Gold prices gain ground after US PPI inflation sparks fresh rate cut hopes

- Gold rebounds from weekly low, fueled by hopes for looser Fed policy after weak PPI.

- Focus on upcoming CPI; cooler report could boost chances for rate cuts.

- Potential Trump tariffs pose a risk to inflation, impacting Gold and market sentiment.

Gold prices edged higher on Tuesday after data from the United States (US) showed that prices paid by producers cooled off. This kept traders hopeful for additional monetary policy easing by the US Federal Reserve (Fed). At the time of writing, the XAU/USD trades at $2,675, up 0.46%.

The yellow metal recovered after beginning the week on the back foot, down over 1%. The US Bureau of Labor Statistics (BLS) revealed that the Producer Price Index (PPI) increased but missed estimates for a higher print. This exacerbated Gold’s jump as traders grew optimistic that if the Consumer Price Index (CPI) report on Wednesday comes cooler than foreseen, it could increase the Fed’s chances of easing policy during the year.

Market participants are eyeing the CPI release on Wednesday. If December prints are below the prior month’s 2.7% number, it could indicate that the disinflation process continues. Inflation has risen since October to 2.6%, following September’s 2.4% YoY increase.

Traders had priced in 29.4 basis points of easing by the Federal Reserve in 2025. But a cool CPI report could bolster bullion prices.

Earlier, Kansas City Fed President Jeffrey Schmid stated that the Fed would act if Trump’s tariffs threw inflation or jobs off course.

In six days, US President-elect Donald Trump will take office. He has threatened to impose universal tariffs, though focused mainly on China, Canada and Mexico. If he goes ahead with this, analysts have mentioned that a trade war could reignite inflation.

Bullion prices are also taking a hit amid good news of a possible deal that could end Gaza's war, according to Reuters, which cited an official briefed on the matter.

In the US, key data releases include consumer inflation figures, Retail Sales and jobless claims for the week ending January 11.

Daily digest market movers: Gold price advances on steady US yields

- Gold price shrugs off higher US real yields, which remain at around 2.34%.

- The US Dollar retreated after the data, with the US Dollar Index (DXY) hitting 109.21, down 0.26%.

- The US 10-year Treasury bond yield remains unchanged at 4.794%.

- The US PPI in December rose 3.3% YoY, below forecasts of 3.4%. Excluding volatile items, the so-called Core PPI expanded by 3.5% YoY, up from November’s figures but beneath 3.8% expectations.

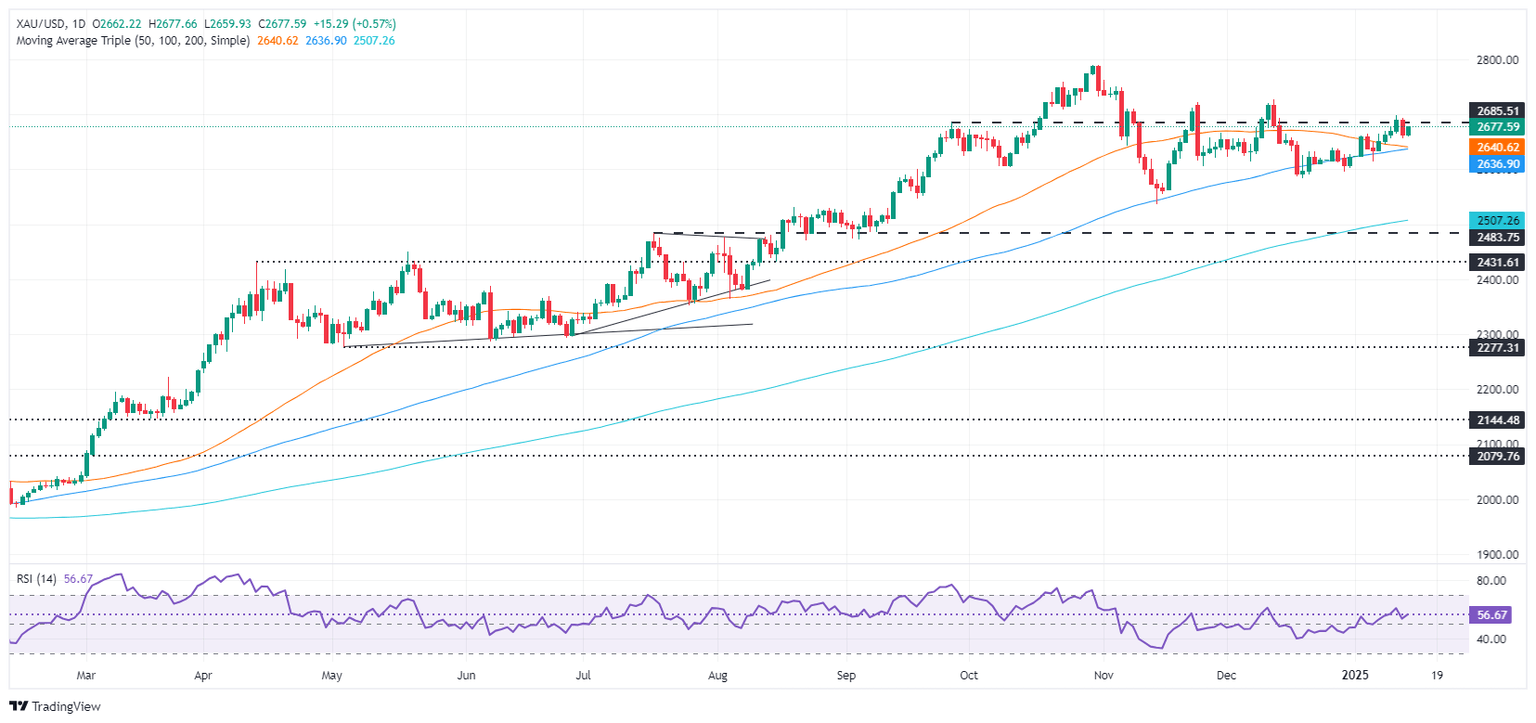

XAU/USD technical outlook: Gold price soars above $2,650 as bulls stepped in

Gold price uptrend resumed after a ‘bearish engulfing’ chart pattern formed, inviting buyers to step in and increase prices. If Bullion clears $2,700, the next resistance would be the December 12 peak of $2,726, followed by the record high at $2,790.

Conversely, if XAU/USD drops below $2,650, the next support would be the 50-day Simple Moving Average (SMA) at $2,643, followed by the 100-day SMA at $2,633.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.