- Gold prices are steady at critical daily support post-Fed statement.

- A benign statement has left markets at a standstill, awaiting Fed's chair presser.

Update: Having posted the heaviest daily closing in over two weeks, Gold (XAU/USD) holds onto Fed-led upside momentum around $1,808, gaining 0.10% intraday amid the early Asian session on Thursday.

The yellow metal showed no major reaction to the Federal Open Market Committee (FOMC) statement. However, the broad US dollar weakness after Chairman Jerome Powell’s press conference leased gold buyers afterward. The Fed Chief said, “Economy has made progress toward goals since setting the bar for taper in December and will continue to assess progress in coming meetings."

It’s worth noting that the Wall Street Journal’s (WSJ) news backing the procedural passage of US President Joe Biden’s infrastructure spending bill in the Senate also favor the precious metal amid the quiet session.

Moving on, gold traders will keep their eyes on the preliminary readings of US Q2 GDP, expected 8.6% annualized versus 6.4% prior, for fresh impulse. Also important will be the stimulus updates and virus news, not to forget headlines from China as Beijing’s crackdown on IT and private education weigh market sentiment of late.

Read: US Q2 GDP Preview: Economy to continue to expand at strong pace, eyes on FOMC

The two-day Federal Open Market Committee meeting has drawn to a close this afternoon and the statement has been released.

This event was widely seen as a placeholder meeting by the Fed and the market's expectation was for a modestly hawkish hold which is what the statement has offered.

There were expectations of the acknowledgements of inflation risks, risks of the delta variant and discussions of tapering which is what we have from the statement.

"Economy has made progress toward goals since setting the bar for taper in December and will continue to assess progress in coming meetings."

Markets are now hinging on the words of the Fed's chair, Jerome Powell in the Press conference.

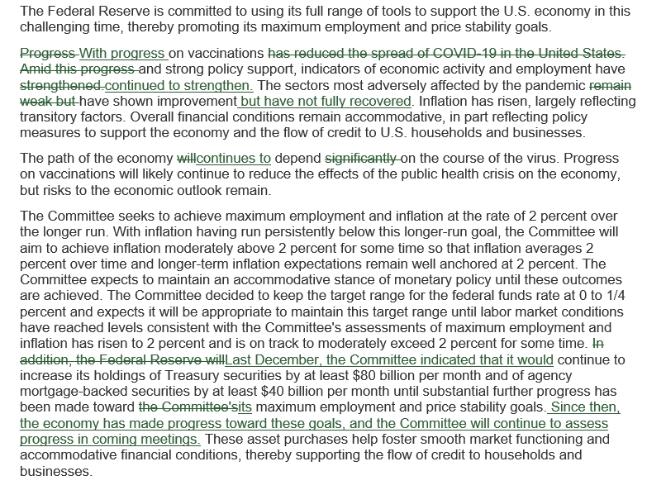

FOMC Statement comparison

The changes that do stand out in the statement are as follows:

1. The FOMC removed this entire line: "Progress on vaccinations has reduced the spread of COVID-19 in the United States".

2. An addition, "Not fully recovered".

3. The Fed "made progress" towards taper goals.

The following highlights the changes between the Jun 16, 2021 and Jul 28, 2021 FOMC meetings:

(Source: TD Securities)

The price of gold is being pressured as the US dollar rallies to test daily and 4-hour resistances.

Gold 15-min chart

A drop and pop back to the start again.

Fed statement, key takeaways

- Benchmark interest rate unchanged; target range stands at 0.00% - 0.25% .

- The interest rate on excess reserves is unchanged at 0.15%.

- Fed announces the launch of the standing repo facility.

- Fed says vaccination progress likely to continue to reduce effects of public health crisis on economy, but risks to the economic outlook remain.

Watch Powell Presser Live

Gold & US dollar technical analysis

Prior to the event, the US dollar was looking into the abyss at trendline support as follows:

The 4-hour structure shows that the price has been reinforced to the downside by two levels of resistance structure.

The most key was the higher level of resistance as this was the apex of the correction that met daily lows and the neckline of the M-formation as follows:

Live market, post-Fed statement

15-min chart

Pop and a drop, back to the start again.

However, the US Fed funds futures showing that the market is fully pricing in 25 basis-point tightening by march 2023 should underpin the dollar in comparison to less hawkish central bank's currencies.

This should continue to be a headwind for gold prices in the near future.

4-hour chart

Meanwhile, for gold, the weekly chart was compelling and a prospect for a downside extension has been building over a number of weeks as follows:

Gold weekly chart

Daily chart support

However, the daily support has been a firm roadblock for the bears into the Fed event and we see little movement so far.

A break of $1,790 would be significantly bearish for the days ahead.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0400 in thin holiday trading

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD struggles to find direction, holds steady near 1.2550

GBP/USD consolidates in a range at around 1.2550 on Tuesday after closing in negative territory on Monday. The US Dollar preserves its strength and makes it difficult for the pair to gain traction as trading conditions thin out on Christmas Eve.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.