Gold price sticks to modest intraday gains above $2,650 amid mixed cues

- Gold price enters a bearish consolidation phase near a one-week trough touched on Monday.

- Geopolitical tensions, softer US bond yields and USD offer some support to the XAU/USD.

- Bets for a less dovish Fed seem to cap the XAU/USD ahead of the FOMC meeting this week.

Gold price (XAU/USD) stages a modest recovery from a one-week trough touched earlier this Monday, albeit it lacks follow-through buying and currently trades around the $2,655 region. A modest downtick in the US Treasury bond yields keeps the US Dollar (USD) bulls on the defensive and offers some support to the commodity. Moreover, persistent geopolitical risks and

concerns about US President-elect Donald Trump's policies remain supportive of a mildly positive tone around the safe-haven precious metal.

That said, growing acceptance that the Federal Reserve (Fed) will slow the pace of its rate-cutting cycle, amid signs that the progress in lowering inflation toward the 2% target has stalled, seems to act as a headwind for the non-yielding Gold price. Traders also seem reluctant and opt to wait on the sidelines ahead of the crucial two-day FOMC monetary policy meeting starting on Tuesday. Nevertheless, the XAU/USD, for now, seems to have stalled its retracement slide from over a one-month high touched last week.

Gold price benefits from geopolitical risks, softer US bond yields and a modest USD downtick

- Israel agreed on plans to allocate state money to expand its presence and double its population in the occupied Golan Heights, raising the risk of a further escalation of tensions in the region.

- Israeli strikes in Gaza killed at least 53 Palestinians, while the Israeli military said that its air and ground forces in the north of the enclave killed dozens of militants and captured others.

- NATO Secretary General Mark Rutte has warned that Russian President Vladimir Putin wants to wipe Ukraine off the map and could come after other parts of Europe next.

- The Syrian Observatory for Human Rights said that Israeli fighter jets targeted the missile launchers in southern Syria and carried out an air strike on radars in eastern Syria.

- The CME Group's FedWatch Tool indicates that traders are pricing in over a 93% chance that the Federal Reserve will lower borrowing costs by 25 basis points on Wednesday.

- The US Consumer Price Index (CPI) and the Producer Price Index (PPI) released last week reinforced expectations that the Fed will slow the pace of its rate-cutting cycle next year.

- The yield on the benchmark 10-year US government bond rose to a three-week high on Friday amid bets for a less dovish Fed, which should cap gains for the non-yielding Gold price.

- Monday's economic docket features the release of global flash PMIs, which, might influence the broader risk sentiment and provide some impetus to the safe-haven precious metal.

- The focus, however, will be on the crucial FOMC decision on Wednesday. Traders will also take cues from the accompanying policy statement and Fed Chair Jerome Powell's remarks.

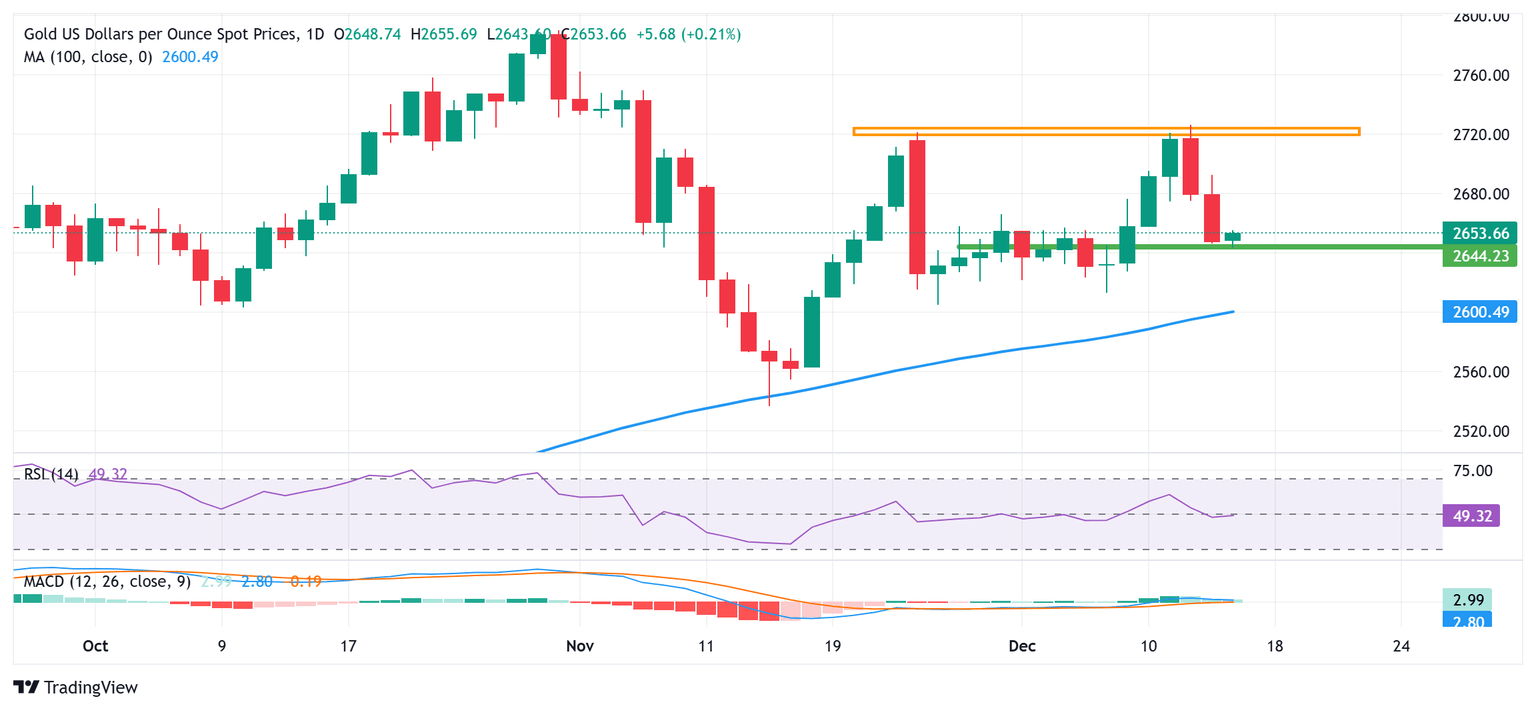

Gold price is likely to attract some sellers at higher levels; the $2,700 mark holds the key

From a technical perspective, the Asian session low, around the $2,644-2,643 area, coincides with a congestion zone. Some follow-through selling has the potential to drag the Gold price to the $2,625 region en route to the monthly low, around the $2,614 zone and the $2,605-2,600 pivotal support. A convincing break below the latter will be seen as a fresh trigger for bearish traders and pave the way for deeper losses.

On the flip side, the $2,665-2,666 region now seems to act as an immediate hurdle ahead of the $2,677 area, above which the Gold price could aim to reclaim the $2,700 round figure. The subsequent move up could extend further towards the monthly swing high, around the $2,726 zone, which if cleared decisively will set the stage for a further near-term appreciating move.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.