Gold price holds steady above $2,650; going no where in a hurry ahead of FOMC decision

- Gold price struggles to gain any meaningful traction and remains confined in a narrow range.

- Expectations for a less dovish Fed and elevated US bond yields cap the non-yielding XAU/USD.

- Geopolitical risks lend support to the safe-haven precious metal ahead of the FOMC meeting.

Gold price (XAU/USD) seesaws between tepid gains/minor losses through the early European session on Tuesday and remains close to a one-week low touched the previous day. Traders now seem reluctant and opt to wait for more cues about the Federal Reserve's (Fed) rate-cut path before placing fresh directional bets. This, in turn, leads to subdued range-bound price action for the second straight day and ahead of the crucial FOMC policy decision on Wednesday.

In the meantime, expectations for a less dovish Fed remain supportive of elevated US Treasury bond yields, which assists the US Dollar (USD) to attract some buyers and acts as a headwind for the non-yielding Gold price. That said, persistent geopolitical risks stemming from the protracted Russia-Ukraine war and tensions in the Middle East offer support to the safe-haven XAU/USD. Traders now look to the US Retail Sales figures for some impetus later this Tuesday.

Gold price traders seem non-committed ahead of the crucial FOMC decision on Wednesday

- Data released on Monday showed that a big part of the US economy expanded at the fastest pace in more than three years. In fact, the S&P Global flash US Services Purchase Managers Index (PMI) rose from 56.1 to 58.5 in December – the highest level in 38 months.

- Furthermore, the Composite PMI surged from 54.9 in November to 56.6, or a 33-month high. This overshadowed a fall in the flash US Manufacturing PMI to a three-month low of 48.3 in December and reaffirmed market expectations for a less dovish Federal Reserve.

- Investors seem convinced that US President-elect Donald Trump's policies may exert upward pressure on inflation and force the Fed to pause its rate-cutting cycle. This lifted the yield on the benchmark 10-year US government bond to its highest level since November 22.

- According to the CME Group's FedWatch Tool, markets have fully priced in that the Fed will deliver a 25-basis-points rate cut on Wednesday. This keeps the US Dollar bulls on the defensive and offers support to the XAU/USD through the Asian session on Tuesday.

- The US hit North Korea and Russia on Monday with new sanctions that the Treasury Department said targeted Pyongyang's financial activities and military support to Moscow. Israel is likely to respond to yet another ballistic missile attack by Yemen’s Houthis.

- Traders now look forward to the release of the US monthly Retail Sales figures for short-term opportunities later during the North American session. The focus, however, will remain glued to the outcome of the highly-anticipated FOMC policy meeting on Wednesday.

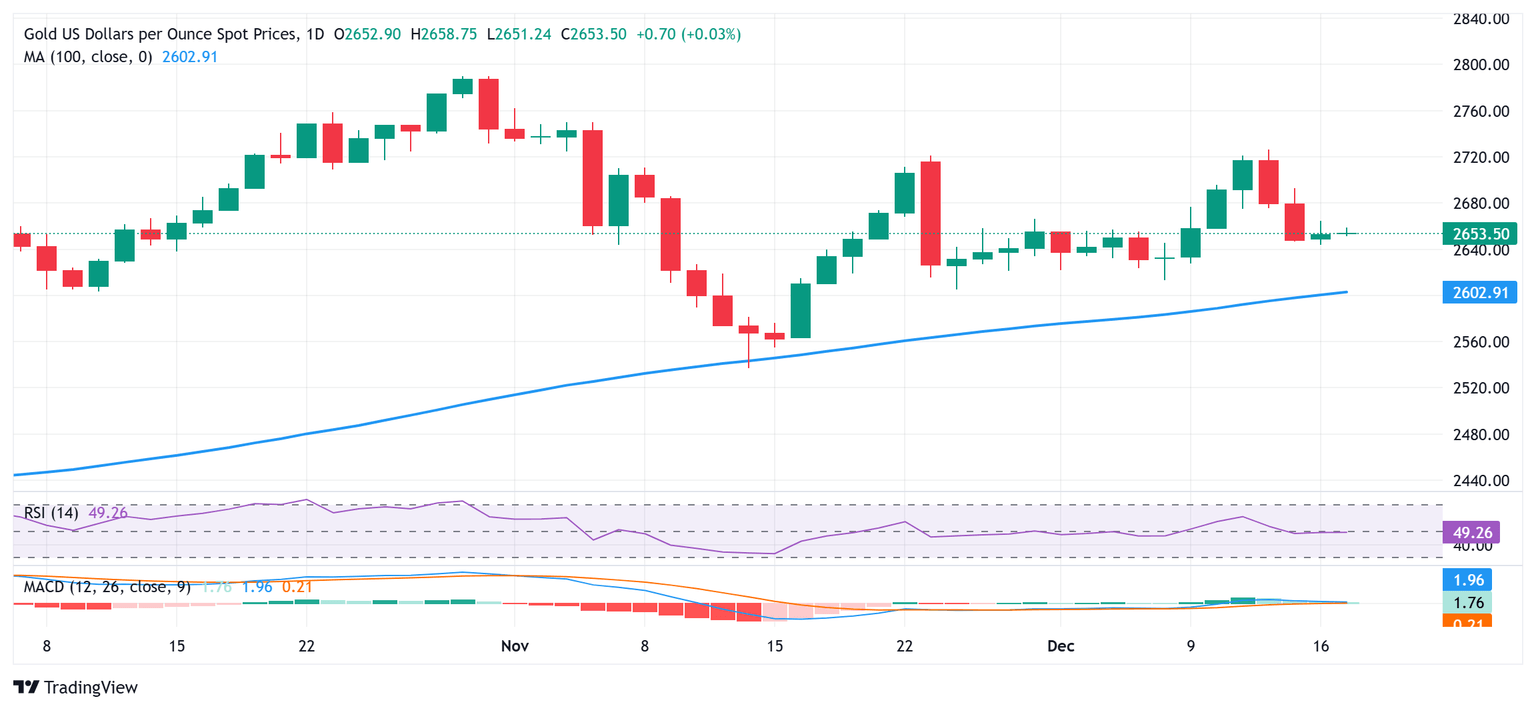

Gold price is likely to attract some sellers near overnight swing high, around $2,664-$2,666 region

From a technical perspective, the $2,644-2,643 area, or a one-week low touched on Monday, now seems to protect the immediate downside ahead of the $2,625 region. This is closely followed by the monthly trough, around the $2,614 zone, and the $2,600 mark, which if broken decisively will be seen as a fresh trigger for bearish traders and pave the way for some meaningful depreciating move for the Gold price.

On the flip side, the $2,664-2,666 region, or the overnight swing high, might continue to act as an immediate strong barrier ahead of the $2,677 area. A sustained strength beyond the latter should allow the Gold price to reclaim the $2,700 round figure. The subsequent move up could extend further towards the monthly swing high, around the $2,726 zone, above which the XAU/USD is likely to resume its upward trajectory.

Economic Indicator

FOMC Economic Projections

At four of its eight scheduled annual meetings, the Federal Reserve (Fed) releases a report detailing its projections for inflation, the unemployment rate and economic growth over the next two years and, more importantly, a breakdown of each Federal Open Market Committee (FOMC) member's individual interest rate forecasts.

Read more.Next release: Wed Dec 18, 2024 19:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.