Gold Price Analysis: XAUUSD eases on the way to $1,765 hurdle amid covid, Taiwan issues, US data eyed

- Gold price remains sidelined around 2.5-month high, mildly offered of late.

- Risk-on mood fades amid Covid fears from China, anxiety ahead of Biden-Xi meeting challenge XAUUSD buyers.

- Sluggish yields, mildly offered US stock futures exert downside pressure on bullion.

- US Michigan CSI, risk catalysts eyed for fresh impulse.

Gold price (XAUUSD) portrays the market’s inaction around a 10-week high during early Friday morning in Europe, after rising the most in a week the previous day. In doing so, the bright metal seesaws around $1,755-50, recently printing mild losses despite picking up bids.

The bullion’s inaction could be linked to the market’s mixed concerns amid Coronavirus woes from China and optimism surrounding the Fed’s easy rate hike.

Beijing reports the biggest daily jump in the Covid cases in over a year as the mainland sees the daily Coronavirus numbers growing past 10,000 for the first time in seven months. On the same line could be anxiety ahead of Monday’s meeting between US President Joe Bide and his Chinese counterpart Xi Jinping.

On the flip side, an eight-month low print of the US Consumer Price Index (CPI) allowed the US Federal Reserve (Fed) policymakers to back easy rate hikes and drown the US Dollar, which in turn helped the market sentiment to bolster. Amid these plays, Asian stocks rise but the S&P 500 Futures struggles for clear directions around a two-month high.

That said, bank holidays in the US and Canada restrict the moves of the US 10-year Treasury yields. The benchmark bond coupons remain inactive around the monthly low near 3.81%, flashed on Thursday, after registering the heaviest slump since early December 2021.

Looking forward, fears emanating from China may challenge the XAUUSD traders ahead of the first readings of the US Michigan Consumer Sentiment Index (CSI) for November, expected 59.5 versus 59.9 prior. However, the buyers are likely to keep the reins unless today’s data prints an extremely high outcome.

Technical analysis

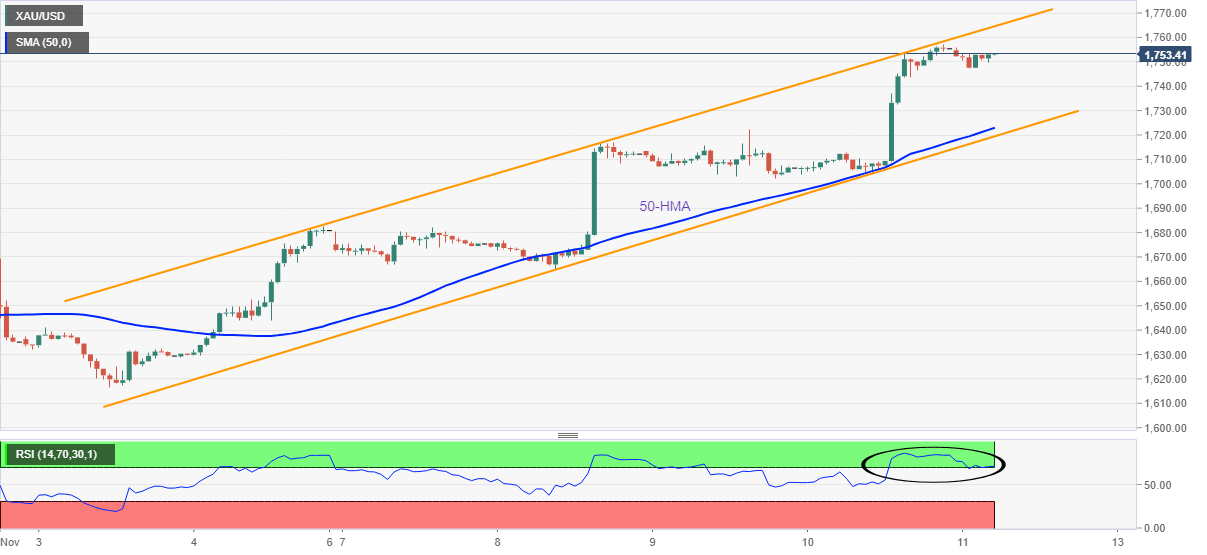

Overbought RSI conditions join the upper line of a weekly bullish channel, around $1,765 by the press time, to challenge the gold buyers.

The pullback moves, however, remain elusive unless the quote remains firmer past $1,719. Also acting as immediate support is the 50-HMA level near $1,723.

It’s worth noting that sustained trading beyond $1,765 won’t hesitate to challenge a five-month-old horizontal resistance area near $1,805.

To sum up, gold remains on the bull’s radar but the upside appears limited.

Gold: Hourly chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.