Gold Price Forecast: XAU/USD eases towards $1,780 on resurgent USD demand

- Gold remains on the back foot below $1,790 amid broad US dollar reboud.

- Market sentiment dwindles as virus-linked news battles geopolitical fears, Fed rate hike concerns.

- Friday’s US CPI becomes crucial as inflation expectations improve, virus-led lockdowns, yields are important to track too.

- Gold Price Forecast: Sellers happily adding on spikes amid a lack of clear direction

Update: Gold price is moving back and forth in a familiar range below $1,790, unable to hold onto the upside amid a broad rebound in the US dollar. The mixed market sentiment is pushing the investors to find safety and certainty in the US dollar even as the Treasury yields fade their recovery momentum.

Traders refrain from placing any directional bet in the bright metal ahead of the all-important US inflation data due this Friday. The latest reports that the ECB could likely boosts its Asset Purchase Programme (APP) next week failed to lift the sentiment around the non-yielding gold.

Read: Gold Price Forecast: XAU/USD traders seem non-committed below 200/100-DMA, US CPI awaited

Gold (XAU/USD) remains steady at around $1,785, recently easing from intraday top heading into Thursday’s European session.

The yellow metal portrayed a bearish candlestick the previous day amid mixed concerns over the South African covid variant and its cure. However, the latest challenges to the market sentiment underpin the US dollar and lure the gold sellers ahead of the all-important US Consumer Price Index (CPI) data, up for publishing on Friday.

News that leading covid vaccines’ booster shots are effective against Omicron joined studies that the virus variant is less detrimental than the previous versions to favor previous risk-on mood. However, fresh virus-led lockdowns in Germany, France and the UK join the latest study from Japan saying four-time more transmissibility of the South Africa-linked COVID-19 strain to weigh on the sentiment.

Elsewhere, US-China tussles got escalated on the Taiwan issue, following the previous tension over Beijing Olympics, which in turn weighed on the sentiment and the gold prices. Adding to the China-linked challenges for risk appetite were fears of Evergrande and Kaisa defaults. On the same line were the US-Russia tussles over Ukraine and Washington-Israel talks concerning Tehran.

While the risk-off mood favors US 10-year Treasury yields and the US Dollar Index (DXY) to stay positive, a four-day rebound of the US inflation expectations propels market chatters over the Fed rate hike and fuels bond coupons as well as DXY, also weighing on the gold.

It should be noted, however, that the market’s wait for Friday’s US CPI and more clues over Omicron keeps the gold prices steady below the key hurdle.

Technical analysis

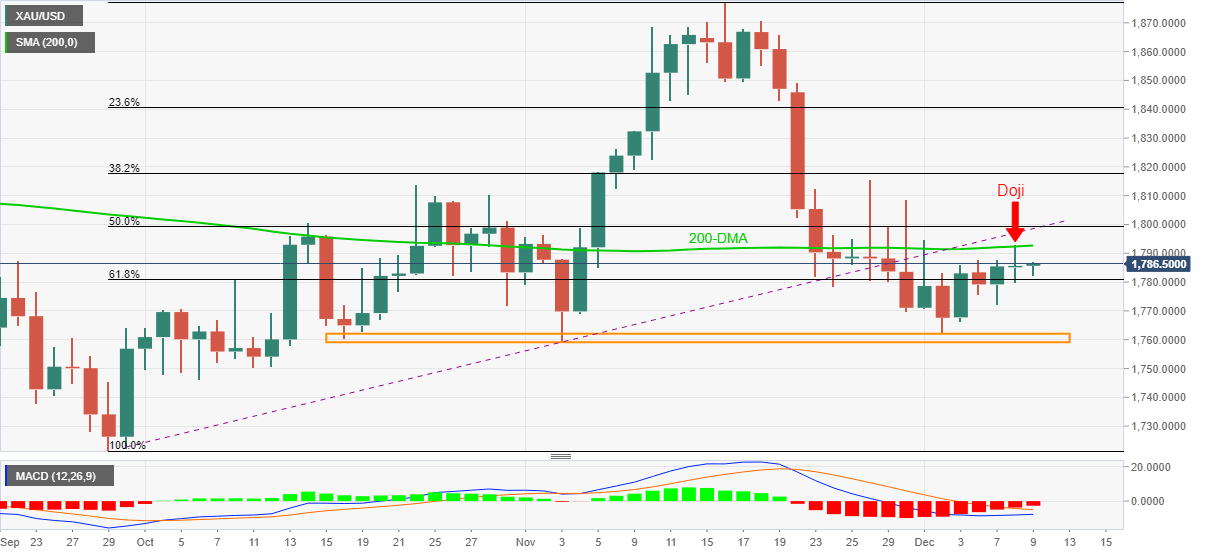

Despite bouncing off a seven-week-old horizontal area, gold stays beneath the 200-DMA, not to forget mentioning the previous support line from late September. The metal’s failures to cross short-term key hurdles join bearish MACD signals and Wednesday’s Doji candlestick to keep sellers hopeful.

That said, the 61.8% Fibonacci retracement (Fibo.) of September-November upside, near $1,780, precedes the $1,772 level to restrict short-term declines of gold prices.

Following that, multiple levels marked since October 18 challenge gold bears around $1,760-62.

On the flip side, the 200-DMA and the support-turned-resistance line, respectively around $1,792 and $1,798, join the 50.0% Fibo. level surrounding $1,800 to question the gold buyers.

During the quote’s sustained run-up past $1,800, the $1,815 and $1,845 levels may offer intermediate halts before directing gold prices towards November’s peak of $1,877.

Gold: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.