- Gold is expected to reach at least a 38.2% Fibonacci of the sharp bearish impulse.

- US yields playing a role in the US dollar's rebound.

The price of gold has started to stabilise and retrace a very sharp bearish impulse from the $1910/20 area.

It has been a US dollar story for the most part which has driven the value of the precious metal lower, in a move sparked off by rising US yields.

''Positioning data immediately following last week's surprise Blue Sweep highlights just how little dry-powder gold bugs had remaining,'' analysts at TD Securities explained.

''CTAs are set to liquidate their gold length and target a net short position, which should weigh on the metal in the near-term,'' the analysis added.

''This doesn't bode well for gold flows, particularly given that gold is an inflation-hedge asset only inasmuch as the Fed's stance on rates translates into a low rates vol environment.''

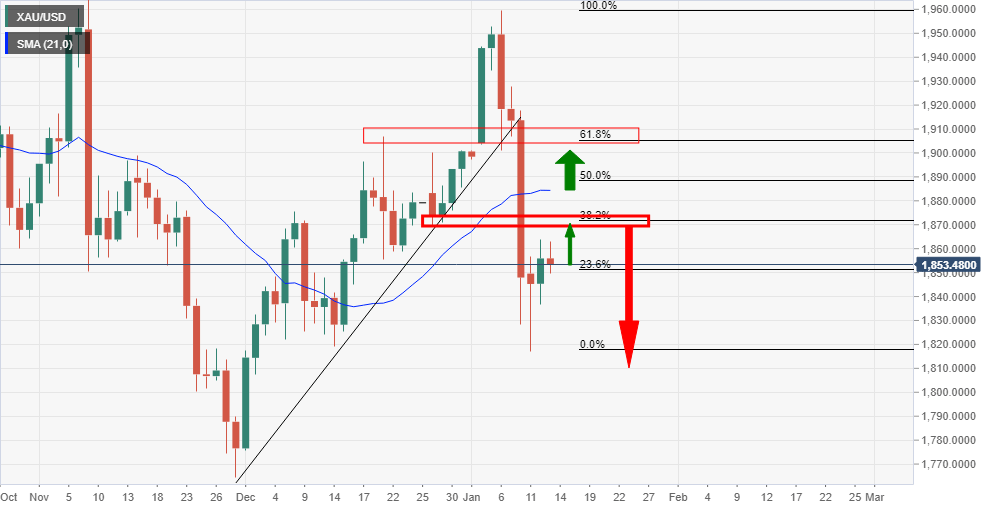

Meanwhile, from a technical perspective, gold is headed back towards a 38.2% Fibonacci retracement of the bearish impulse.

$1,872 comes in as the 38.2% Fibonacci retracement level.

Gold daily chart

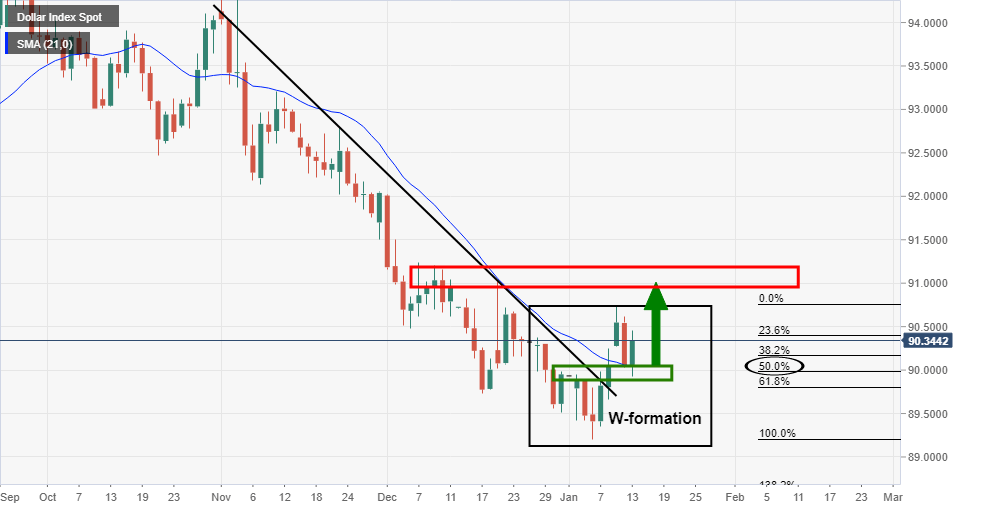

DXY analysis

Meanwhile, the US dollar has just completed a W-formation.

The price has met a 50% mean reversion of the bullish impulse and would now be expected to extend the bullish correction from a confluence of the 21-day moving average, old resistance and the neckline of the W-formation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD remains deep in the red below 0.6500 on US-China trade risks

AUD/USD remains under heavy selling pressure below 0.6500 in the Asian session on Tuesday, reversing some losses. Trump's threatened additional 10% tariffs on China, weighinmg heavily on risk sentiment and the China-proxy Australian Dollar while lifting the haven demand for the US Dollar.

USD/JPY extends its consolidative price move around 154.00

USD/JPY remains confined in a familiar range as traders seem reluctant amid mixed fundamental cues. The uncertainty over the timing and pace of interest rate hikes by the BoJ, the recent surge in the US bond yields and the risk-on mood undermine the JPY.

Gold rebounds from one-week low; finds support ahead of $2,600

Gold price dropped to a one-week low during the Asian session on Tuesday, albeit finds some support in the vicinity of the $2,600 mark. The prevalent risk-on environment, along with bets for slower Fed rate cuts and elevated US bond yields, drives flows away from the safe-haven XAU/USD and supports prospects for further losses.

Ripple's XRP eyes $1.96 after WisdomTree files for XRP ETF in the US

Ripple's XRP surged over 7% on Monday and aims to stage a rally toward its April 2021 high after WisdomTree registered for an XRP ETF in the US state of Delaware on Monday.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.