Gold price struggles for a firm near-term direction as traders keenly await US NFP report

- Gold price extends its consolidative price move amid mixed fundamental cues.

- Geopolitical risks and trade war fears offer support to the safe-haven XAU/USD.

- Less dovish Fed expectations and rebounding US bond yields act as a headwind.

Gold price (XAU/USD) continues with its struggle for a firm near-term direction amid mixed fundamental cues and remains confined in a familiar range through the first half of the European session on Thursday. Persistent geopolitical risks stemming from the worsening Russia-Ukraine conflict, trade war fears, along with political turmoil in France and South Korea, act as a tailwind for the safe-haven precious metal. Adding to this, a softer US Dollar (USD) is seen as another factor lending some support to the commodity.

That said, expectations for a less dovish Federal Reserve (Fed) trigger a modest bounce in the US Treasury bond yields and cap the upside for the non-yielding Gold price. In fact, comments from several FOMC members on Wednesday, including Fed Chair Jerome Powell, suggested that the US central bank will adopt a cautious stance on cutting rates. This warrants some caution before placing aggressive directional bets around the XAU/USD as traders await the US Nonfarm Payrolls (NFP) report on Friday.

Gold price awaits US NFP report on Friday for some meaningful impetus

- The Federal Reserve's Beige Book showed on Wednesday that US economic activity expanded slightly in most regions since early October, with inflation rising at a modest pace and businesses expressing optimism about the future.

- St. Louis Fed President Alberto Musalem said that it may be appropriate to pause interest-rate cuts as soon as the December meeting as the risks of lowering borrowing costs too quickly are greater than those of easing too little.

- Fed Chair Jerome Powell acknowledged that the US economy is in very good shape and is definitely stronger than expected and that the central bank can take a little more cautious approach cutting interest rates toward neutral.

- Separately, San Francisco Fed President Mary Daly said there is no sense of urgency to lower interest rates and that a lot more work needs to be done to deliver on the 2% inflation target and durable economic growth.

- Furthermore, speculations that US President-elect Donald Trump's policies will reignite inflation suggest that the Fed might stop cutting rates or possibly raise them again, triggering a modest bounce in the US bond yields.

- The yield on the benchmark 10-year US government bond rebounds after registering its lowest closing level since October 21, which, in turn, is seen exerting some downward pressure on the non-yielding Gold price on Thursday.

- Meanwhile, the US Dollar, so far, has been struggling to gain any meaningful traction and might act as a tailwind for the XAU/USD amid concerns that Trump's trade tariffs could trigger the second wave of global trade wars.

- Traders now look forward to the release of the usual US Weekly Initial Jobless Claims for some impetus later this Thursday. The focus, however, remains glued to the closely watched US Nonfarm Payrolls (NFP) report on Friday.

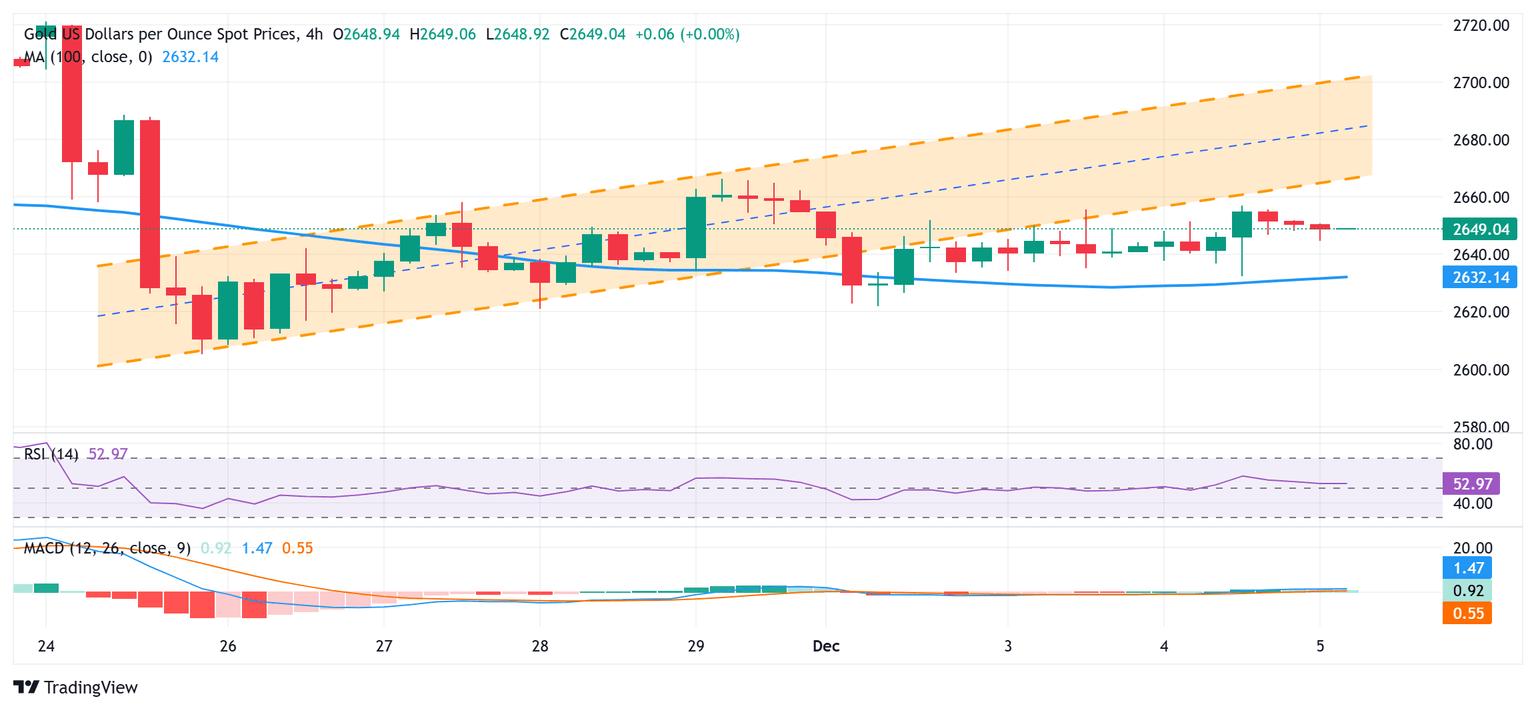

Gold price bears have the upper hand; ascending channel breakdown in play

From a technical perspective, this week's breakdown below a multi-day-old ascending channel was seen as a key trigger for bearish traders. That said, neutral oscillators on daily/4-hour charts make it prudent to wait for some follow-through selling below the recent trading range support, around the $2,630 area, before positioning for further losses. The subsequent downfall has the potential to drag the Gold price below the weekly swing low, around the $2,622-2,621 region, towards the $2,600 mark. The downward trajectory could extend further towards the 100-day Simple Moving Average (SMA), currently pegged near the $2,581 area, en route to the November monthly trough, around the $2,537-2,536 region.

On the flip side, the $2,655 area might continue to act as an immediate barrier ahead of last Friday's swing high, around the $2,666 region. Some follow-through buying, leading to a subsequent strength beyond the $2,677-2,678 hurdle, should allow the Gold price to aim to reclaim the $2,700 round figure. Any further move up, however, is likely to confront stiff resistance near the $2,721-2,722 supply zone, which if cleared decisively might shift the bias in favor of bulls and pave the way for some meaningful appreciating move in the near term.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Dec 06, 2024 13:30

Frequency: Monthly

Consensus: 200K

Previous: 12K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.