Gold Price Forecast: XAU/USD sticks to weekly lows near $1,815 amid firmer yields

- Gold fell heavily following hawkish remarks from the Federal Reserve's chairman.

- XAU/USD bears throw in the towel near a critical support area.

- The focus is on a significant correction back towards $1,830.

Update: Gold price is meandering near one-week lows of $1,813, as the demand for the US dollar remains unabated amid rising two-year Treasury yields. The two-year US rates spike to fresh 23-month highs of 1.192% as the Fed funds futures tumble on expectations of five rate hikes this year. Fed Chair Jerome Powell fanned hopes of March lift-off while opening doors for faster rate-hikes to tame inflation. In reaction to the hawkish Fed outlook, gold price corrected sharply from two-month peaks, having failed to find acceptance above the $1,850 mark.

Looking ahead, the US advance Q4 GDP and Durable Goods data will be eyed for fresh US dollar valuations, which will have a strong bearing on gold price.

Read: Federal Reserve rate cycle to begin in March, markets reverse on warning

At $1,820, Gold, (XAU/USD) is virtually flat in Tokyo following market volatility overnight. Jerome Powell surprised markets with a hawkish pivot, commenting that the Fed could raise rates at every meeting if need be.

Additionally, Powell said in the presser that the Fed could move faster and sooner than they did the last time which helped the US dollar to extend on pre presser gains as US 2-year yields jumped the biggest one day gain since 2020. The US dollar rose to a five-week high:

DXY M5 chart, US session

''Today’s announcement from the Fed is expected to prepare the market for a March rate hike and confirm QE will end before then. The tone set by Powell will be closely watched for any signals as to how quickly the Fed intends to par back its balance sheet,'' analysts at ANZ Bank exlained.

''Several members of the Federal Open Market Committee (FOMC) have already indicated they support a March rate hike. Inflation has been stronger than anticipated, wage inflation is increasing and the falling unemployment rate now sets the scene for the FOMC to signal that rate hikes, in March, are on the cards.''

US Treasury yields across the curve jumped and added to gains when the Fed chairman added colour to the statement that said US interest rates would rise "soon", adding that it will end its asset purchase program in early March.

The Fed, however, did not set a specific date for raising interest rates. With that being said, federal funds futures have fully priced in a quarter-point tightening for the Fed's March meeting, and another three hikes for 2022.

Powell was uber hawkish in his comments around raising rates at every meeting. "Quite a bit of room to raise rates without hurting jobs'', he added.

Fed's Powell's key comments

- We are of the mind to raise rates at the March meeting.

- The current economy means we can move sooner, perhaps faster than we did last time.

- The next meeting will be coming to more of the details on the Balance Sheet.

- Other forces this year should also bring down inflation.

- Quite a bit of room to raise rates without dampening employment.

- No decision made on policy path, path to be led by incoming data.

As a consequence, the benchmark US 10-year yield rose to 1.855%. The US 30-year yields were moved to 2.172% and on the front end of the curve, US 2-year yields shot up to 1.095%.

Equity markets rallied ahead of the FOMC statement but soon ran into sellers following the combination of the statement and Powell's hawkish comments.

Fed's statement, key takeaways

- A rather mixed and fairly dovish statement ticked some of the boxes as follows:

- As expected, the benchmark interest rate was unchanged; The Target Range stands at 0.00% - 0.25% - Interest Rate on Excess Reserves is also unchanged at 0.15%.

- There were no mentions of early rate hikes, let alone a 50bp hike (which some analysts have been expecting).

- QE is not indicated to end early either and that the balance sheet shrinking would start after rate hikes commence.

- The Fed has warned that soon it will be appropriate to raise rates.

- The Fed has stated that both the economy/employment have strengthened and that jobs gains are solid.

- "Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to US households and businesses," is an unchanged statement that indicates we are no closer to lift off than of the prior meeting.

- Subsequent to this statement, Fed's funds futures are looking for four rate hikes for this year.

US stocks slid when Powell reinforced expectations for a March interest rate hike. The Nasdaq Composite ended near flat at 13,542.12, Microsoft helped the index keep out of negative territory though. The S&P 500 ended 0.2% lower at 4,349.93 and the Dow Jones Industrial Average was also bleeding, ending down 0.4% to 34,168.09.

XAU prices were steady leading into Powell’s press conference following the FOMC meeting. However, his comments that rates could rise sharply saw gold prices sell off sharply late in the session.

