- Gold price tests the higher levels once again amid steady USD, Treasury yields.

- Gold traders remain cautious of the critical US inflation data, Fed minutes.

- Gold on the back foot as NFP fails to alter taper prospects.

Gold price is posting modest gains but remains well within the recent trading range above the $1750 level so far this Tuesday. A flight to safety amid intensifying stagflation fears offers support to the traditional safe-haven gold. Further, a pause in the US Treasury yields rally aides the rebound in gold price. However, the Fed’s tapering expectations continue to limit gold’s upside potential, as investors await the return of full markets and Wednesday’s critical US inflation report for a fresh directional move in gold price.

Read: Gold Price Forecast: Will XAU/USD find a foothold above 21-DMA? US inflation in focus

Gold Price: Key levels to watch

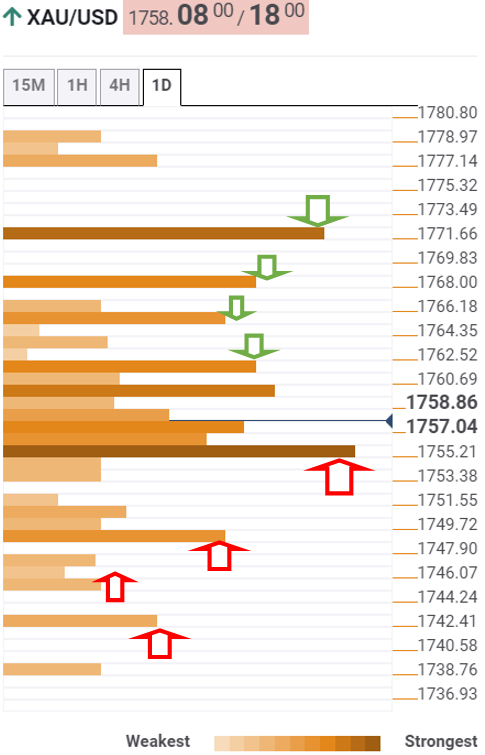

According to the Technical Confluences Detector, gold is moving back and forth, without a clear directional bias, with a bunch of healthy barriers stacked up in either direction.

Immediate upside is capped at $1762, which is the convergence of the Bollinger Band one-hour Upper and the previous day’s high.

The next significant topside hurdle is seen at $1765, where the Fibonacci 38.2% one-month aligns.

The Fibonacci 61.8% one-week at $1767 will then challenge the bearish commitments.

Gold bulls need to find acceptance above the pivot point one-day R3 at $1771 to initiate a meaningful uptrend.

Alternatively, gold buyers will once again challenge bids at $1755, the convergence of the Fibonacci 23.6% one-week and Fibonacci 38.2% one-day.

A sustained move below the latter will expose the $1750 psychological level, below which the next downside target at $1748 could get tested. That level is the Fibonacci 23.6% one-month.

The next cushion appears around $1745, where the previous week’s low intersects the pivot point one-day S2.

The pivot point one-week S1 at $1741 will be the level to beat for gold bears.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays weak near 1.0400 as trading conditions thin out

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD consolidates below 1.2550 on stronger US Dollar

GBP/USD consolidates in a range below 1.2550 on Tuesday, within striking distance of its lowest level since May touched last week. The sustained US Dollar rebound and the technical setup suggest that the pair remains exposed to downside risks.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.