Gold price rally stalls as Fed to delay rate cuts later this year

- Gold price falls as receding Fed rate cut hopes limit demand.

- Strong US Retail Sales fuel uncertainty over the timing of the Fed interest-rate cuts.

- Worsening Middle East tensions keep supporting the Gold price.

Gold price (XAU/USD) drops after facing selling pressure near the crucial resistance of $2,400 in Tuesday’s early American session. The precious metal comes under pressure as the US Dollar and Treasury yields extend their upside after strong March United States Retail Sales data added to doubts about when the Federal Reserve (Fed) will deliver an initial rate cut.

10-year US Treasury yields rise to 4.68%, refreshing a five-month high. Financial markets anticipate that the Fed will begin reducing its key borrowing rates from September. Also, traders see only two cuts instead of three as projected by most Fed policymakers in the latest dot plot. The US Dollar Index (DXY), which tracks the US Dollar’s value against six major currencies, rises to 106.30.

Higher bond yields weigh on Gold as they increase the opportunity cost of investing in it. However, Gold has performed strongly in the past few weeks despite rising bond yields amid geopolitical tensions in the Middle East region. As a safe-haven asset, Gold demand from investors and central banks increases at times of global economic uncertainty and worsening geopolitical tensions.

Daily digest market movers: Gold price drops as robust US Retail Sales fuel stubborn inflation outlook

- Gold price slides to $2,370 while attempting to recapture new all-time highs around $2,430. Sheer strength in the US Dollar and US bond yields have been acting as a barricade to Gold. The appeal of the US Dollar strengthens and bond yields rise further as robust Retail Sales data for March has deepened the uncertainty about when the Federal Reserve will start lowering its key interest rates.

- The US Retail Sales data for March, released on Monday, indicated a strong demand despite US interest rates remaining higher. The monthly Retail Sales increased by a sharp 0.7%, more than the 0.3% rise expected. Retail Sales in February were revised higher to 0.9% from 0.6%. Retail Sales data is one of the leading indicators of consumer spending, which accounts for more than two-thirds of the US economy. Higher Retail Sales suggest demand from households remains strong, a factor fueling inflation.

- Strong Retail Sales data, combined with robust labor demand and a higher-than-expected Consumer Price Index (CPI) data, has forced traders to unwind expectations for early Fed rate cuts. The CME FedWatch tool shows markets are pricing in that interest rates will remain unchanged in the range of 5.25%- 5.50% in the June and July meetings. The Fed is now anticipated to pivot to rate cuts in September.

- Meanwhile, fears over Middle East tensions spreading beyond Gaza keep the safe-haven demand strong. Investors worry about a further escalation in the Israel-Iran tensions after Israel’s military Chief of Staff Herzi Halev said they would respond to Iran’s attack on their territory, in which hundreds of drones and missiles were fired, AlJazeera reports. US President Joe Biden said it won’t support the counterattack from Israel.

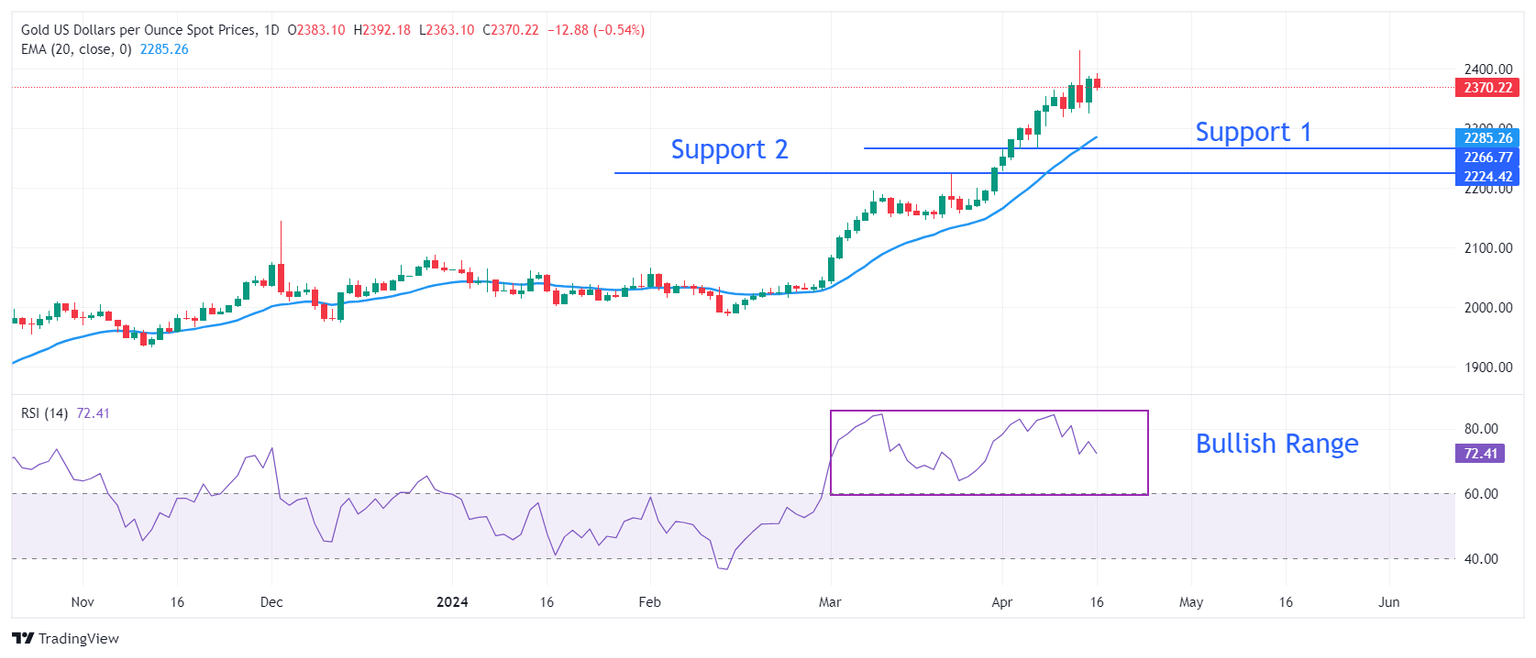

Technical Analysis: Gold price faces selling pressure near $2,400

Gold price falls back after failing to recapture fresh lifetime highs near $2,430. The upside in the precious metal remains limited as momentum oscillators are cooling down after turning extremely overbought. The 14-period Relative Strength Index (RSI) on the daily chart drops slightly after peaking around 85.00. The broader-term demand is intact as the RSI remains in the bullish range of 60.00-80.00.

On the downside, April 5 low near $2,268 and March 21 high at $2,223 will be major support areas for the Gold price.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.