Gold price sets for a bullish weekly close on higher US Unemployment Rate

- Gold price prints a fresh all-time high of above $2,180 amid multiple tailwinds.

- The US Dollar weakens on slower wage growth and a higher Unemployment Rate in February.

- US Treasury yields plunge as Fed Powell delivers a slight dovish guidance on interest rates.

Gold price (XAU/USD) rallies to a fresh all-time high above $2,180 in Friday's early New York session as yields on 10-year US bonds fell to 4.04% after the release of the US NFP data. A sharp slowdown in wage growth and a higher Unemployemnt Rate is expected to prompt market expectations for the Federal Reserve (Fed) to reduce interest rates in the June policy meeting.

The United States Bureau of Labor Statistics (BLS) has reported that the Unemployment Rate rose to 3.9% compared to expectations, and the former reading was 3.7%. However, Nonfarm Payrolls (NFP) for February were higher at 275K against expectations of 200K, but remained lower than the prior reading of 353K

The inflation outlook is expected to cool down as Average Hourly Earnings grew slower than market participants anticipated. Monthly wages grew slightly by 0.1% against a 0.6% increase in January. Investors projected that wage growth would have halved to 0.3%. Annual wage growth decelerated to 4.3% from expectations and a prior reading of 4.4%. For January, wage growth has been revised down from 4.5%.

Meanwhile, slower wage growth and a high jobless rate have elevated selling pressure on the US Dollar. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, has refreshed its seven-week low around 102.40.

In the European session, the precious metal also exhibited strength as Fed Chair Jerome Powell indicated the central bank is close to gaining evidence for inflation returning sustainably to the 2% target. In his two-day testimony before Congress, Jerome Powell said: "We are waiting to become more confident that inflation is moving sustainably down to 2%. When we do get that confidence, and we’re not far from it, it will be appropriate to begin to dial back the level of restriction so that we don’t drive the economy into recession.”

Daily digest market movers: Gold price rallies as US yields plummets after US NFP report

- Gold price prints a fresh all-time high near $2,180 on downbeat US jobless rate, slightly dovish commentary from Federal Reserve Chair Jerome Powell, and geopolitical tensions.

- In his two-day testimony before Congress, Jerome Powell said policymakers are not far from gaining confidence that inflation will return to the 2% target. He recognized the need to dial back the restrictive monetary policy stance to prevent the economy from falling into a recession.

- The rally in the Gold price indicates that the slight dovish commentary from Fed Powell has built confidence among investors that rate cuts will be announced sooner. The expectations for the Fed reducing interest rates in the June policy meeting remain firm. The Fed is expected to keep interest rates unchanged in the range of 5.25%-5.5% in the March and May policy meetings.

- Meanwhile, New York Fed Bank John Williams said in an interview with LSE in the late American session that restrictive monetary policy had built downward pressure on the aggregate demand and inflation expectations have come down a bit.

- In the Middle East region, the death of three civilians on a merchant ship flowing from the Red Sea by Iran-backed-Houthis has increased the risk of escalating geopolitical tensions in the region.

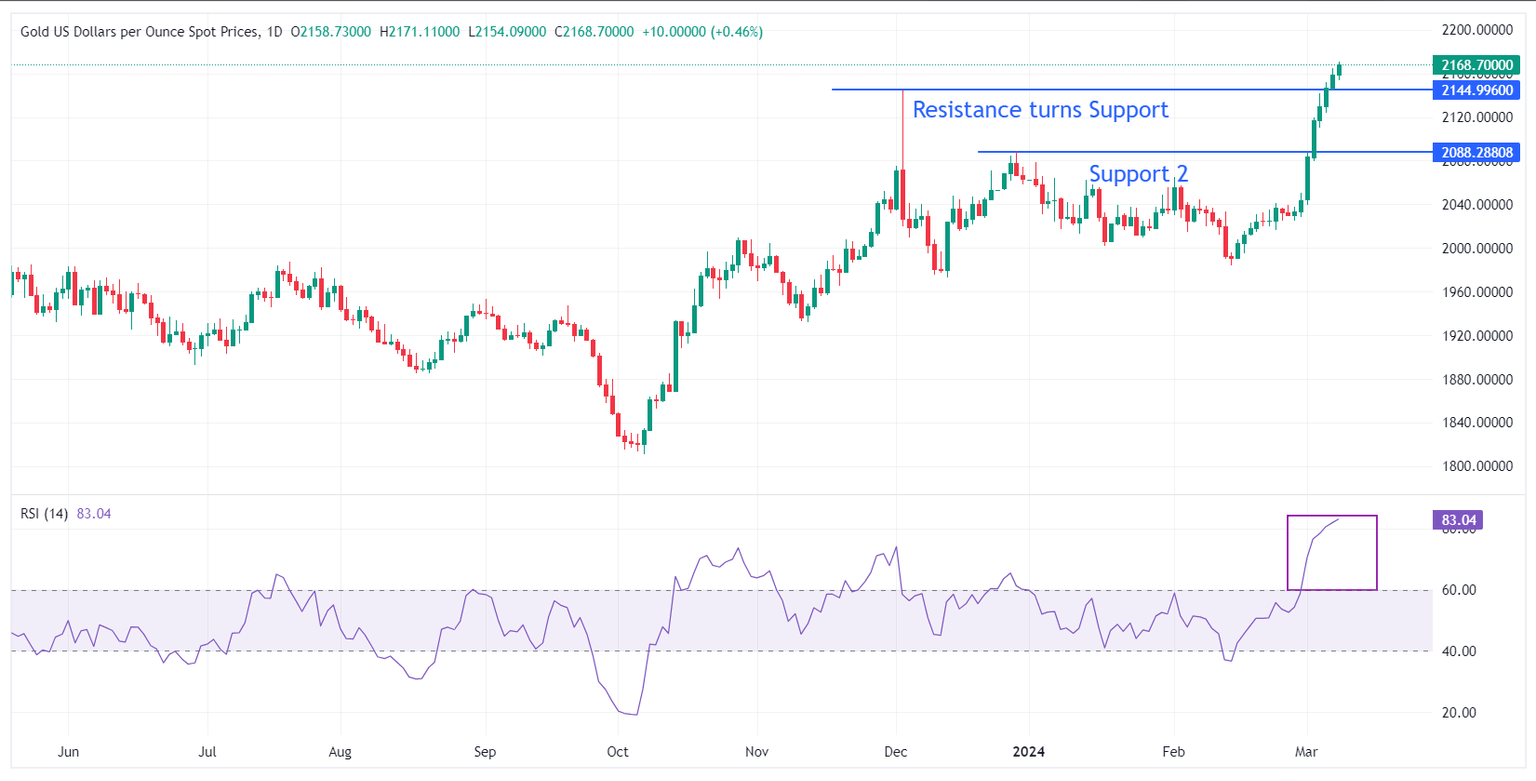

Technical Analysis: Gold price jumps above $2,180

Gold price carry-forwards its winning streak for an eighth trading session on Friday. The precious metal has refreshed its all-time highs above $2,180 after breaking above the horizontal resistance line plotted from December 4 high near $2,145.

The Gold price is trading in unchartered territory and is expected to remain broadly bullish. However, a corrective move in the asset cannot be ruled out as momentum oscillators have reached the overbought territory. The 14-period Relative Strength Index (RSI) has reached 83.00, well above the 70.00 threshold, which signals overbought levels and points to some correction ahead.

On the downside, December 4 high near $2,145 and December 28 high at $2,088 will act as major support levels.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.