- Gold is looking to extend Wednesday’s rebound towards $1800.

- Month and quarter-end flows rescued gold price but for how long?

- All eyes remain on the US ISM Manufacturing PMI and NFP data.

- Gold Weekly Forecast: Sellers look to retain control following uninspiring rebound

Update: Gold is 0.2% higher in the US session as the price holds territory above the 10 and 20 EMAs meeting on the 4-hour time frame. There has a reluctance to commit from the bulls in the $1,780s as markets get set for the showdown of the month in the US Nonfarm Payrolls. The greenback depends on it. In the data, the headline its self will not necessarily be what matters, although payrolls probably surged again, with the pace up from the +559k in May. Meanwhile, wages are key to broad-based price inflation and any signs of acceleration should get the market’s attention.

Update: Gold built on the previous day's recovery move from the vicinity of the $1,750 level, or two-and-half-month lows and gained traction for the second consecutive session on Thursday. The momentum pushed the XAU/USD back closer to the $1,780 level during the early European session, though any meaningful upside still seems elusive amid the prevalent strong bullish sentiment surrounding the US dollar. A stronger greenback tends to undermine demand for dollar-denominated commodities, including gold.

The markets have been speculating that the Fed will tighten its monetary policy if price pressures continue to intensify. The market expectations were further cemented by the overnight hawkish comments from Dallas Fed President Robert Kaplan. In an interview with Bloomberg TV, Kaplan said that they are seeing a broadening of price pressures and would prefer to taper sooner than the end of the year. This, along with a stronger ADP report, continued acting as a tailwind for the greenback and might cap gains for gold.

In fact, the key USD index climbed to the highest level since April 8 and was further supported by a goodish pickup in the US Treasury bond yields. This could further collaborate to keep a lid on any meaningful upside for the non-yielding gold. Moreover, investors might also refrain from placing any aggressive bets, rather prefer to wait on the sidelines ahead of Friday's release of the closely watched US monthly jobs report – popularly known as NFP. This, in turn, warrants some caution for bullish traders.

Heading into the key event risk, traders on Thursday will take cues from the US economic docket – highlighting the release of ISM Manufacturing PMI later during the early North American session. Apart from this, the US bond yields, might influence the USD price dynamics and produce some short-term trading opportunities around gold.

Previous update: Gold price is building on Wednesday’s rebound from two-month lows of $1750, although the bulls seem to lack follow-through momentum, as the US dollar holds the higher ground. The risk-off sentiment remains at full steam amid growing concerns over the rapid spread of the Delta covid strain, especially in the Asia-pac region. Meanwhile, rising expectations that the Fed will resort to dialling back of the monetary stimulus, after the US ADP NFP numbers outpaced expectations in June, keep the sentiment buoyed around the greenback.

Gold’s next direction will depend on the US NFP jobs report due this Friday. In the meantime, gold traders eagerly await the US ISM Manufacturing PMI for fresh dollar trades.

Read: Gold prices pull back ahead of key US jobs data: What’s next? [Video]

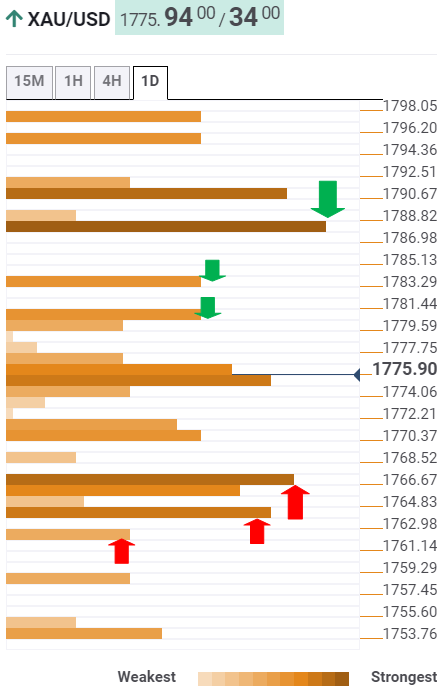

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold price is battling powerful resistance at $1775, which is the convergence of the SMA10 one-day, Fibonacci 61.8% one-week and the previous day’s high.

The next upside barrier is seen at the pivot point one-day R1 at $1778. Further up, the bulls will look to the Fibonacci 38.2% one-week at $1884.

The confluence of the Fibonacci 23.6% one-week and pivot point one-day R2 at $1787 will be a tough nut to crack for gold optimists.

On the flip side, the immediate cushion is aligned at $1770, the intersection of the Fibonacci 23.6% one-day and the previous high on four-hour.

Strong support emerges around $1765, the meeting point of the pivot point one-week S1 and Fibonacci 38.2% one-day.

The previous week’s low of $1761 could be next on the sellers’ radars. At that point, the Fibonacci 61.8% one-day collides.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD battles 1.3200 after UK jobs data

GBP/USD is defending minor bids near the 1.3200 mark in the early European session on Tuesday. The latest data from the UK showed that Unemployment Rate steadied at 4% in the quarter to February while Average Earnings disappointed, weighing negatively on the Pound Sterling.

EUR/USD stays defensive near 1.1350 as US Dollar looks to stabilize

EUR/USD remains on the back foot for the second consecutive session, trading near 1.1350 in the European trading hours on Tuesday. The pair weakens as the US Dollar attempts to regain stability amid the US-China trade war and growing concerns over US recession. German/ EU data are awaited.

Gold price holds above $3,200; bullish bias remains amid trade uncertainty

Gold price regains positive traction as US tariff uncertainty continues to underpin safe-haven assets. Bets for aggressive Fed rate cuts in 2025 keep the USD depressed and also benefit the XAU/USD pair. Trump's temporary tariff reprieve improves global risk sentiment and might cap the commodity.

XRP resilient amid looming ETF deadlines

Ripple (XRP) flaunted a bullish outlook, trading at $2.1505 at the time of writing on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move, eyeing $3.0000 psychological level.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.