Gold Price Forecast: XAU/USD eases from eight-month highs above $1,900, geopolitics in focus

- Gold holds near the fresh cycle highs of $1,900, driven higher by the Russian and Ukraine crisis.

- US dollar pinned to the floor as markets reassess Fed's tightening path.

- Is it worth adding gold to your portfolio in 2022?

Update: Gold price is retreating from fresh eight-month highs reached at $1,903 reached in early Asia, as an improvement in the market sentiment is diminishing the metal’s safe-haven appeal. Investors turn hopeful that US President Joe Biden’s meeting with international leaders on a potential Russian invasion of Ukraine will help pressurize both warring sides to de-escalate the ongoing geopolitical tensions.

On Thursday, the risk was heavily sold-off into the US’ warnings on an imminent Russian incursion on the Ukrainian border while the former kept denying such plans. Reports of mortar shelling fired by Ukraine military and rebels in four war-torn localities in the Donbas region of East Ukraine brought a sudden risk-off wave and rattled markets.

Looking, the geopolitical developments surrounding Ukraine will remain the main market driver this Friday amid a lack of first-tier US macro data.

Read: Russia and Ukraine threaten the global recovery as central banks confront inflation

The price of gold rallied on Thursday and was coming to a close near the highs of the day of $1,901 at $1,898, ending up over 1.54%. The uncertainty surrounding the Russian NATO crisis over Ukraine appears to be generating solid demand for gold as a haven, despite the risks to the yellow metal of substantially higher real rates amid a hawkish central bank regime.

The US dollar index was little changed on Thursday though as investors weighed comments made by NATO allies and officials that sent the message to the market that war appeared imminent after shelling on the Ukraine front line. Against a basket of its rivals (DXY), the US dollar was ranging between 95.71 and 96.10. However, stocks on Wall Street were battered with the S&P 500 losing 2.1% to 4,380.26, the Nasdaq Composite sliding 2.9% to 13,716.72 and the Dow Jones Industrial Average was falling 1.8% to 34,312.03, its biggest loss in 2022.

Investors continue to see a high probability of a 50 basis point hike at the Federal Reserve's March meeting. However, money markets were pricing in a 72% likelihood of a 50 bps rate hike next month compared to 80% at the start of the week which likely weighed on the greenback. The 10-year US Treasury yield also sank 8 basis points to 1.96%.

Are trend followers accumulating at the top?

This was the title given to a piece written by analysts at TD securities who, at the core, are bearish on gold.''Precious metals funds are finally seeing an increase in fund flows year-to-date, as participants accumulate positions since early February to hedge against geopolitical risk. How sustainable is this demand if this geopolitical risk event subsides?'' the analysts wrote. ''This question is key to our view for gold prices to consolidate under the weight of a hawkish Fed.''

''Traders should recall that geopolitical risk also carries a heavy time decay, suggesting as the Russia risk premium could be wiped clean as soon as next week if troops head home. Ultimately, we still don't find evidence of sustained buying behaviour, suggesting that gold could simply have been buoyed by a large one-off purchase, followed by a safe-haven bid amid these tensions, which has catalyzed a CTA buying program.''

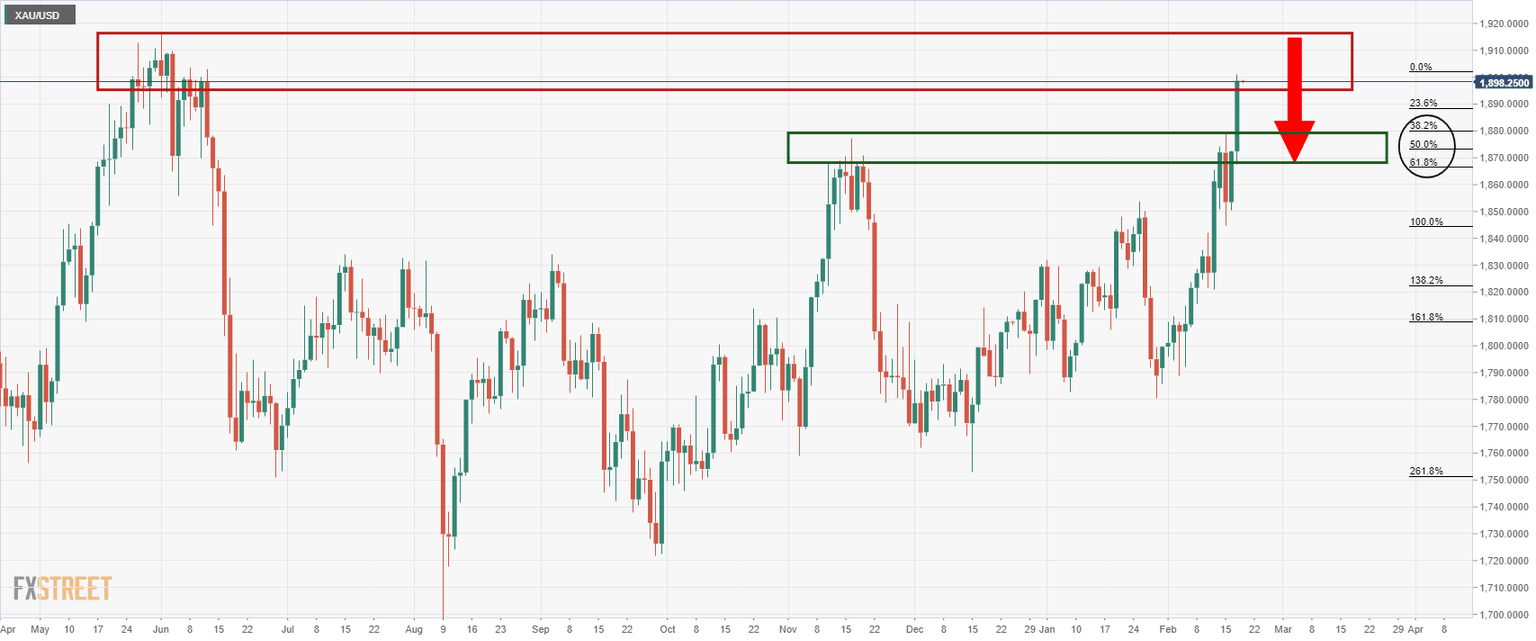

Gold technical analysis

The price is attempting to break into the longer-term resistance on the daily chart. If the price fails to move through the May 2021 highs, then the focus will be back towards the $1,880's and lower with the 61.8% golden ratio in mind.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.