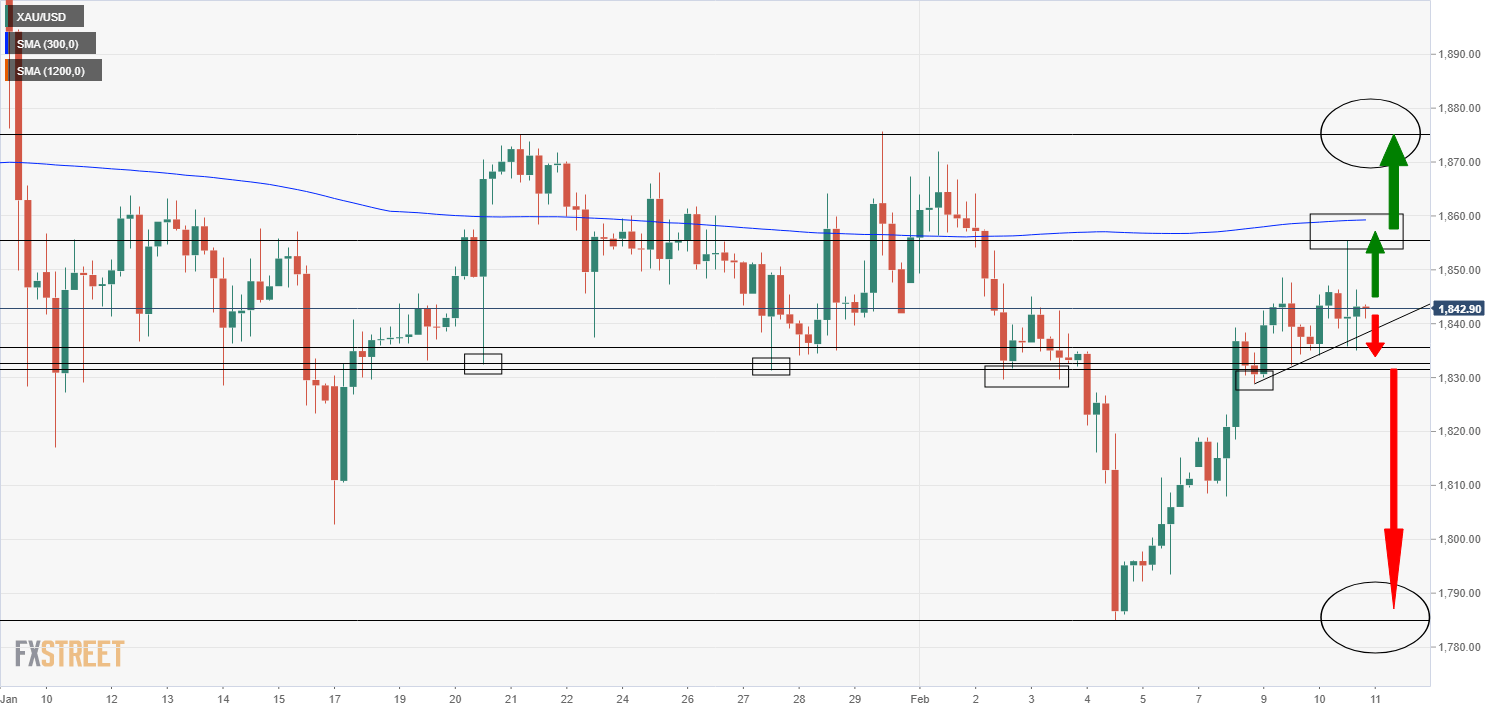

- Spot gold prices look likely to squeeze between a short-term uptrend support and resistance in the $1850s.

- A break above the 200 and 50DMAs in the $1850s could open the door to a move towards late-January highs at $1875.

Spot gold prices were choppy on Wednesday, swinging between a roughly $20 range between the $1835 and $1855 levels, but still managed to close Wednesday’s session with gains of around 0.3%.

Looking at the spot price over a short time horizon, XAU/USD has respected an uptrend from the Monday Asia Pacific session open low at just under $1830. Meanwhile, XAU/USD’s 200-day moving average (DMA) at $1854 provided tough resistance on Wednesday, implying that so long as the precious metal continues to respect this week’s uptrend support and 200DMA resistance, prices should continue to squeeze in the hours/days ahead, forming an ascending triangle that would theoretically be subject to a break out to the upside.

Breaking above Wednesday’s high/the 200DMA will be tough as, as spot prices will also need to surpass the 50DMA at $1857. But should the bulls succeed, XAU/USD would then be in with a shot of rallying back towards its late-January highs of around $1875.

Conversely, failure to break above this tough area of resistance in the $1850s and a subsequent break below the uptrend that has offered support to the price action thus far this week would open the door to a test of support in the $1830-$1835 area (the 20 and 27 January and 2 February lows). A break below this level could open the door to a collapse back down towards this month’s low in the $1780s, ahead of lows set last November in the $1760s.

XAU/USD four hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD strengthens as Trump confirms talks with China

The Australian Dollar extends its rally, with the AUD/USD gaining ground as the US Dollar weakens amid growing concerns over the economic impact of tariffs on the United States. Market participants are closely monitoring developments in US trade negotiations, although trading activity is expected to be subdued due to the Good Friday holiday.

USD/JPY weakens below 142.50 as Japanese CPI came in at 3.6% YoY in March

The USD/JPY pair softens to near 142.25 in a thin trading volume session on Friday. The US Dollar edges lower against the Japanese Yen amid concerns over the economic impact of tariffs.

Gold bounces off daily lows, back near $3,320

The prevailing risk-on mood among traders challenges the metal’s recent gains and prompts a modest knee-jerk in its prices on Thursday. After bottoming out near the $3,280 zone per troy ounce, Gold prices are now reclaiming the $3,320 area in spite of the stronger Greenback.

Ethereum ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs. Meanwhile, Tron founder Justin Sun said that he won't sell his ETH holdings despite the sustained downtrend in the top altcoin’s price.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.