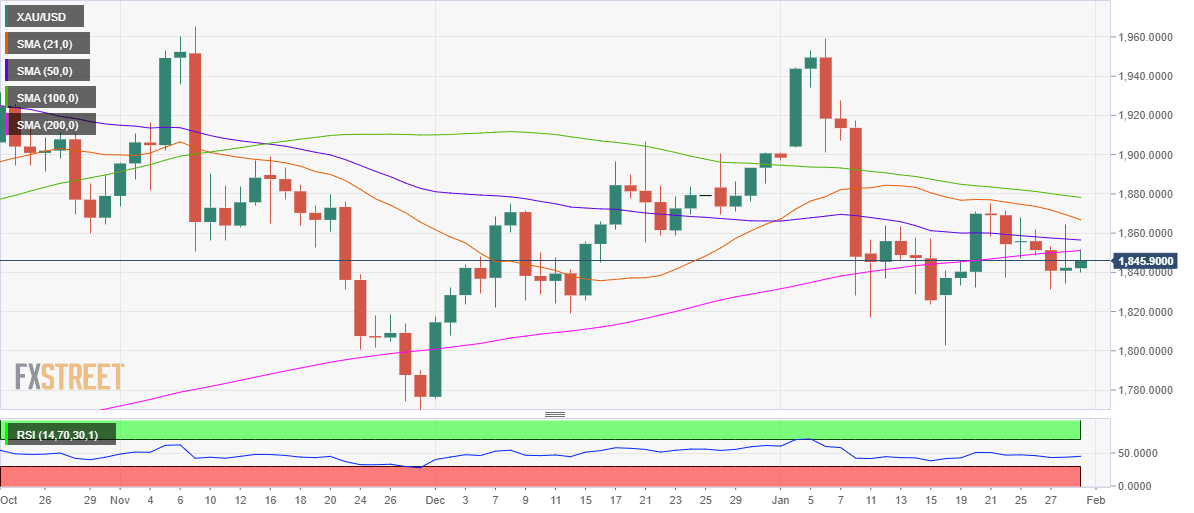

Gold Price Analysis: XAU/USD’s bearish bias intact while below 200-DMA

- XAU/USD’s upside attempts remain capped by 200-DMA

- Technical set up on the daily chart favors the bears.

- Focus remains on US data, stimulus and vaccine news.

Gold (XAU/USD) fails to resist above the $1850 level once again, as sellers return in early European trading.

Despite the latest leg down, gold prices remain in a familiar range of around $1840-45 levels, awaiting fresh impetus from the US economic data.

The US dollar clings onto its recovery gains across its main rivals, as the risk-off action in the US stock futures weighs on the market mood amid ongoing Wall Street speculative trades and vaccine concerns.

Gold Price Chart: Daily

From a technical perspective, the XAU bears remain hopeful so long as the price makes a sustained move above the critical 200-daily moving average (DMA), now at $1851.

Gold bulls have failed to find acceptance above the latter over the past six trading sessions, leaving the downside risks intact in the metal.

Therefore, Thursday’s low of $1834 could be challenged en route the January 13 low at $1803. The Relative Strength Index (RSI) edges higher but remains the midline, backing the case for the sellers.

Alternatively, 50-DMA at $1857 could test the bulls’ commitment.

Gold Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.