Gold price rises above $2,400 on firm Fed rate-cut bets, Fed Powell's speech eyed

- Gold price gains above $2,400, driven by growing speculation for Fed rate cuts in September.

- Softer-than-expected US inflation for June indicated that price pressures are on course to return to 2%.

- Investors await Fed Powell’s speech and the US Retail Sales data for June.

Gold price (XAU/USD) resumes its upside journey above $2,400 in Monday’s American session after a modest correction from a seven-week high of $2,424 on Thursday. The precious moves higher as the US Dollar (USD) retreats after giving up its intraday gains driven by an assassination attack on former United States (US) President Donald Trump.

The sniper attack on Trump has increased his odds of winning the US Presidential elections later this year. This led to investors pouring funds into the US Dollar, as Donald Trump is known for favoring protective trade policies, which is a favorable scenario for the Greenback. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, gains firm footing near 104.00.

The higher US Dollar makes the Gold price an expensive bet for investors. However, the US Dollar falls back as its near-term outlook remains weak on firm speculation that the Federal Reserve (Fed) will begin reducing interest rates from the September meeting.

Daily digest market movers: Gold price moves higher as US Dollar retreats

- Gold price recovers after a hiatus in the uptrend near a seven-week high of $2,424, recorded on Thursday. However, the near-term outlook for the Gold price remains firm as US bond yields weaken. US Treasury yields fall as market expectations for the Fed to begin reducing interest rates from the September meeting have accelerated significantly.

- 10-year US Treasury yields edge higher to 4.20% but are close to an almost four-month low. Lower yields on interest-bearing assets reduce the opportunity cost of holding an investment in non-yielding assets, such as Gold.

- The bulging probability of Fed rate cuts is the outcome of easing US consumer inflation and cooling labor market strength. Last week, the US Consumer Price Index (CPI) report for June showed that price pressures decelerated at a faster pace than expected. Soft inflationary pressures boosted confidence that the disinflation process has resumed after a moderate reverse in the first quarter of this year. Also, the monthly headline CPI deflated for the first time in four years.

- This week, investors will majorly focus on the US Retail Sales data for June, which will be published on Tuesday. The Retail Sales report is expected to show that sales at retail stores remained unchanged after a meager growth of 0.1% in May.

- In Monday’s session, investors will focus on Fed Chair Jerome Powell’s speech at the Economic Club of Washington, scheduled at 16:30 GMT. In his latest comments at semi-annual Congressional testimony, Powell acknowledged some progress in inflation but reiterated that policymakers want to see inflation declining for months to gain confidence for interest rate cuts.

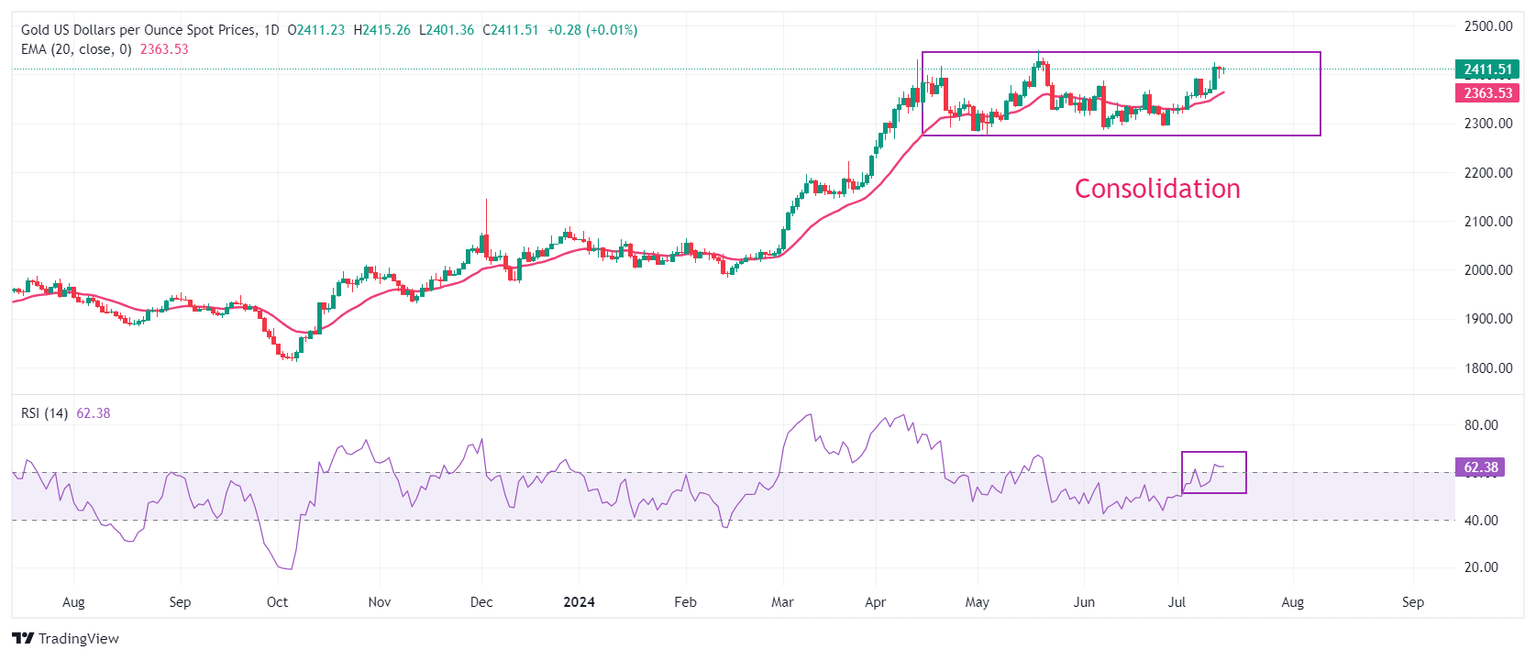

Technical Analysis: Gold price aims to gain firm footing above $2400

Gold price trades in a tight range, slightly above $2,400. The precious metal seeks more cues about when the Fed will start reducing interest rates. The yellow metal exhibits a consolidation move for the last three months, ranging between $2,277-2,450.

The upward-sloping 20-day Exponential Moving Average (EMA) near $2,363 suggests that the overall trend is bullish.

The 14-day Relative Strength Index (RSI) rises above 60.00 for the first time in more than a month, suggesting more upside ahead due to the absence of signals such as oversold and divergence.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.