Gold Price Forecast: XAU/USD rises past $1,750 as US Treasury yields ease from three-month top

- Gold is under pressure as the US dollar resurges.

- Evergrande remains a thorn in the side for risk-sensitive assets.

- XAU/USD remains vulnerable amid hawkish Fed outlook

Update: Gold (XAU/USD) extends Friday’s rebound while picking up bids to $1,760, up 0.50% intraday during early Monday. In doing so, the precious metal benefits from the upbeat market sentiment, which in turn triggers US Treasury yields pullback from the multi-day top.

The retreat in the benchmark bond yields weighs on the US Dollar Index (DXY), down 0.05% intraday near 93.24 at the latest.

The risk-on mood takes clues from optimism towards US stimulus, recently backed by House Speaker Nancy Pelosi, as well as headlines concerning covid and US-China relations, mainly due to Canada-China prisoner swap.

It’s worth noting that the absence of Evergrande news and a little silence over the Fed tapering concerns add to the brighter risk appetite.

Moving on, US Durable Goods Orders will be checked to reconfirm the optimism that recently helped gold buyers.

End of update.

The price of gold is steady in the opening session on Monday, albeit weighed by a firmer US dollar. The DXY index, a measure of the US dollar vs a basket of currencies, posted its third straight week of gains on Friday as the uncertainty over beleaguered Chinese property developer Evergrande helped the greenback bounce back from a sharp decline in the prior session. At the time of writing, gold is trading at $1,749 and near to where it left off on Friday.

US dollar better-bid

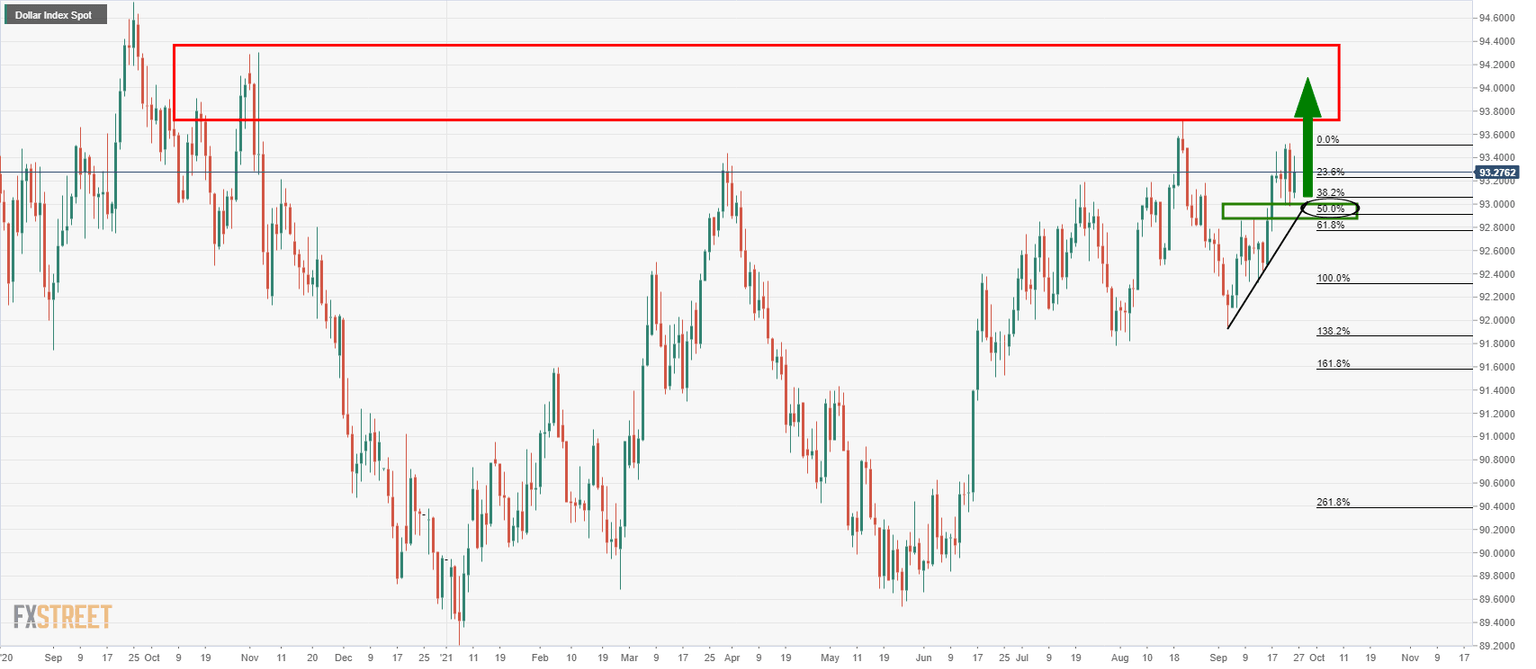

DXY is sitting in the bullish territory near 93.29 following a bullish hourly 20/50 EMA cross-over after it rose through the 200-hour smoothed MA. Investors will be keenly watching critical resistance of 94 level:

The safe-haven US dollar recovered from its biggest one-day percentage drop in about a month on Thursday after Beijing injected new cash into the financial system. At the same time, the Evergrande Group that owes $305 billion and has run short on cash, announced it would make interest payments on an onshore bond, boosting risk sentiment.

