Gold price eases below $3,330 after record high as Powell flags stagflation risk

- Gold pulls back from $3,357 all-time high as Powell warns Fed’s goals may conflict, raising stagflation concerns.

- Market mixed: Dow dips on UnitedHealth crash while other indices see modest gains.

- Trump signals trade progress with EU and China; ECB cuts rates 25 bps, widening global policy divergence.

Gold retreated on Thursday ahead of the Good Friday Easter holiday, losing 0.60%, after enjoying a rally of close to $400 gains during the last seven trading days on uncertainty about the United States' (US) trade policies. /USD trades at $3,319 after hitting a record high of $3,357 earlier in the session.

Market mood closed the last trading day of the week mixed, with two of the three main US indices posting gains, while the UnitedHealth Group plunge hit the Dow Jones. Wednesday’s speech by the Federal Reserve (Fed) Chair Jerome Powell continues to be digested by the markets.

Fed Chair Powell turned hawkish, revealing that a weak economy and high inflation could conflict with the central bank's two goals, making a stagflationary scenario possible.

“We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension,” he said. “If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.”

Regarding trade talks, Trump said they’re doing well and added that he is very confident about a trade deal with the European Union (EU) and China.

Data-wise, the European Central Bank (ECB) reduced rates by 25 basis points earlier and the US economic docket revealed the US labor market remains solid, but not so housing, after printing strong Building Permits figures, but weak Housing Starts.

Daily digest market movers: Gold price falls as US yields rise

- The US 10-year Treasury yield rises five basis points to 4.333%. US real yields followed suit, climbing five bps to 2.163%, as shown by the US 10-year Treasury Inflation-Protected Securities yields failing to cap Gold prices.

- US Initial Jobless Claims for the week ending April 12 came in at 215K, down from 224K and below the 225K forecast—highlighting continued strength in the labor market.

- Building Permits rose 1.6% to 1.482 million, exceeding the 1.45 million estimates. In contrast, Housing Starts dropped sharply from 1.494 million to 1.324 million, indicating softness in residential construction.

- In rates markets, money market traders have priced in 86 basis points of Fed rate cuts by the end of 2025, with the first cut expected in July.

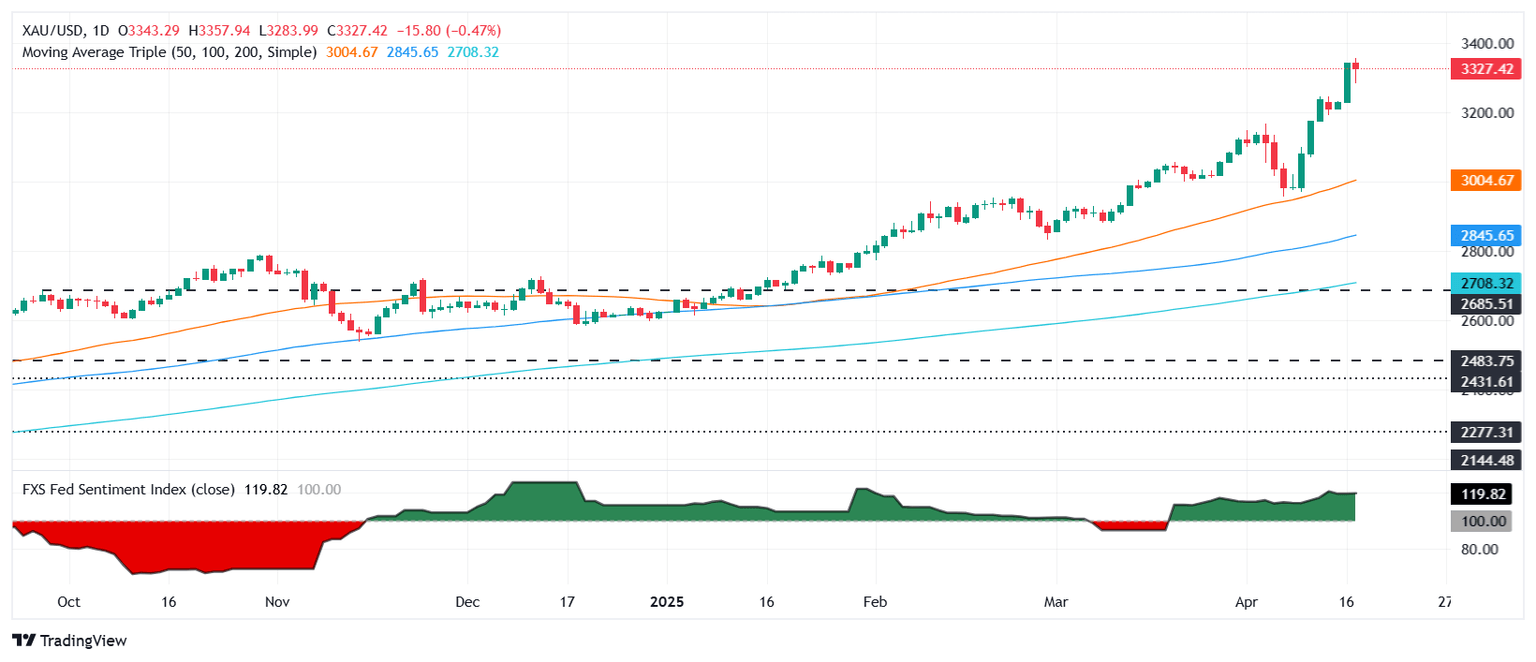

XAU/USD technical outlook: Gold price retraces, but remains poised to test new record highs

The uptrend in Gold prices remains despite retreating somewhat on Thursday, below the $3,330 figure. As the precious metals trim some of their earlier losses, price action indicates the lack of acceptance of lower prices, opening the door for further upside.

From a momentum standpoint, the Relative Strength Index (RSI) is overbought but not near the 80 extreme level. Nevertheless, as the RSI aims lower, it suggests that a mean reversion move is on the cards. In the event of that outcome, XAU/USD's first support would be the $3,300 figure. A breach of the latter will expose the April 16 daily low of $3,229.

If bulls push prices past $3,350, they could test the year-to-date (YTD) peak, followed by $3,400.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

BRANDED CONTENT

Not all brokers provide the same benefits for Gold trading, making it essential to compare key features. Knowing each broker’s strengths will help you find the ideal fit for your trading strategy. Explore our detailed guide on the best Gold brokers.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.