Gold slides below $2,600 as Fed signals two rate cuts in 2025

- Gold falls sharply, impacted by Fed's less dovish outlook.

- Fed Chair Powell stresses prudent policy amid ongoing upside inflation risks.

- Fed sees 2% inflation target return in 1-2 years, suggesting slow progress.

- Latest dot plot indicates few rate cuts through 2026, stabilizing Fed funds rate at 3.4%.

Gold prices plummet as Federal Reserve Chair Jerome Powell takes a stance after the US central bank decided to cut rates. Projections suggest the Fed shifted less dovish. The XAU/USD trades below $2,600, down by over 2.28%.

Federal Reserve Chair Jerome Powell indicated that the central bank may adopt a more cautious approach to future policy adjustments, noting that current measures are less restrictive. He emphasized that inflation risks and uncertainties remain tilted to the upside, partly explaining the dot plot changes.

Powell also projected that it could take one to two years for inflation to return to the 2% target while assuring that the labor market's current state does not raise significant concerns about overheating.

The Federal Reserve cut rates by 25 basis points to the 4.25%-4.50% range, yet the decision was not unanimous, as Cleveland Fed President Beth Hammack opted to keep rates unchanged. When comparing the statement to the past meeting, there was little change, though traders were focused on the Summary of Economic Projections (SEP).

According to the SEP, the dot plot suggests that Fed officials see just two cuts for 2025 and two more for 2026. Officials estimate the Fed funds rate to end at 3.9% in 2025 and 3.4% in 2026.

Other projections suggest that the Fed’s favorite inflation gauge, the Core PCE, is expected to end at 2.8% in 2024, 2.5 % in 2025, and 2.2% in 2026. Regarding growth, the economy is foreseen to end at 2.5% in 2024, 2.1% in 2025, and 2% in 2026.

The Unemployment Rate is expected to end the current year at 4.4% and remain unchanged at 4.3% in 2025 and 2026.

After the data, gold prices plunged sharply as traders assessed the cut as hawkish, with just 100 basis points of easing for the next two years.

This week, investors will also focus on Thursday's US GDP data and the Fed’s favorite inflation gauge, the core Personal Consumption Expenditures (PCE) Price Index, which could impact Bullion demand.

Daily digest market movers: Gold price tumbles after Fed's decision

- Gold prices dropped as US real yields recovered, up by 7 basis points to 2.14%, a headwind for the precious metal.

- The US 10-year Treasury bond yield rises 5 basis points at 4.45% after Fed’s decision.

- The US Dollar Index, which tracks the performance of the American currency against six others, surges 0.70%% to 107.69.

- Building Permits in November rose by 6.1% MoM from 1.419 million to 1.505 million.

- Housing Starts for the same period fell -1.8% MoM from 1.312 million to 1.289 million.

- Recently released US Retail Sales data and Flash PMIs hint that the economy remains solid amid interest rates set above 4%. Although inflation edged lower, core prices stalling at 3% and headline inflation printing higher readings for three straight months suggest that inflation risks are skewed to the upside.

- The CME FedWatch Tool suggests that traders had priced in a 95% chance of a quarter-point rate cut on Wednesday.

- For 2025, investors are betting that the Fed will lower rates by 100 basis points.

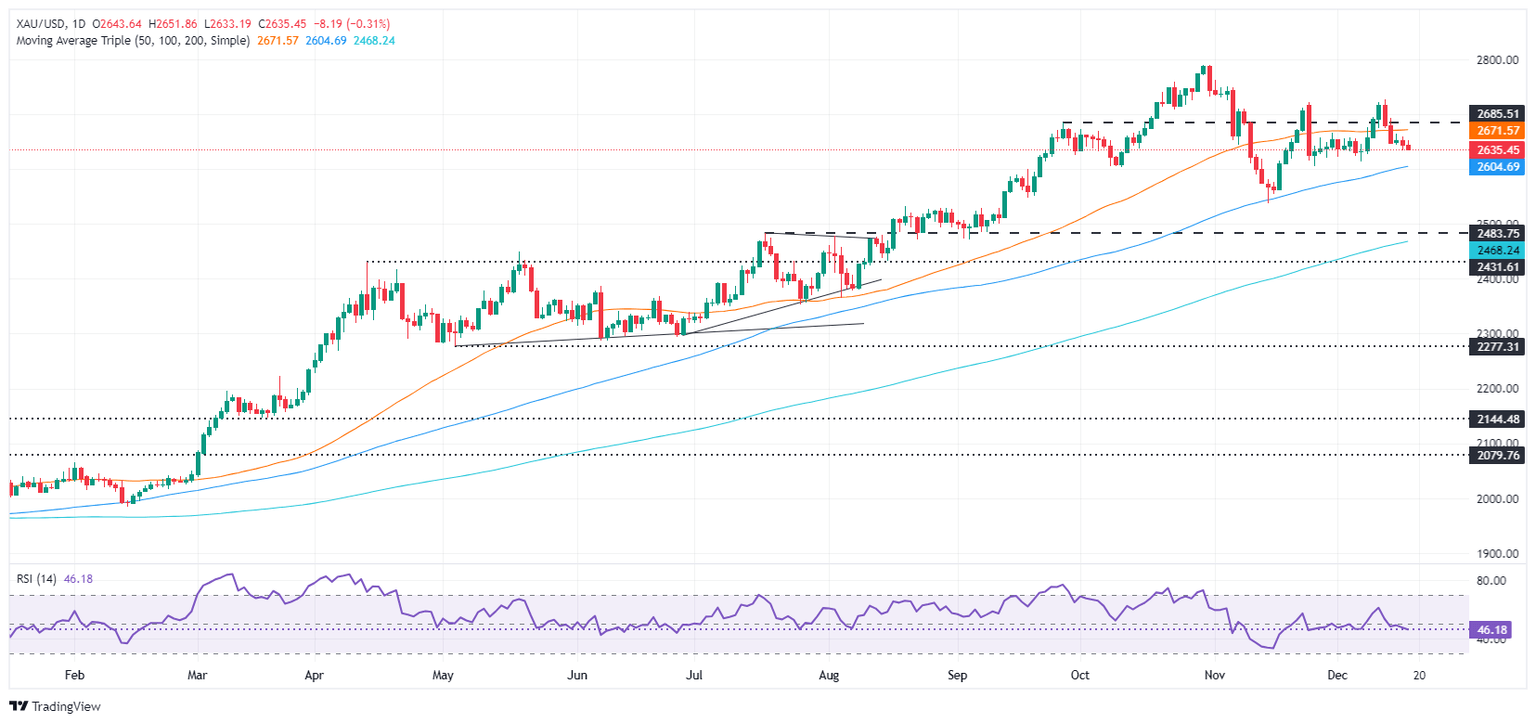

Technical outlook: Gold price retreats, sellers eye 100-day SMA

Gold price remains upwardly biased, though it has remained trading sideways during the last three days, with no definitive direction. The golden metal trades within the $2,602-$2,670 area, capped by the 100 and 50-day Simple Moving Averages (SMAs), respectively.

For a bullish resumption, the XAU/USD must clear $2,650, followed by the 50-day SMA at $2,670. If surpassed, the next stop would be $2,700. Conversely, if XAU/USD drops below the 100-day SMA, the next support would be $2,600. If the price slips, the next support would be the November 14 swing low of $2,536, before challenging the August 20 peak at $2,531.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.