However, Evergrande missed a Thursday deadline for paying $83.5 million and left investors questioning whether it will make the payment before a 30-day grace period expires. The fears are that a default of the company could create systemic risks to China's financial system and wider markets off-shore. The Evergrande debt resolution story is far from clear and until a full debt restructuring is announced, markets are likely to remain on edge and vulnerable to the headlines surrounding the debacle. This is expected to keep the greenback underpinned.

Meanwhile, the US dollar has picked up a safe-haven bid while the Federal Reserve moves closer to tapering and rates lift-off. On Friday, Kansas City Fed President Esther George said the US labour market has already met the central bank's test to pare its monthly bond purchases. This echoed words from the Fed chair Jerome Powell who spoke in a virtual press conference following last week's Fed meeting.

That meeting was especially hawkish owing to the Fed Dots that showed a tightening cycle that is way above anything priced in money markets. This has sparked substantial ETF liquidations of gold contracts in a delayed response and rising US 10-year yield has crimped demand for the non-yielding asset.

Additionally, Cleveland Fed President Loretta Mester on Friday echoed the sentiment for tapering this year, and said the central bank could start raising rates by the end of next year should the job market continue to improve as expected. In this regard, a whole host of Fed speakers attending conferences on both sides of the Atlantic this week. Meanwhile, US data this week focuses on consumer confidence, personal income and the September ISM Manufacturing.

''Looking forward, the 'stagflation' narrative is still capturing the market's share of mind, as participants look to a period of high inflation and slowing growth, but this has yet to translate into additional interest for gold,'' analysts at TD Securities said.

Gold technical analysis

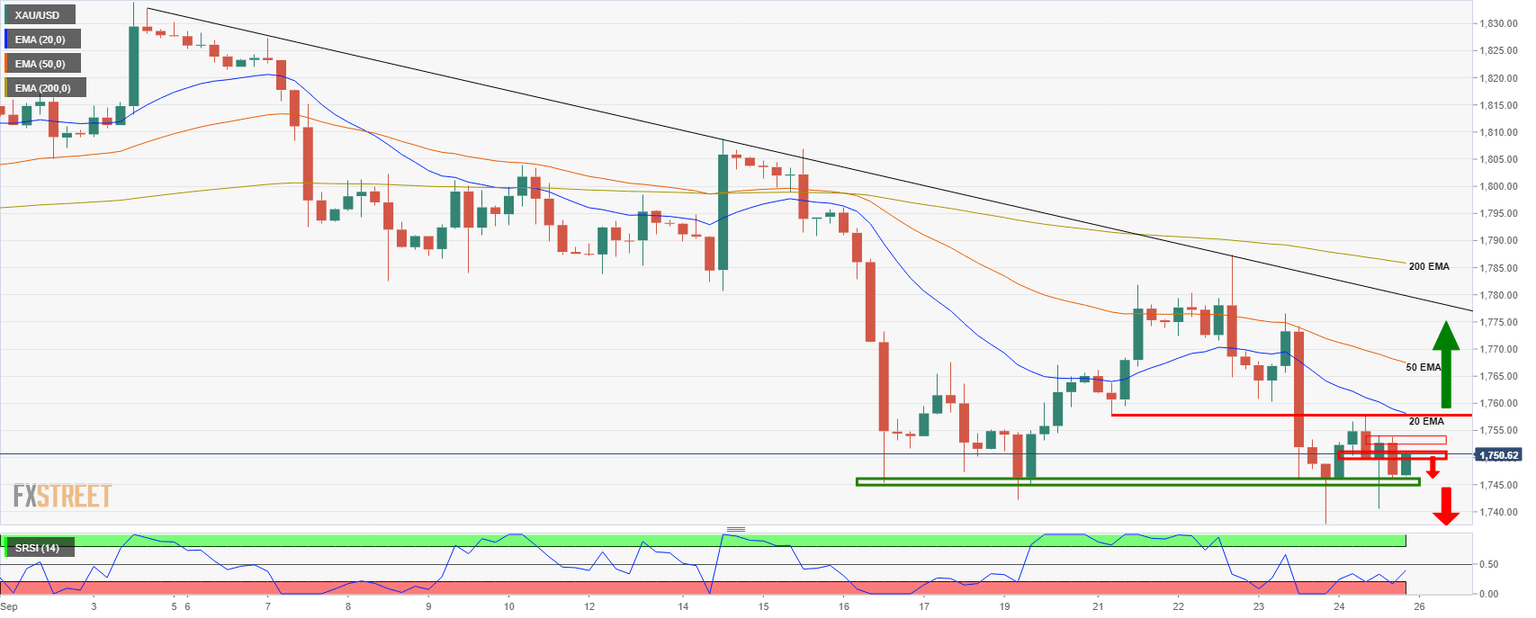

(4-hour chart)

As per this week's Chart of the Week, gold is trading in bearish territories while below a confluence zone near to $1,760.

''From a 4-hour study, the price is in a bearish trend while below the 200 EMA and the divergence of the 50 and 20 EMAs. The price is attempting to restest the 20 EMA which might play out a little longer. However, so long as the price remains below 1,760 and the RSI below 50, then the bias is to the downside.''

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.