Gold price crashed over 2.8% as Powell turns hawkish on tariffs and inflation

- Gold drops for the second day as safe-haven appeal wanes, despite Powell highlighting increased downside risks.

- Powell states the Fed can delay action for clarity, noting tariffs may prolong inflation and unnerving Gold bulls.

- Hawkish Fed tone boosts DXY by 0.47% to 102.56; deepening yield curve inversion stokes recession concerns.

Gold (XAU) prices are extending on Friday their drop for the second consecutive day, hitting a seven-day low of $3,023 per troy ounce, down more than 2.80% as Federal Reserve Chair Jerome Powell turned hawkish in a conference in Virginia.

XAU/USD sinks to $3,023 as Fed Chair warns tariff-driven inflation could linger, dashing hopes for near-term rate cuts

Powell said that monetary policy is well-positioned to wait for clarity before considering adjustments on monetary policy, adding that “Tariffs likely to raise inflation in coming quarters; more persistent effects possible.”

He added that measures of long-term inflation are “well anchored” and that the US central bank's obligation is to be sure that a “one-time increase in price levels doesn't become an ongoing inflation problem.”

Regarding the economy, he added that the outlook is highly uncertain and that despite the fact that the economy is in a good place, downside risks have risen.

As Powell answered questions, Gold prices extended their losses. It should be noted that the Greenback is being bid, with the US Dollar Index (DXY) rising 0.47% to 102.56.

Money market traders had priced in over 1% of Fed easing by 2025. This is due to a pessimistic scenario about the economic outlook. Investors had begun to price in a recession, as the US 10-year to 3-month yield curve has deepened its inversion, with the latter paying 25 basis points more than the 10-year T-note yield.

Gold price reaction

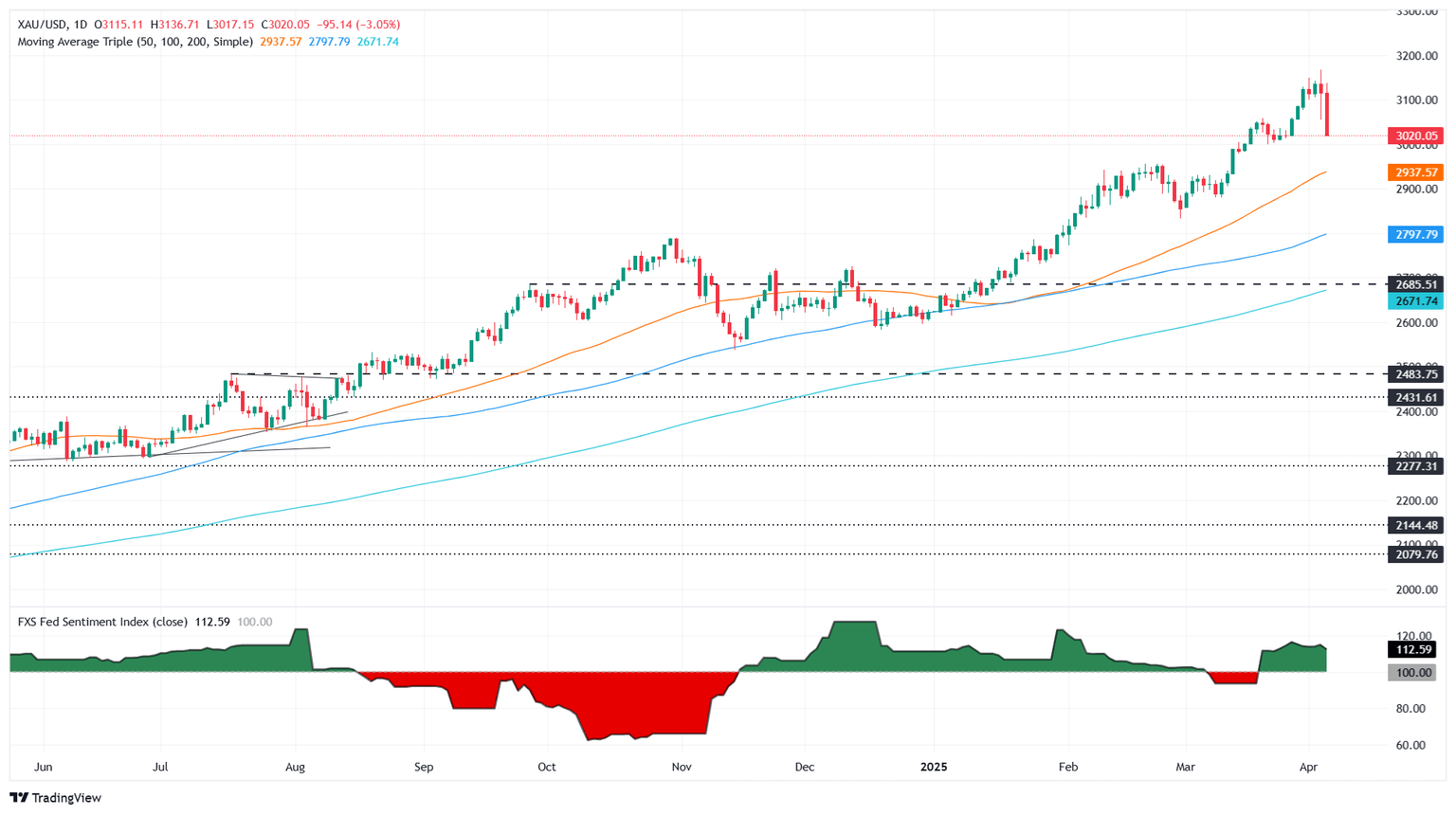

Gold is puking at the time of writing, as sellers continue to push prices lower, with them eyeing a challenge of the $3,000 mark. If cleared, that will put into play the 50-day Simple Moving Average (SMA) at $2,937, followed by the $2,900 figure. On the other hand, if XAU/USD edges up, buyers need to reclaim $3,100 if they would like to regain control.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.