- Gold price struggles around a three-month high, after posting a bearish candlestick.

- Federal Reserve officials challenge United States inflation-led optimism.

- Jitters surrounding China also test Gold prices amid a light calendar.

- Downside risk appears to be escalating amid the US Dollar rebound.

Gold price (XAUUSD) remains depressed at around $1,770 while justifying the previous day’s bearish candlestick formation and sluggish market conditions during Tuesday’s Asian session.

The yellow metal’s latest weakness could also be linked to the mixed comments from the US Federal Reserve (Fed) officials and fears surrounding China. It should be noted, however, that a light calendar also offers trading filters for the Gold price.

Federal Reserve officials challenge optimism over the Gold price

Having promoted the easy rate hikes and teased pivot talks in the last week, the US Federal Reserve policymakers began the week on a mixed footing as Vice-Chair Lael Brainard favored a 50 bps rate hike but also stated, “We have additional work to do.” Earlier on Monday, Federal Reserve Governor Christopher Waller also promoted the ideal of a 0.50% rate hike while warning against the market’s perception of the pivot. Such comments from the US Federal Reserve officials tamed optimism surrounding future policy moves and renewed the US Dollar's strength.

Headlines from China also tease Gold price downside

China is the largest customer of bullion, and hence the latest mixed headlines from the dragon nation probe the Gold price. Recently, US President Joe Biden and his Chinese counterpart Xi Jinping talked face-to-face for the first time in three years and tried to promote healthy competition, which should have favored the Gold price. However, the thorny issue surrounding Taiwan soured the optimism surrounding the event.

Elsewhere, China’s easing of some Covid restrictions and help to the real-estate sector joins the jump in the daily coronavirus numbers to challenge the Gold traders.

US Treasury yields are the key

Given the US Treasury yields’ rebound underpinning the US Dollar’s comeback, the Bond coupons will be crucial to watch for clear directions, especially amid mixed updates and a light calendar. Should the bond bears keep fearing recession and hold control, the Gold price is likely to remain firmer. That said, the benchmark US 10-year Treasury yields remain near 3.86% by the press time.

US inflation expectations are important too

It’s worth noting that an increase in the New York Federal Reserve’s (Fed) inflation expectations appeared to have renewed the US bond selling and hence headlines surrounding price pressure should also be watched for near-term Gold price directions. As a result, today’s US Producer Price Index (PPI) for October, expected 8.3% YoY versus 8.5% prior, should be watched carefully to aptly forecast the near-term Gold price moves.

Technical analysis

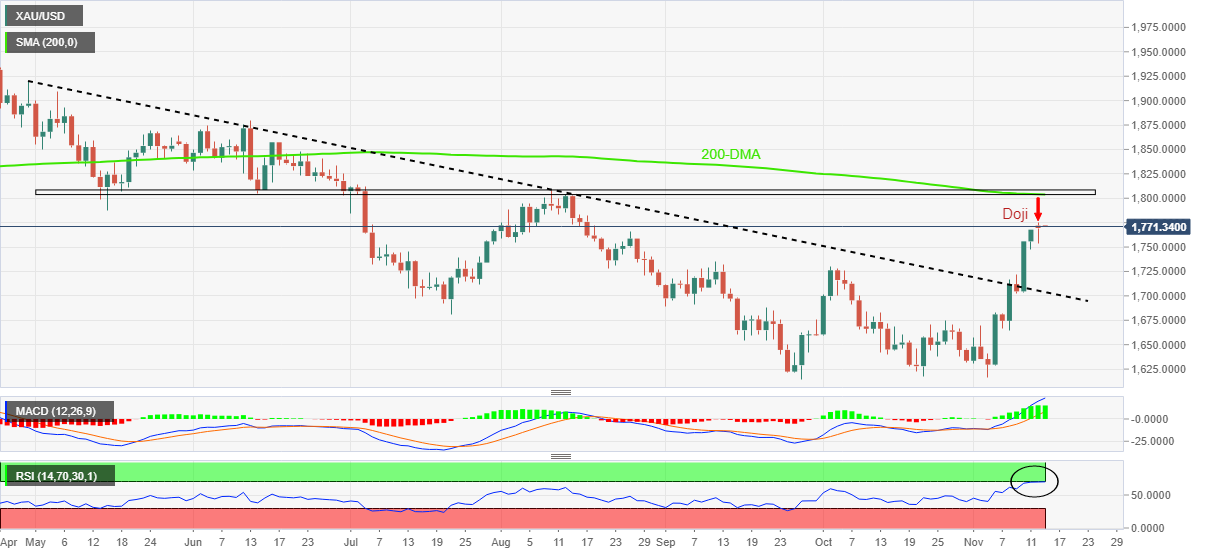

Gold price justifies the previous day’s bearish Doji candlestick and the oversold conditions of the Relative Strength Index (RSI), located at 14, while printing mild losses.

That said, the Gold price could approach September’s high surrounding $1,735 during further downside, as the Moving Average Convergence and Divergence (MACD) also appears to ease the bullish bias.

However, the previous resistance line from late April, around $1,703 at the latest, could challenge the further downside of the Gold price.

Alternatively, a daily closing beyond the previous day’s high near $1,775 could recall the bullion buyers.

Even so, a convergence of the 200-DMA and multiple levels marked since mid-May, around $1,805-08, appears a tough nut to crack for the Gold price to cross before convincing the buyers.

Gold price: Daily chart

Trend: Further downside expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.