Gold Price Forecast: XAU/USD's struggle with 100-DMA extends into a big week

- Gold bulls looking for an upside extension as US dollar wobbles on a softer inflation outlook.

- DXY needs to give out at daily support to help gold bulls towards the daily 38.2% Fibo target.

- XAU/USD fails to clear key resistance at $1,790

Update: Gold price is posting small gains starting out a big week this Monday, consolidating the previous week’s three-day uptrend, as the US dollar attempts a recovery across the board. Markets have turned cautious amid Delta covid strain concerns and an unexpected slowdown in the Chinese services sector, lifting the dollar’s safe-haven demand. However, with the attention turning towards the FOMC minutes and ECB’s special meeting, gold is struggling to extend last week’s advance above the critical 100-Daily Moving Average (DMA), currently at $1790.

On Friday, gold price jumped and briefly recaptured the 100-DMA on a big beat on the US NFP data, which downed the dollar amid ‘sell the fact’. The precious metal failed to close the day above that level, as the upbeat numbers boosted the Fed’s tapering expectations.

Read: Will Fed hawks peck Gold?

For the start of the week, the price of gold is looking bid and it ended on Friday higher for the third day in a row.

The US dollar was a factor this time around that had otherwise been supported into the Nonfarm Payrolls.

During the mid-week business, the greenback was rising at the same time as gold but this time around gold was propelled forward by a weaker US dollar which snapped 4-days of higher highs.

XAU/USD was ending at $1,787.45 by the close and had travelled between the lows of $1,774.35 and the highs of $1,795.10 following a mixed US Nonfarm Payrolls report for June.

Despite the strong headline number, the dollar failed to move higher even though 850,000 jobs last month had been created after rising 583,000 in May.

There was a focus, however, on the Unemployment Rate which rose to 5.9% from 5.8% in May, while the closely watched average hourly earnings, a gauge of wage inflation, rose 0.3% last month.

The wage component was lower than the consensus forecast for a 0.4% increase and, therefore, traders do not see there being any rush from the Fed to react to inflation at this time.

Profit-taking has ensued ahead of the July 4th holidays but as traders return, price action in the greenback could get interesting.

Despite a soft dollar on Friday, it posted the week on a positive note, with an 0.5% gain as markets look ahead to the Federal Open Market Committee meetings on July 27-28 and September 21-22, along with the Jackson Hole Symposium August 26-28.

Moreover, gold will likely come under pressure if there is an environment of continuous strong US data over the coming weeks that should lend support to the greenback.

However, for the immediate future, the greenback would be expected to ease off in the wake of Friday’s US jobs report, which markets took a “goldilocks” view of, falling into the hands of the higher beta currencies.

CFTC positioning

Meanwhile, gold investors continued to reduce net length following the Fed's June hawkish tilt last week which leaves prospects for a short-covering to propel prices higher.

''At the end of the week, gold jumped to $1,788/oz as the market judged the June payrolls data to be conducive to easy monetary policy for a prolonged time, and as yields plunged'' analysts at TD Securities explained.

''Given that there may be additional angst surrounding the Delta variant in the coming weeks and less worry about tight labour markets supporting inflation, gold may well move above the 100 DMA resistance to a new higher level, which should see net long exposure increase.''

Technical analysis, DXY & gold

From a technical standpoint for the DXY, should current support give way, then the price will be en route to the neckline of the W-formation:

Meanwhile, the price of gold broke and closed above 1,782 1 July highs after retesting the 10 EMA on the 4-hour time frame which acted as support.

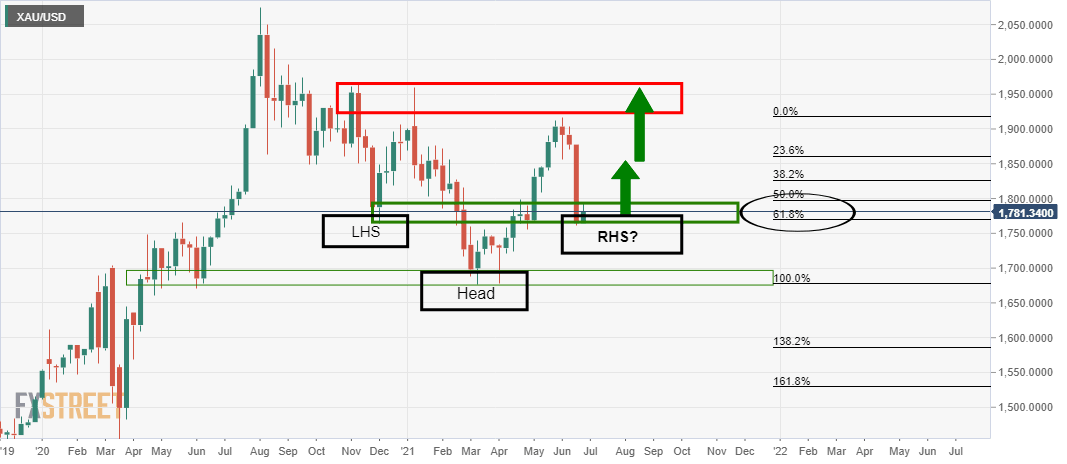

The following is an analysis that shows the progress by the bulls seeking a weekly upside extension within a reverse head and shoulders:

Live market progress

meanwhile, the price is seeking an extension above the highs at this juncture which opens the case for 1,808 as being the 38.2% Fibo of the last daily bearish impulse which has a confluence with the 13th May lows.

Previous update

Update: Gold (XAU/USD) snaps a three-day uptrend amid a sluggish Asian session on Monday. That said, the yellow metal drops to $1,785, down 0.15% intraday, by the press time. In doing so, the gold prices follow S&P 500 Futures as market players reassess Friday’s risk-on mood amid a light calendar and the coronavirus (COVID-19) woes.

Mixed readings of the US jobs report for June raised doubts on the chatters over the Fed’s monetary policy adjustments, which in turn backed the market’s optimism and gold prices on Friday. However, covid concerns in Asia-Pacific and a recheck of the sustained easy money policies, amid a quiet day, seem to weigh on the sentiment of late. Against this backdrop, S&P 500 Futures print 0.13% intraday losses after refreshing the record top the previous day.

Given the off in the US and an absence of major catalysts, gold prices may extend the pullback moves.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.