Gold price retreats further from all-time peak amid modest pickup in USD demand

- Gold price pulls back from the vicinity of the all-time peak, though the downside seems limited.

- Concerns about Trump’s trade tariffs and a global trade war should lend support to the bullion.

- The underlying USD bearish sentiment might contribute to limiting losses for the XAU/USD pair.

Gold price (XAU/USD) extends its steady intraday retracement slide from the vicinity of the record high touched the previous day and drops to a fresh daily low, around the $2,920 area during the first half of the European session on Friday. The US Dollar (USD) attracts some buyers and reverses a part of the previous day's slump to its lowest level since December 10. This, along with the Federal Reserve's (Fed) hawkish stance, prompts some profit-taking around the non-yielding yellow metal amid slightly overstretched conditions on the daily chart.

However, worries that US President Donald Trump's tariff plans could trigger a global trade war might continue to act as a tailwind for the safe-haven Gold price. Furthermore, expectations that Trump's protectionist policies would reignite inflation could act as a tailwind for the bullion, which is seen as a hedge against rising prices. This, in turn, makes it prudent to wait for strong follow-through selling before positioning for any meaningful corrective slide for the XAU/USD pair, which remains on track to register gains for the eighth consecutive week.

Gold price bulls take some profits off the table amid the emergence of some USD buying

- The uncertainties surrounding US President Donald Trump's threatened tariffs and their impact on the global economy lifted the safe-haven Gold price to a fresh record high, near the $2,955 region on Thursday.

- Trump has imposed a 25% tariff on steel and aluminum, and an additional 10% tariff on Chinese imports since taking office on January 20, and also plans to announce fresh tariffs over the next month or sooner.

- Meanwhile, a softer-than-anticipated sales forecast from Walmart raised doubt over underlying economic strength amid worries that Trump's policy moves would boost inflation and undermine consumer spending.

- Hopes for a peace deal between Russia and Ukraine seem to have faded in the wake of intensifying Ukrainian drone attacks on Russian Oil pumping stations, which could further act as a tailwind for the precious metal.

- The US Dollar remains close to its lowest level since December 10 amid bets for more rate cuts by the Federal Reserve and might turn out to be another factor that could lend support to the XAU/USD pair.

- Fed officials, however, remain wary of future interest rate cuts amid still-sticky inflation, which, in turn, prompts some profit-taking around the non-yielding yellow metal amid slightly overbought conditions.

- St. Louis Fed President Alberto Musalem warned on Thursday that rising inflation expectations combined with the risk of stubborn stagflation could create a double challenge for the US economy.

- Earlier on Thursday, Fed Board Governor Adriana Kugler said that US inflation still has some way to go to reach the central bank's 2% target and that its path toward that goal continues to be bumpy.

- In contrast, Atlanta Fed president Raphael Bostic struck a more dovish tone and sees room for two more rate cuts this year, though noted that much depends on the evolving economic conditions.

- Traders now look forward to the flash PMI prints for a fresh insight into the global economic health, which, in turn, should provide some impetus to the commodity heading into the weekend.

- Apart from this, the US economic docket – featuring the release of Existing Home Sales data and the revised Michigan Consumer Sentiment Index – might contribute to producing short-term opportunities.

Gold price needs to break below $2,900 to support prospects for deeper corrective fall

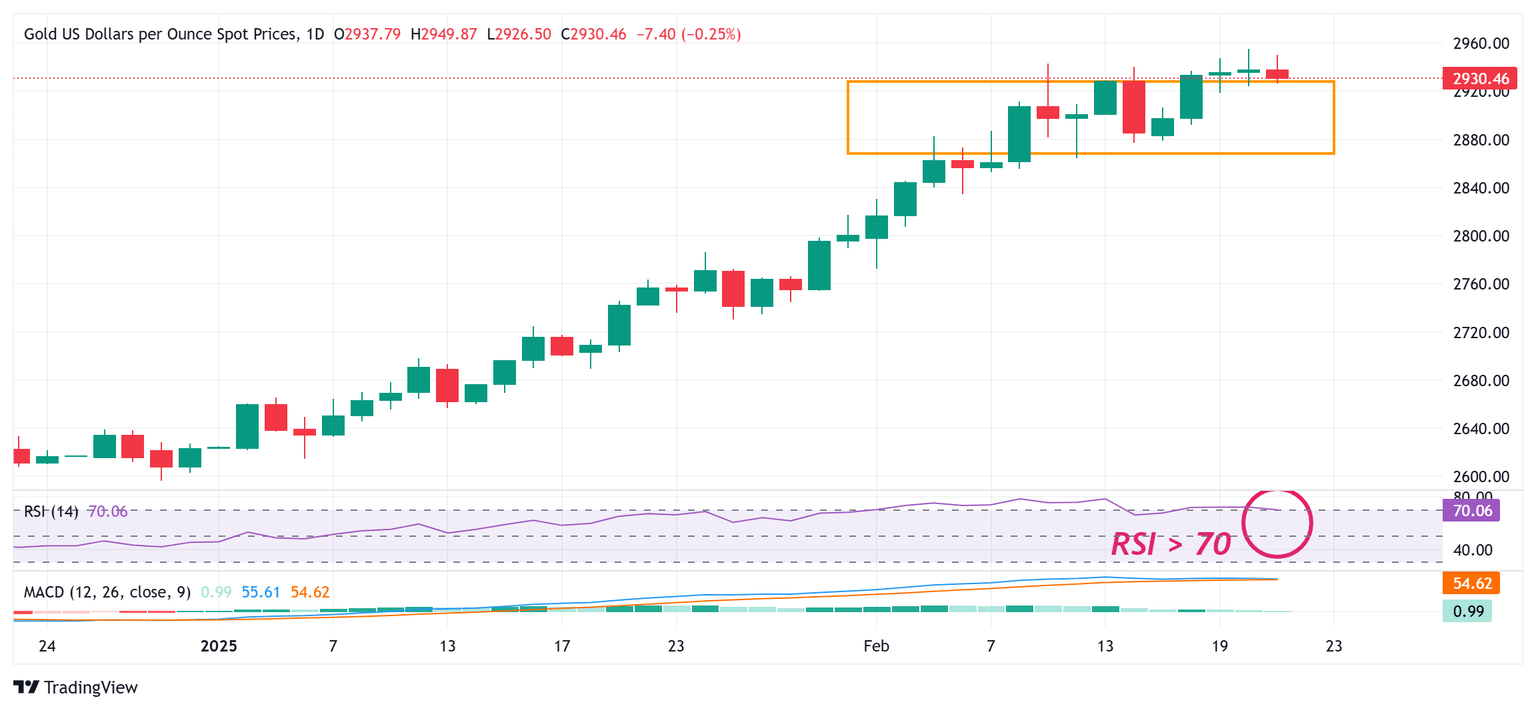

From a technical perspective, the daily Relative Strength Index (RSI) remains close to the 70 mark and warrants caution for bullish traders. That said, the recent breakout through the $2,928-2,930 horizontal barrier, representing the top boundary of a short-term trading range, suggests that the path of least resistance for the Gold price remains to the upside. Hence, any further slide could be seen as a buying opportunity near the $2,900 mark. This is followed by the $2,880 support, which if broken could drag the XAU/USD to the $2,860-2,855 area en route to the $2,834 zone and eventually to the $2,800 mark.

Meanwhile, bullish traders might now wait for some near-term consolidation and some follow-through buying beyond the $2,950-2,955 region before placing fresh bets. Nevertheless, the constructive setup supports prospects for an extension of the recent well-established uptrend witnessed over the past two months or so.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.