- Gold sold-off 2% on Friday, loses $56 on the week.

- XAU/USD could see a quick pullback before the downside resumes.

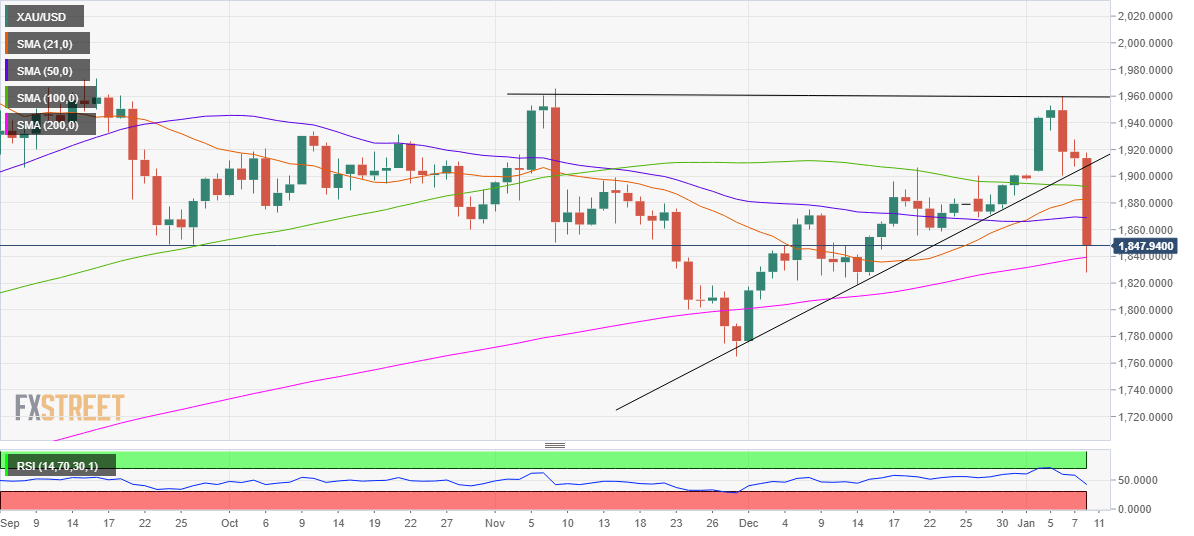

- Daily RSI has pierced through the midline, into the bearish zone.

Gold (XAU/USD) recovered some ground into the weekly closing, although booked a 2% loss on Friday.

The sell-off knocked-off the metal to the weakest levels in three weeks at $1828.

Gold Price Chart: Daily

The price cut through all the key daily moving averages (DMA) on its downside break of the ascending triangle formation on the daily chart.

However, the XAU bulls recovered to $1848 levels, having recaptured the critical 200-DMA at $1839 as the week drew to an end. The spot lost as much as $70 on Friday while eroding $56 on a weekly basis.

The triangle breakdown validation prompted the 14-day Relative Strength Index (RSI) to pierce the midline from above, entering into the bearish zone.

All in all, the path of least resistance appears to the downside, although a dead cat bounce towards the horizontal 50-DMA at $1869 cannot be ruled, as the price managed to close the week above the 200-DMA.

On the flip side, the sellers remain poised to test the $1800 level, below which the four-month lows of $1764 could be challenged.

Gold Additional levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds the uptick above 0.6450 after mixed Chinese data

AUD/USD is holding higher ground above 0.6450 in Friday's Asian trading, shrugging off mixed Chinese activity data for October. Traders are looking to cash in after the recent downfall even though the US Dollar stay firm and market mood remains cautious. US data is next in focus.

USD/JPY reverses Japan's GDP-led spike to 156.75

USD/JPY defends minor bids below 156.50 in the late Asian session on Friday, revesing the early spike to 156.75 fuelled by unimpressive Japanese Q3 GDP data. The pair is facing headwinds from Japanese verbal intervention and a tepid risk tone, despite the sustained US Dollar strength.

Gold price struggles to gain ground on bullish US Dollar, US PPI data looms

Gold price struggles to gain ground around $2,570 on Friday after bouncing off a two-month low in the previous session. The precious metal remains under selling pressure amid the strong US Dollar and the rising uncertainty surrounding the Federal Reserve's pace of interest rate reductions.

Bitcoin Price Forecast: BTC eyes $100K, what are the key factors to watch out for?

Bitcoin trades below $90K in the early Asian session on Friday as investors realized nearly $8 billion in profits in the past two days. Despite the profit-taking, Bitwise CIO Matt Hougan suggested that BTC could be ready for the $100K level, fueled by increased stablecoin supply and potential government investment.

Trump vs CPI

US CPI for October was exactly in line with expectations. The headline rate of CPI rose to 2.6% YoY from 2.4% YoY in September. The core rate remained steady at 3.3%. The detail of the report shows that the shelter index rose by 0.4% on the month, which accounted for 50% of the increase in all items on a monthly basis.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.