analysts at BBH noted.

''It’s clear that once tapering starts, the Fed wants to get it over quickly, perhaps in the span of six months rather than twelve.''

''As such, our current call is for an explicit tapering announcement at the September FOMC, tapering of $20 bln in USTs and $10 bln in MBS at each meeting starting November 3, and completion by March 2022. If the economy continues to develop as the Fed expects, then this would allow for rate a waiting period of 6-9 months before lift-off in Q4 2022.''

Meanwhile, on Friday was ending the day flat following a day of consolidation with the price oscillating between a low of $1,778.42 and a high of $ 1,788.49.

Risk appetite improved which helped to support the commodity complex and weighed on the greenback.

The dollar index DXY, which measures the US currency against six rivals, rose to as high as 93.734 for the first time since early November, before trading 0.1% lower at 93.491. For the week, it posted a 1% gain, the most in two months.

Talk at the Jackson Hole of robust growth in the US relative to other major economies and a gradual tightening of monetary policy will likely put further upward pressure on the greenback and be a headwind for gold prices.

DXY live market analysis

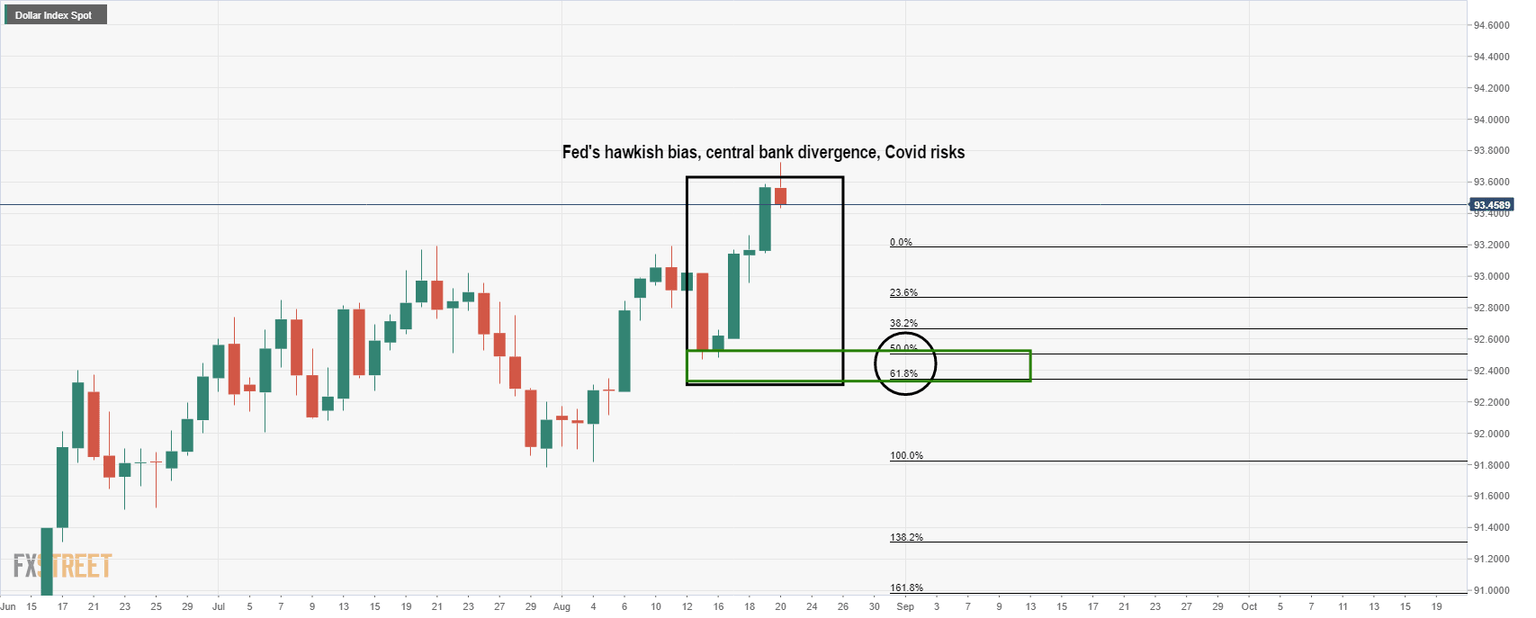

As forecasted, above and with follow-up explanation here: US dollar bid for its safe-haven status and on central bank divergence, DXY has made its move through 93.50:

With that being said, it is still to convince with a weekly or a monthly close above 93.50:

This leaves scope for some weakness in the greenback leading into the end of the week's showdown where gold could find some relief.

Gold technical analysis

The Bearish Doji Stars accompanied by a strong bearish candle that was engulfing the majority of the prior days of ranges is keeping the bears in play for the seat of the week.

However, Friday’s range was an inside bar which was supported by the 10-day EMA:

Until the 10-day EMA is broken, there lacks bearish momentum. Having said that, daily RSI remains below 50 as does MACD.

Nevertheless, bears might wish to wait for additional confirmation before pouncing on the long squeeze.

A close below the 10 EMA near 1,780 or a break of the 4-hour support of 1,770 could be enough to see a significant move to the downside and beyond 1,764 daily lows.

Failures there will likely lead to a downside continuation of the broader bearish trend to target the 50% mean reversion and the confluence of the 200-day Smoothed MA near 1,755.

Much further out, 1,677 daily swing lows will be in focus. Meanwhile, a break of resistance opens risk back into the 1,800s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.