''Certainly, markets have priced-in a March hike for some time, which takes the sting out of the hiking signals, but evidence that quantitative tightening might be more impactful for asset prices suggests that this axis will still be relevant,'' analysts at TD Securities explained.

''With little additional information provided about the pace of quantitative tightening, the complex should continue to struggle to attract capital in the face of a hawkish Fed. In this context, while gold ETFs recorded massive inflows last week, these may have been distorted by options-related activity, with the concurrent rise in volatility suggesting only some mild safe-haven flows,'' the analysts added.

''The evidence continues to overwhelmingly point to Chinese purchases as the single largest source of inflows, which are vulnerable with Lunar New Year around the corner. CTA trend followers are set to liquidate some gold length should prices break below $1810/oz.''

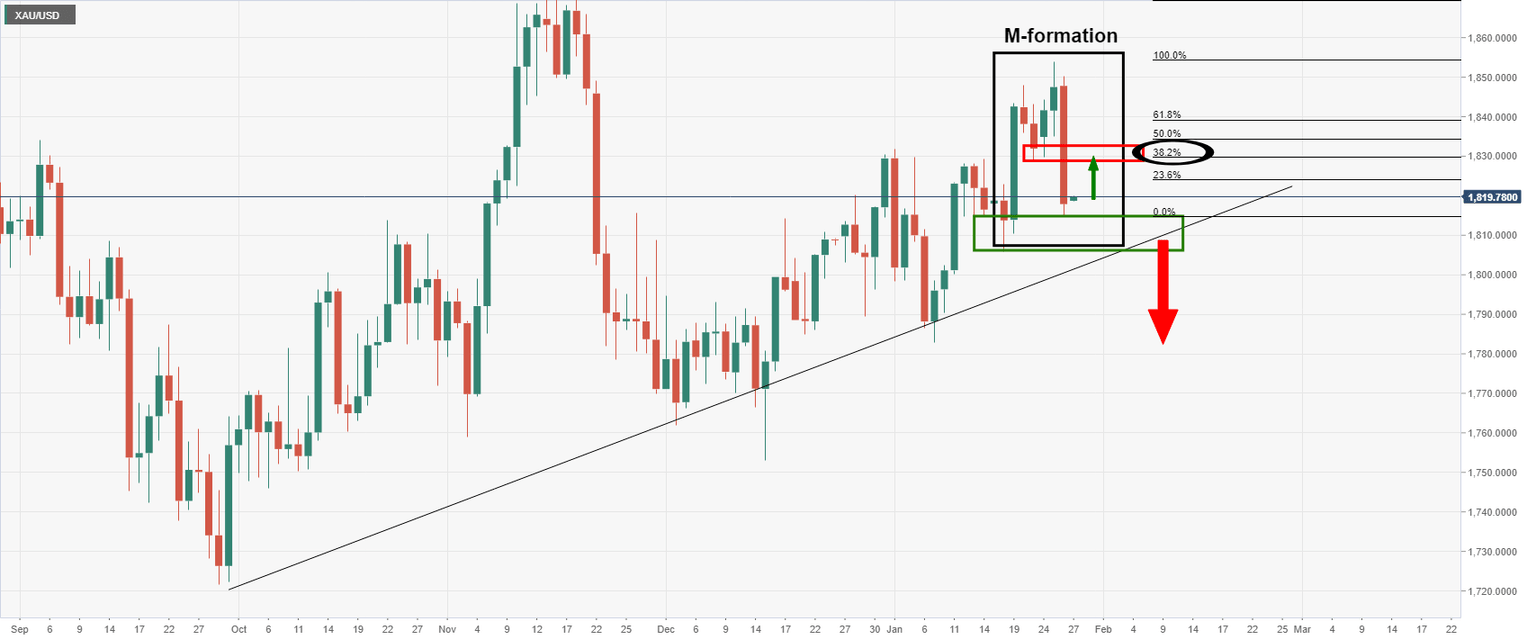

Gold technical analysis

The price of gold has left an M-formation on the daily chart. This is a reversion pattern and has a high completion rate of the price being drawn back to test the neckline of the M-formation.

As it stands, the 38.2% Fibonacci retracement level has a direct influence on the neckline, which adds extra confluence as an attractive bullish corrective target for the days ahead near $1,830. Alternatively, a break of $1,810 and the trendline support opens significant risk to the downside.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.